Contract Workshops With Stipends In Texas

Instant download

Description

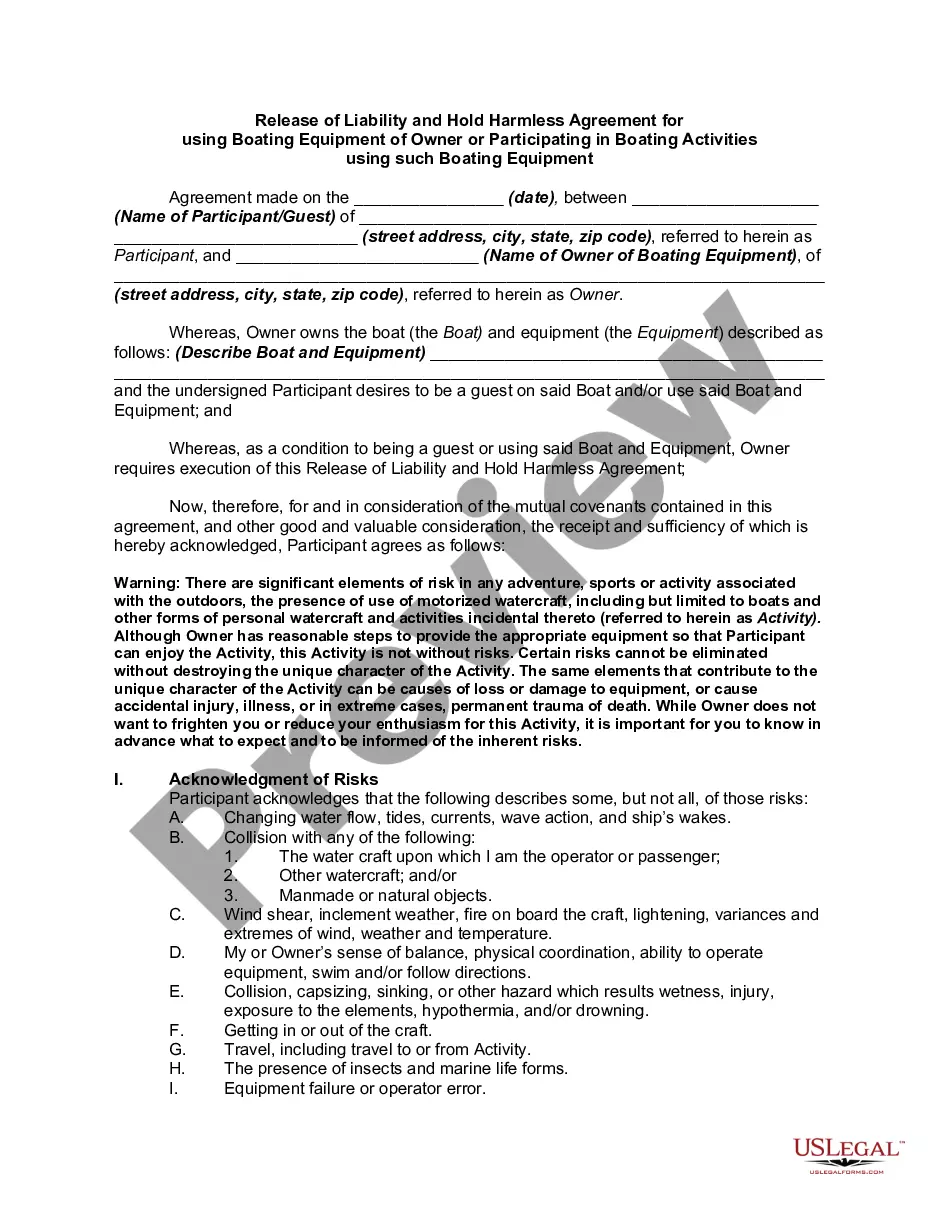

The Contract with Consultant to Teach Workshops outlines the terms between a corporation and a consultant for conducting workshops in Texas. This legally binding document specifies key aspects such as the nature of work, place of work, and time commitments, emphasizing the consultant's independent contractor status. The contract also details payment arrangements, including a percentage of fees for services rendered and stipulates that the consultant handles their own expenses. It is designed for a professional audience, including attorneys, partners, owners, associates, paralegals, and legal assistants, ensuring clarity by outlining responsibilities and expectations. Users should fill in the specific details related to the corporation, consultant, and workshop content as applicable. The document may serve various use cases, including legal validation of agreements, budgeting for workshops, and defining roles within consultancy arrangements. Overall, this contract is a crucial tool for managing legal relationships and financial arrangements in the educational workshop environment.

Free preview

Form popularity

FAQ

In general, scholarship/fellowships that originate from sources outside the United States are not taxable or reportable to tax nonresidents. Revenue ruling 89-67 describes the source of the payment is determined by the "residence or the payor" not the location of the educational activity.

Non-Chapter 21 Contract – A contract for a specific term that does not include rights under Chapter 21. The contract and district policy sets the terms and conditions of this contract.

Stipends are considered taxable income by the IRS if they don't belong in the pre-tax or non-taxable categories. Companies must list the benefits on employees' W-2 forms and withhold state and federal taxes ingly.