Closing Property Title Form Texas In Queens

Description

Form popularity

FAQ

You may choose any title company you want; you don't have to use a company selected by a real estate agent, builder, or lender. Section 9 of the Real Estate Settlement Procedures Act (RESPA) prohibits sellers from conditioning the home sale on the use of a specific title insurance company.

Some searches can be completed in as little as a few hours, but in most cases, a title search will take between 10 and 14 days. In general, the older the home, the longer the title search.

And without delays. Working with experienced professionals familiar with New York's title searchMoreAnd without delays. Working with experienced professionals familiar with New York's title search procedures.

Once a deed has been recorded by the County Clerk's Office, copies of the deed may be requested if the original deed has been misplaced. Plain copies can be found by using the Official Public Records Search and selecting "Land Records". A certified copy may be purchased through request either in person or by mail.

Liens are the most common title defect. Mortgages, unpaid real estate taxes, HOA assessments, and court judgments are examples of liens. Other common title problems are errors in the public records, missing owners, invalid deed signatures, unknown encumbrances, document errors, and boundary disputes.

Here are five ways to avoid paying capital gains tax on inherited property. Sell the inherited property quickly. Make the inherited property your primary residence. Rent the inherited property. Disclaim the inherited property. Deduct selling expenses from capital gains.

– Quitclaim Deed: This deed transfers the grantor's interest in the property without any warranties or guarantees. It is often used for transfers between family members where the grantor may not want to warrant the current status of title.

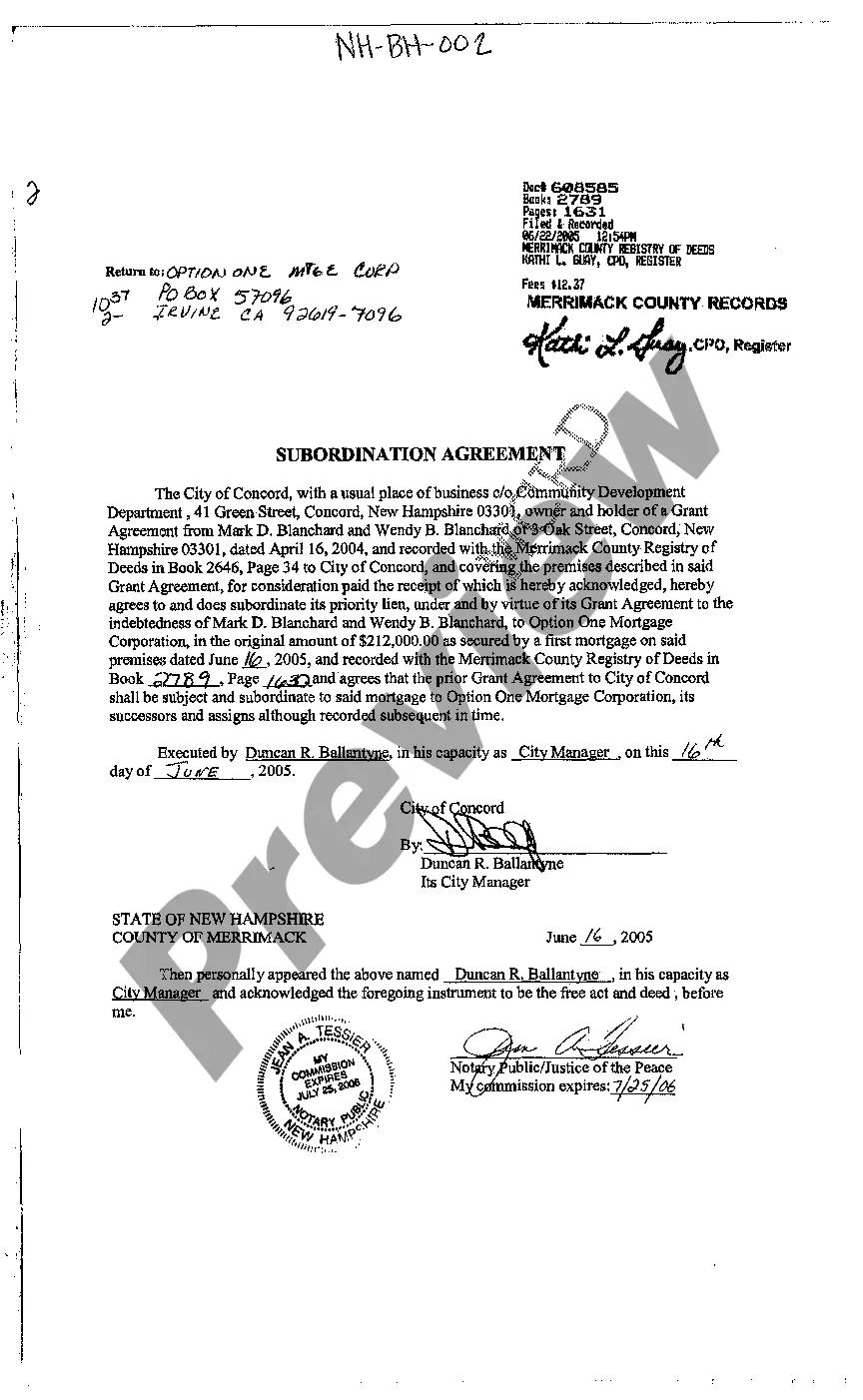

Transfers of real property must be in writing and notarized. Deeds should be recorded in the county where the property is located. To ensure a legal change to the property title, you'll want the services of an attorney. A qualified attorney will prepare and file the real estate transfer deed.

Inheritance Tax: Unlike the federal government, Texas does not impose a state-level gift tax. However, it's crucial to understand the federal gift tax laws, which may impact your decision. As of the last knowledge update in 2022, individuals can gift up to $15,000 per recipient per year without triggering the gift tax.

Here are the steps to follow when transferring property ownership in Texas legally: Step 1: Prepare the Deed. The first step is to prepare the deed, but what's the difference between a title vs. Step 2: Sign the Deed. Step 3: Record the Deed. Step 4: Update Property Records.