Closing Property Title With Mortgage In Santa Clara

Category:

State:

Multi-State

County:

Santa Clara

Control #:

US-00447BG

Format:

Word

Instant download

Description

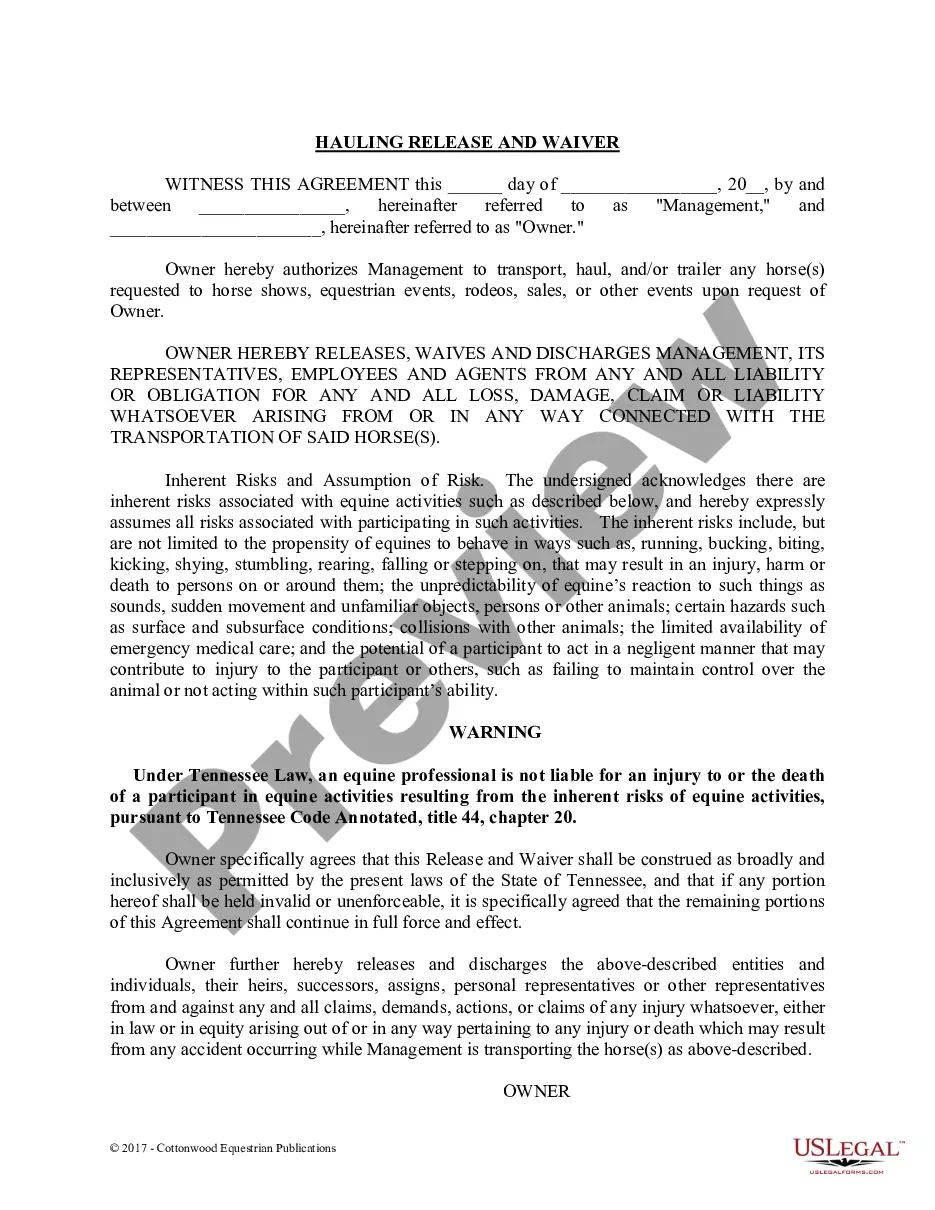

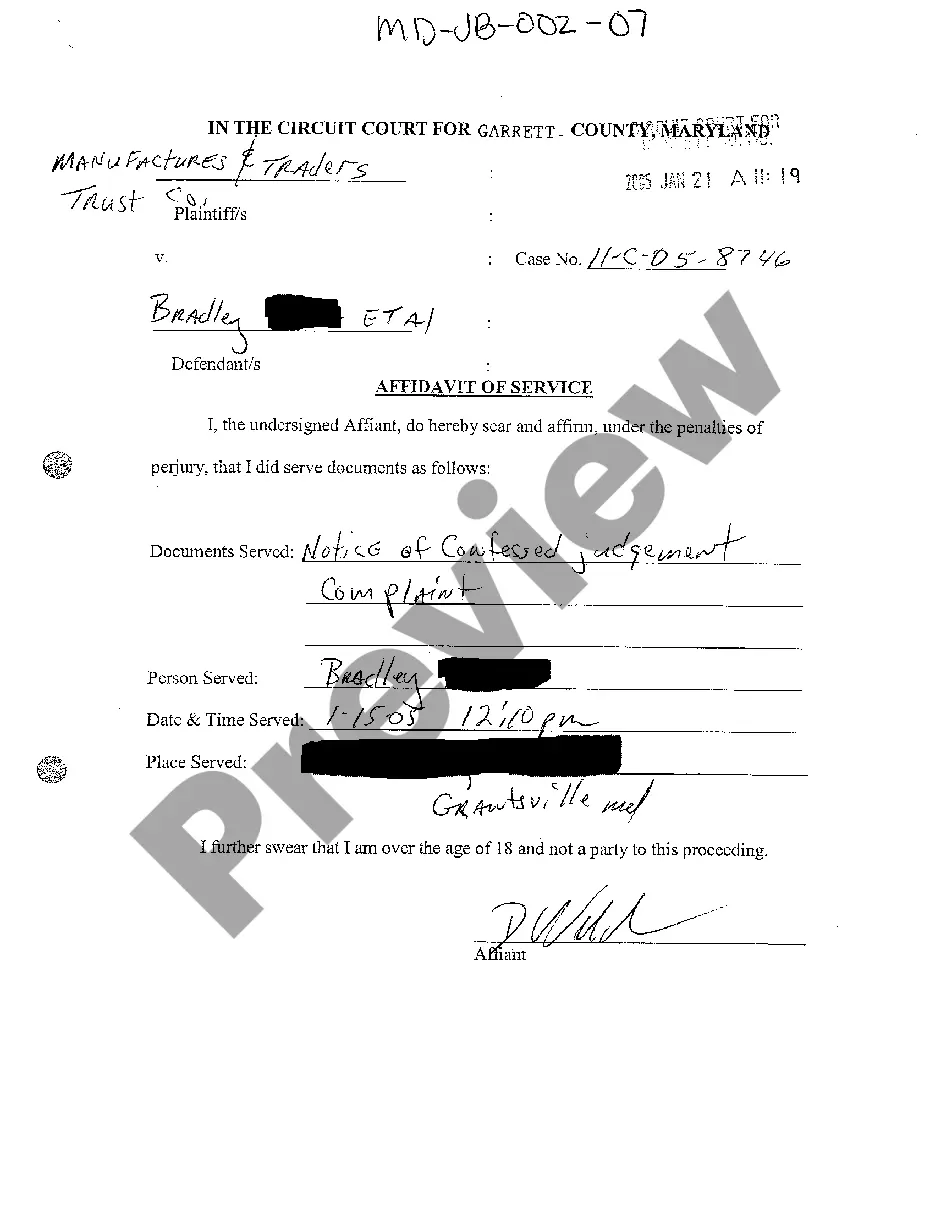

The document titled Agreement for the Sale and Purchase of Residential Real Estate facilitates the process of closing the property title with mortgage in Santa Clara. It outlines key transaction details including the property description, purchase price, down payment, and contingencies related to obtaining a mortgage loan. Notably, the sellers must ensure the property is free of liens and provide a Certificate of Title at closing. Specific sections cover the allocation of closing costs, deposit conditions, and the timeline for closing and possession. The form includes provisions for addressing potential breaches and conditions of the property, including the responsibilities of both buyers and sellers regarding repairs and the state of the property. This document is especially useful for attorneys, partners, owners, associates, paralegals, and legal assistants as it provides a structured legal framework for real estate transactions, ensuring compliance and clarity for all parties involved in the sale and purchase process.

Free preview

Form popularity

FAQ

A CLTA policy is a California Land Title Association Policy. This is often referred to as a standard policy. As the chart shows, a CLTA policy protects the policy holder against clouds on title that are uncovered through a public records search.