Credit Card Form Statement With Zero Balance In Franklin

Description

Form popularity

FAQ

Quarterly Asset Summary Statements are available online by logging into your account and clicking the “Statements & Tax Documents” link under the “Transactions” drop-down menu.

The total minimum investment amount is $1,000 per fund unless the account(s) will be funded by Automatic Investment Plan.

Fund Performance: The fund's annualized returns for the past 3 years & 5 years has been around 21.07% & 25.09%. The Franklin India Smaller Companies Direct Fund comes under the Equity category of Franklin Templeton Mutual Funds.

This share class requires an initial investment of $1,000. The fund's risk compared to that of other funds in this category is considered high by Morningstar for the trailing three-, five- and 10-year periods.

Investor Services The Trustee of Franklin Templeton decided to wind up six of our debt schemes in April 2020. The difficult decision was taken because the markets had become illiquid due to the severe impact of COVID-19. The sole objective of this decision was to safeguard value for our investors.

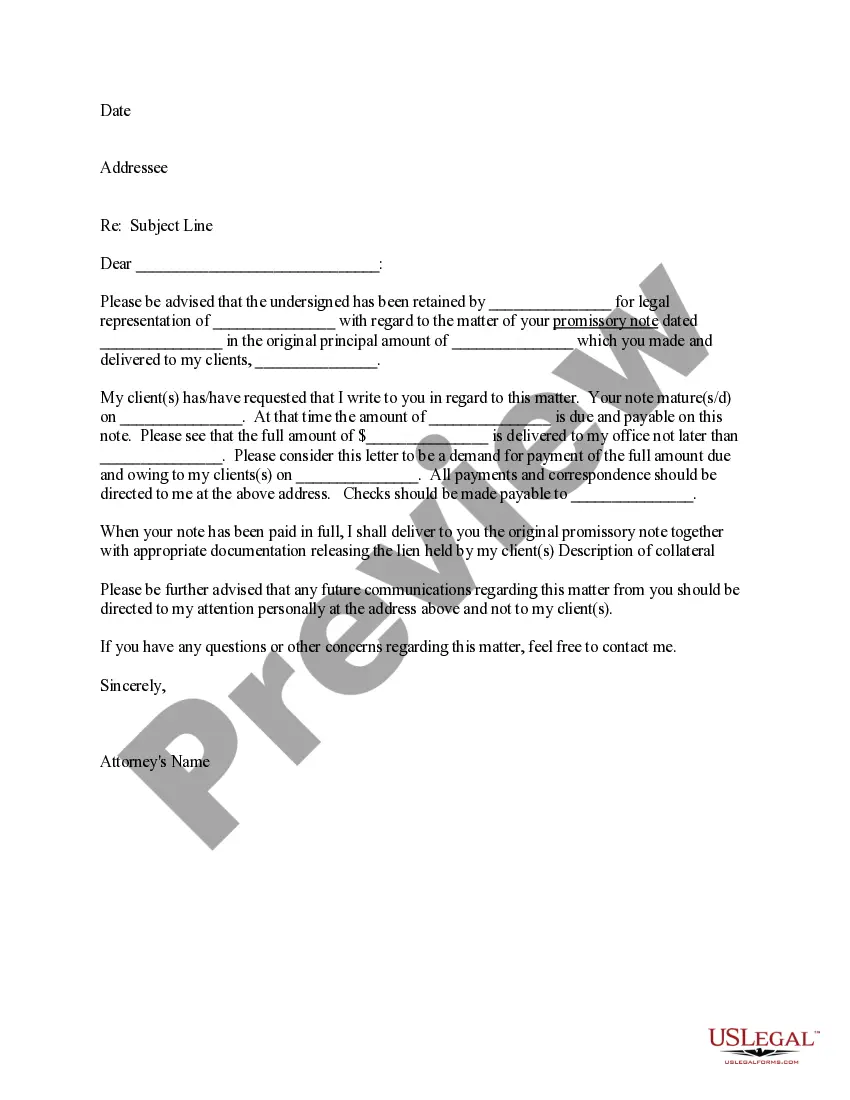

Your statement balance is the total owed, based on adding all charges and payments, at the end of a billing cycle. Your current balance includes new purchases and other activity that may have occurred since the previous billing cycle ended.

A zero balance typically means you have no outstanding balance on the card. In many cases, that means you don't need to make a payment, and you won't incur any late fees or interest charges. Reading your credit card agreement can help you avoid any fees that may apply to your credit card.

Lenders may judge your usage by looking at the statement balance. If your statement balance is zero, as others have said, it will look like you are not actively using your card or your credit line, and it may negatively impact your card.

Depending on how you have opted to receive it, you will get the Credit Card statement via courier at your correspondence address or as an email statement or both. You can also view your Credit Card statement online (via NetBanking if you are using an HDFC Bank Credit Card).

If a borrower does not receive a zero-balance letter after paying off their debt, they should contact their lender or creditor to request one. It is important to keep a copy of the letter for their records, as it serves as proof of debt repayment and can be useful for future reference or disputes regarding the account.