Closing Property Title Without In Salt Lake

Description

Form popularity

FAQ

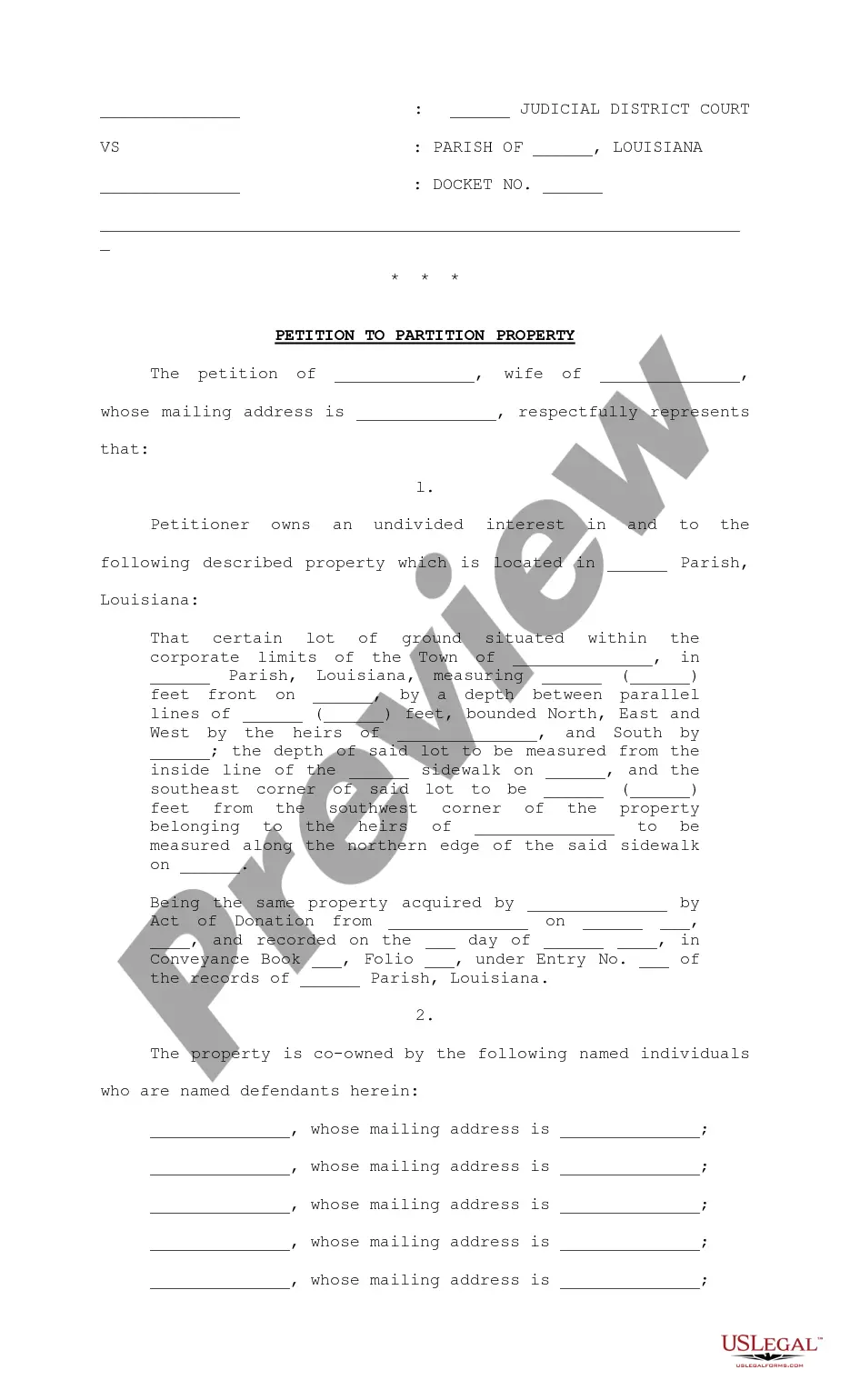

A house title represents the legal ownership of a property and goes hand-in-hand with the deed. The house title shows that the current seller legally owns the property and has the right to sell the home to the buyer. During closing, the title will transfer to the new owner, making the sale official.

The title shows who's owned the property in the past, contains a physical description of the property and shows any liens on it. If you just bought the home, your mortgage will be on the title as a lien. It's different from a deed, which is a document you get at closing that states you own the property.

A clear title is one that has no questions surrounding legal ownership of a property. Before the sale of a property, title companies will check for any claims or liens against that property's title.

A deed and title are closely related — you need both to make a legitimate sale or transfer of property. Having a deed without a title is a bit like buying a new car without getting the keys.

Title and ownership. A simple title report is typically completed in less than two weeks, if not faster, from order to receipt.

A “title agent” is technically a licensed insurance agent who issues title insurance to purchasers and lenders. A “closing agent” is technically the person who sits down with the buyer or seller or borrower (or all three) and goes over the documents with them and answers their questions.

The key documents required for a title transfer in Utah include the Certificate of Title, Bill of Sale, Release of Lien, and Affidavit of Ownership. Having these documents prepared is essential for a successful transfer process.

– Quitclaim Deed: This deed transfers the grantor's interest in the property without any warranties or guarantees. It is often used for transfers between family members where the grantor may not want to warrant the current status of title.

The Process Of Car Title Transfer In Utah Obtain the Title: Buyers must receive the original title from the seller. Complete DMV Form: Fill out the DMV title application form, available on the Utah DMV website. Sign the Title: Both the seller and buyer must sign the title, confirming the transfer of ownership.