Credit Card Form Statement For Icici Bank In Middlesex

Description

Form popularity

FAQ

The most common methods include online banking, mobile banking apps, email, and physical mail. Online Banking. Most credit card issuers provide online banking platforms where you can easily access your statements. Mobile Banking Apps. Email Statements. Physical Mail.

The cardholder contacts the issuer and disputes the transaction. The cardholder can call the issuing bank, send an email, or mail a letter. The issuer might even have an online banking portal with a dispute feature.

It requires customers to provide personal details, reasons for the dispute, and information about disputed transactions. Customers must fill out the form in capital letters and black ink, and attach necessary documents such as a copy of the FIR if applicable.

ONLINE CARDHOLDER DISPUTE FORM Provide Your 10 digital Mobile No. Input the OTP. Select Product Type ( Eg Debit /Credit / Prepaid Card) Enter last 4 digit of the Card No. Select Merchant/Beneficiary Name. Select Disputed transaction date ( last 60 days) Enter the dispute reason and details in the text box. Enter Submit.

It requires customers to provide personal details, reasons for the dispute, and information about disputed transactions. Customers must fill out the form in capital letters and black ink, and attach necessary documents such as a copy of the FIR if applicable.

Please contact your bank branch immediately. The funds can only be reversed if the beneficiary of the wrong transfer account provides an authorization letter to the nearest ICICI Bank branch, stating that the funds were erroneously credited to his/ her account and the same can be reversed to the remitter.

ICICI Bank automatically sends monthly statements by mail which are password protected and can only be accessed by using the right password only. ICICI Bank Statement PDF Password is usually the combination of the first 4 letters of the name and date of birth.

Online: Card issuers usually send credit card statement to your registered email ID on the same date every month, which is known as the billing date. Another way to access your credit card statement online is by logging into your bank's net banking portal.

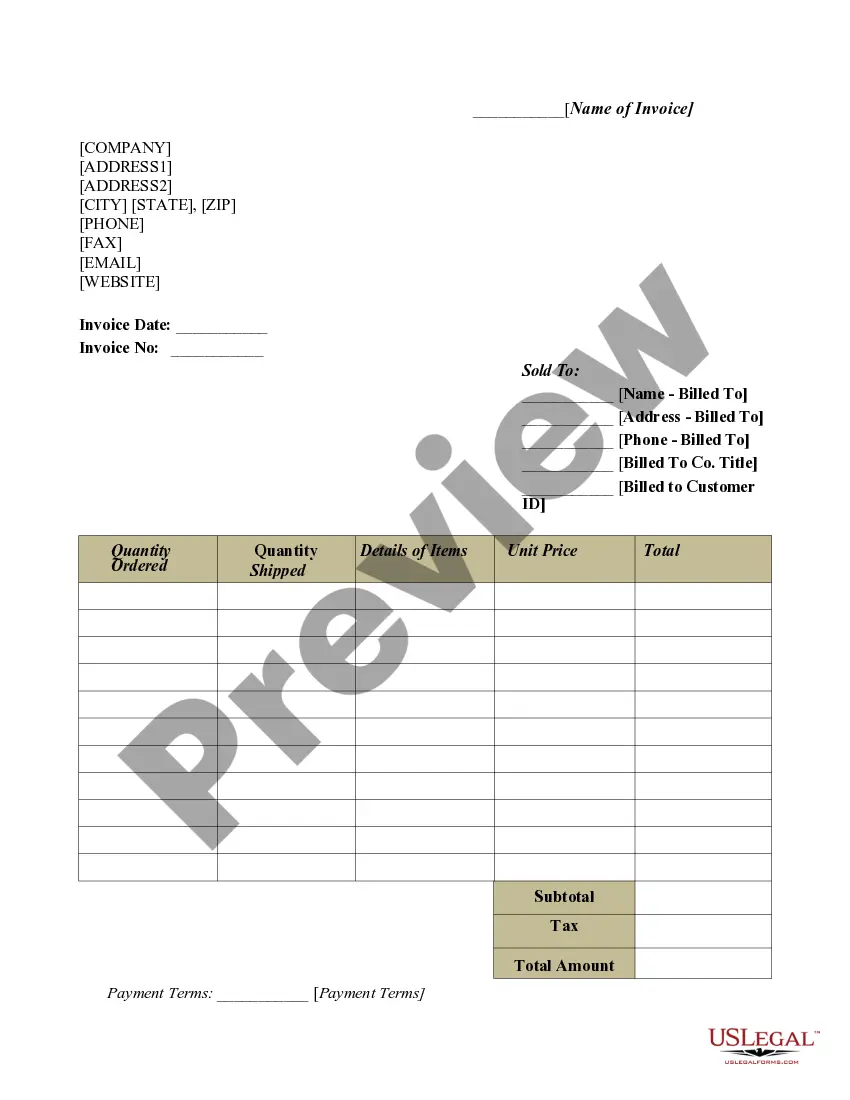

Key points about credit card statements It includes your statement balance, the minimum payment amount and due date, a list of transactions since your last statement, a breakdown of your balance and useful account information.