Completion Report For In North Carolina

Description

Form popularity

FAQ

The annual report must also comply with any requirements prescribed by the rules, which are detailed in this guidance. For entities that report on a financial year basis the annual report must be prepared and provided to the responsible Minister by 15 October for each reporting period.

Annual returns along with payment of tax are due on or before March 15 of each year. Installment returns (if required) along with payment of tax are due on or before April 15, June 15, and October 15 of each year.

If you do not file an annual report on time, the state of North Carolina will send you a “Notice of Grounds for Administrative Dissolution.” If you do not file your report within 60 days, your business will be dissolved.

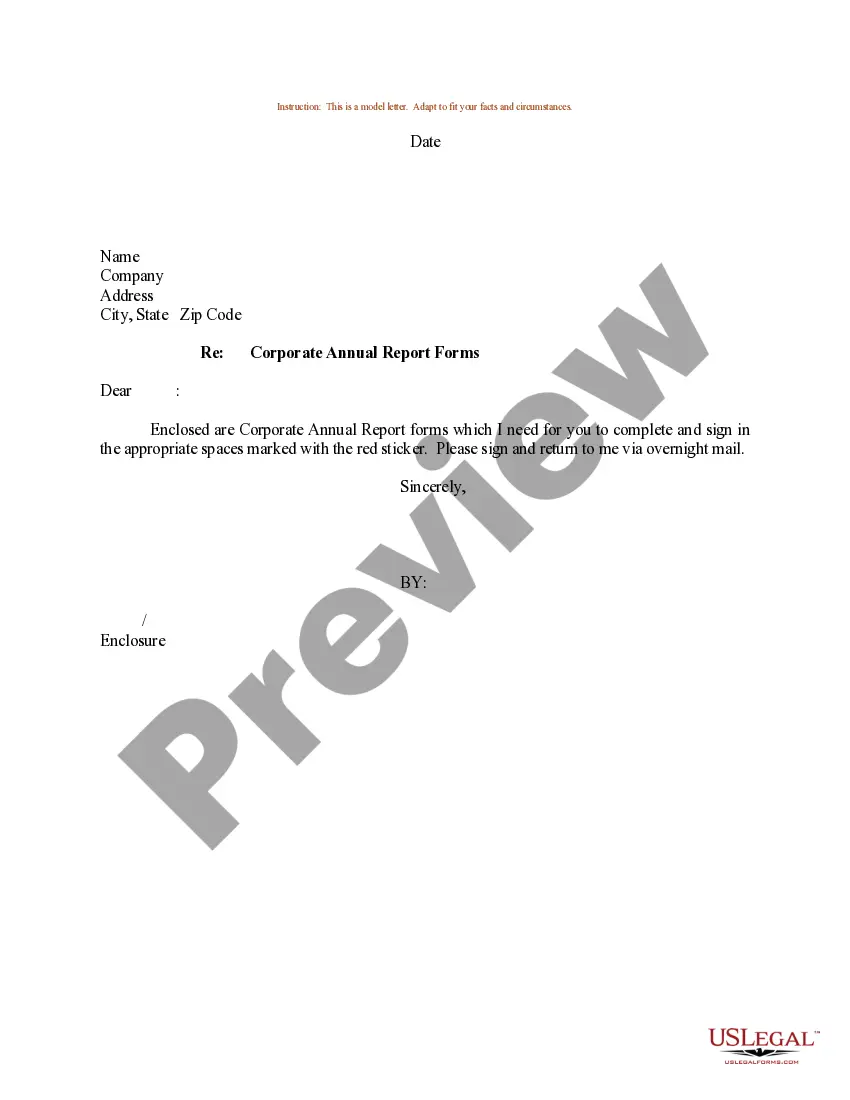

Your report is due on April 15th of each year after the year of creation.

Each Business Corporation, LLC, LLP and LLLP is required to file an annual report with the Secretary of State.

