House For Sale By Owner Forms With Property In Orange

Description

Form popularity

FAQ

The Clerk-Recorder manages the indexing and archiving of all these essential records to give the public access. Researchers and homebuyers can visit the Clerk-Recorder's office locations to look up current and historical property records for parcels in Orange County.

How unaffordable is it? Well, back in 2024's first quarter, a house hunter would have to make $349,200 annually to comfortably buy the county's $1.37 million median-priced, existing single-family home, ing to stats from the .

Typical Expenses 1 ADULT2 ADULTS (BOTH WORKING) 0 Children1 Child Required annual income after taxes $55,912 $105,175 Annual taxes $11,063 $16,917 Required annual income before taxes $66,976 $122,0918 more rows

70-80k is the low end of the middle class for the state so it probably slows higher in so cal and the Bay area.

And other parts that may be more affordable. It's also three and a half times the national averageMoreAnd other parts that may be more affordable. It's also three and a half times the national average of nearly. $100,000 needed to buy a medium pric. Home a dip in mortgage.

With a high down payment, low property taxes and cheaper insurance, the mortgage payments on a $500,000 home may be as low as $3,045. To adhere to the 28/36 rule, your gross monthly income would need to be $10,876, which is a little more than $130,000 annually.

State Property Tax Postponement Program – Seniors The State Controller's Property Tax Postponement Program allows homeowners who are 62 and over and who meet other requirements to file for a postponement.

How much is property tax on a $300000 house in California? The property tax on a $300,000 house in California would be approximately $2,310 per year. This is based on the average effective property tax rate of 0.77%.

In California, all properties are subject to a basic tax rate of 1% based on their assessed value. This value is set by the county assessor when the property is bought or newly built. For example, if your assessment is $500,000, the basic property tax you owe would be $5,000 annually.

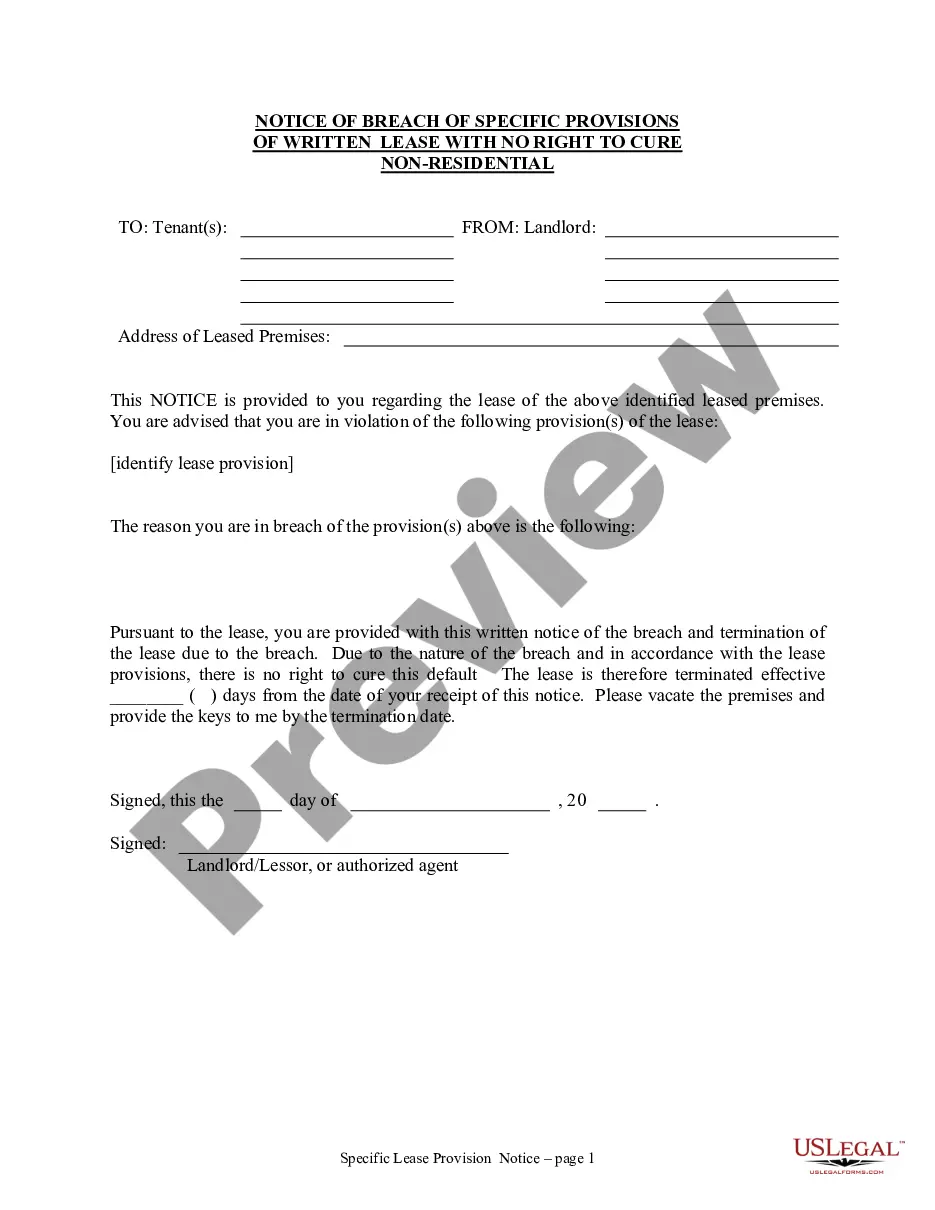

After a property sale or transfer, the necessary documents, such as the deed, must be submitted to the Orange County Recorder's Office.