This is a generic form for the sale of residential real estate. Please check your state=s law regarding the sale of residential real estate to insure that no deletions or additions need to be made to the form. This form has a contingency that the Buyers= mortgage loan be approved. A possible cap is placed on the amount of closing costs that the Sellers will have to pay. Buyers represent that they have inspected and examined the property and all improvements and accept the property in its "as is" and present condition.

House For Sale By Owner Forms With Property In Riverside

Description

Form popularity

FAQ

How do I file an appeal? The assessment appeals process is administered by the Clerk of the Board. To file for an assessment appeal, you must timely complete an Assessment Appeal Application (form BOE-305-AH). The form may be obtained by contacting the Riverside County Clerk of the Board or by visiting their website.

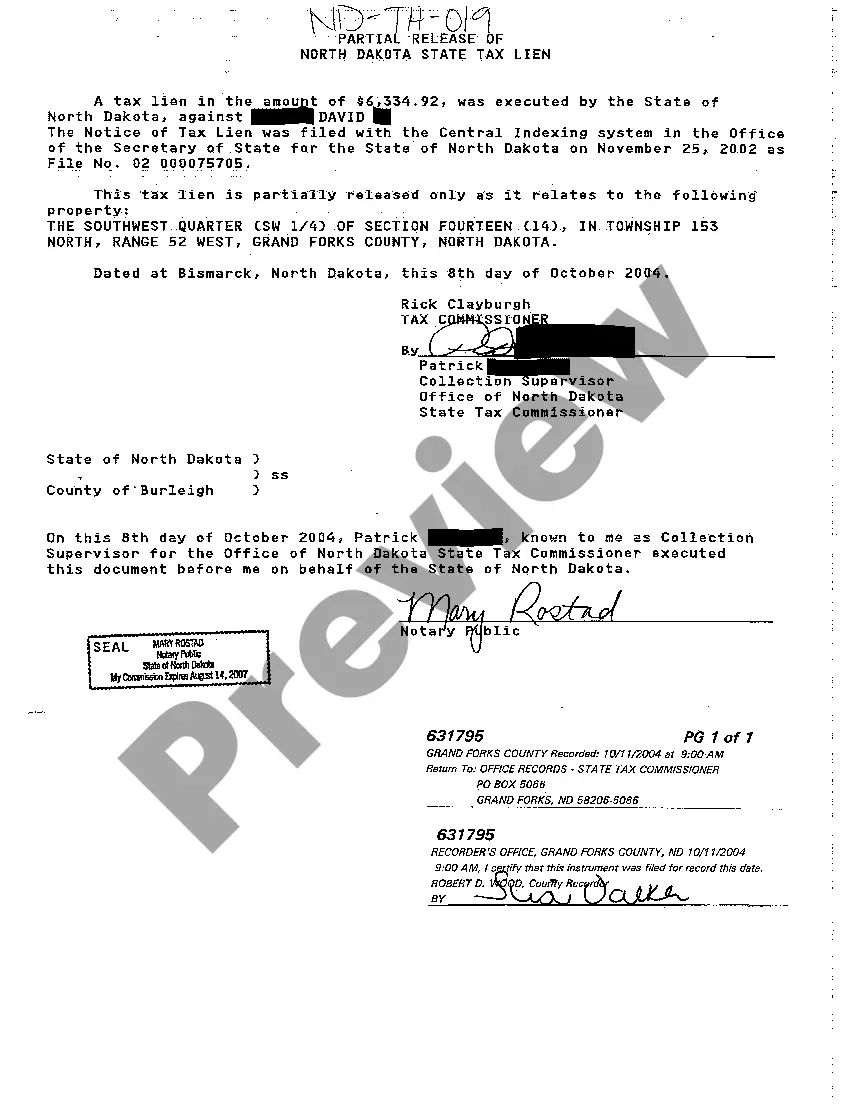

Rules for Recorded Documents At least the top 2-½ inches of the first page shall be reserved for recording information. The left 3-½ inches of this space shall be used by the public to show the name of the person requesting recording and the name and address to which the document is to be returned following recording.

So long as the individuals and the legal entity have the same proportional ownership interests, the real property will not be reassessed when transferred to or from the entity or the individual. A and B can transfer property owned by them 50/50 to an LLC owned by them 50/50 without reassessment.

New Fees Page County Clerk FeesAmount Marriage License 100.00 Confidential Marriage License 110.00 Affidavit to amend Confidential License (within one year) 11.00 Affidavit to amend Confidential License (after one year) 23.0021 more rows

Fortunately, property tax appeals are a lifeline for homeowners grappling with inflated assessments. A property tax appeal can lower your bill if you're facing an overwhelming rate hike from your city or county.

Peter Aldana was elected the Assessor-County Clerk-Recorder for Riverside County in June of 2014. Peter has been with the Riverside County ACR office for over 30 years in a variety of appraisal, supervisory, and management positions.

Use polite language and express your willingness to provide additional information if needed. Factual Presentation: Stick to the facts. Avoid emotional appeals or personal grievances, as these can weaken your case. Example: “I respectfully request a reassessment of my property's value based on the attached evidence.

You do not have to report the sale of your home if all of the following apply: Your gain from the sale was less than $250,000. You have not used the exclusion in the last 2 years. You owned and occupied the home for at least 2 years.

You're not required to hire a real estate agent to sell your home in California. But selling without one involves a lot of work and a big time commitment. While selling by owner spares you from paying the commission of a seller's agent, you'll still be responsible for the buyer's agent's commission.

The County Administrative Center is located at 4080 Lemon Street in Riverside. Residents can call (951) 955-1000 or 2-1-1 for more information on county services and departments. You can reach out with questions for the county here.