NC community college students who were enrolled full-time were the most likely to complete a degree or credential within six years (58%). In contrast, about two in five students enrolled part-time (39%) earned a degree within six years, indicating the importance of full-time enrollment for timely degree completion.

You must send payment for taxes in North Carolina for the fiscal year 2022 by April 16, 2024. The Extension Deadline is October 15, 2024 to file your North Carolina income tax return. North Carolina automatically grants 6 months extensions on filing income taxes if a federal extension is filed.

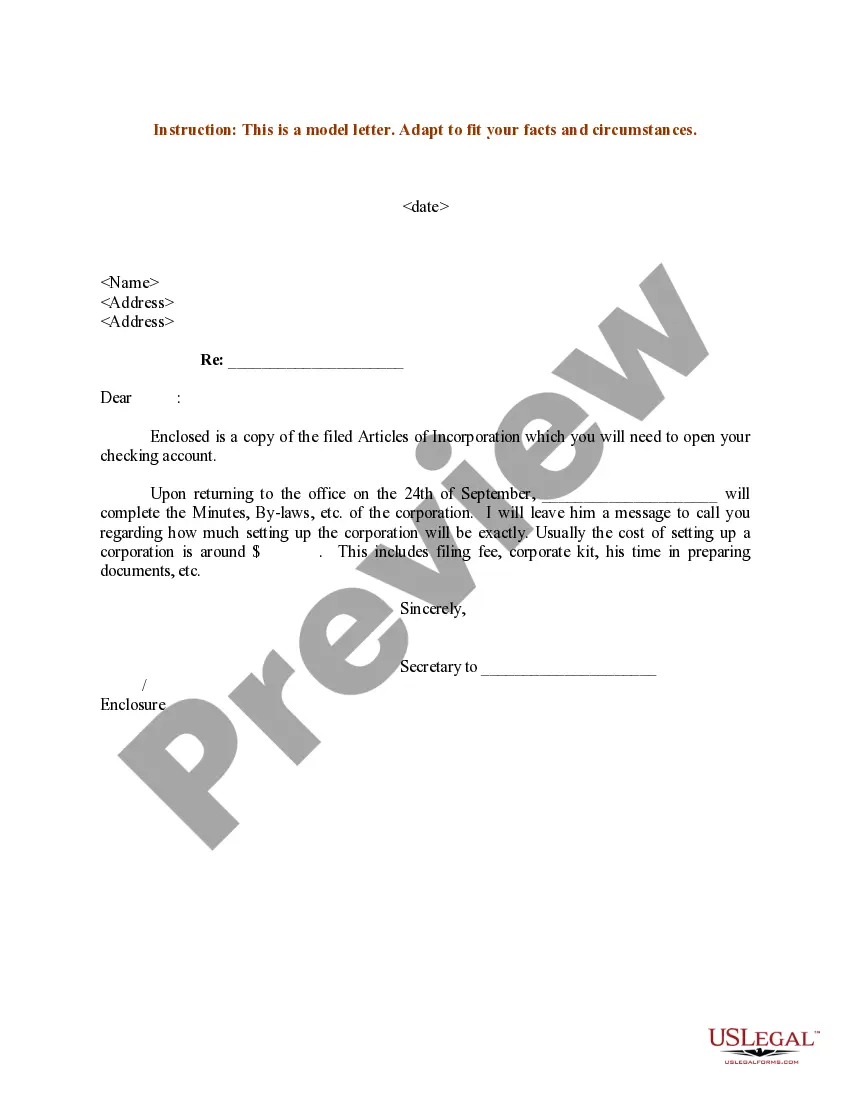

How Long Does It Take to Form an LLC in North Carolina? Once you've gathered all of your information together and filed your Articles of Organization (or had Bizee do it for you), it can take 3-5 business days for the North Carolina Secretary of State to legally create your LLC.

Northwest will form your LLC for $39 (60% discount). See details. Every North Carolina LLC needs to file an Annual Report each year to renew their LLC.