Closing Property Title Without In North Carolina

Description

Form popularity

FAQ

You can go to a ``title company'' and they can do that search for you. If you choose to do it yourself, go to your local courthouse and ask for their procedure in pursuing a title search.

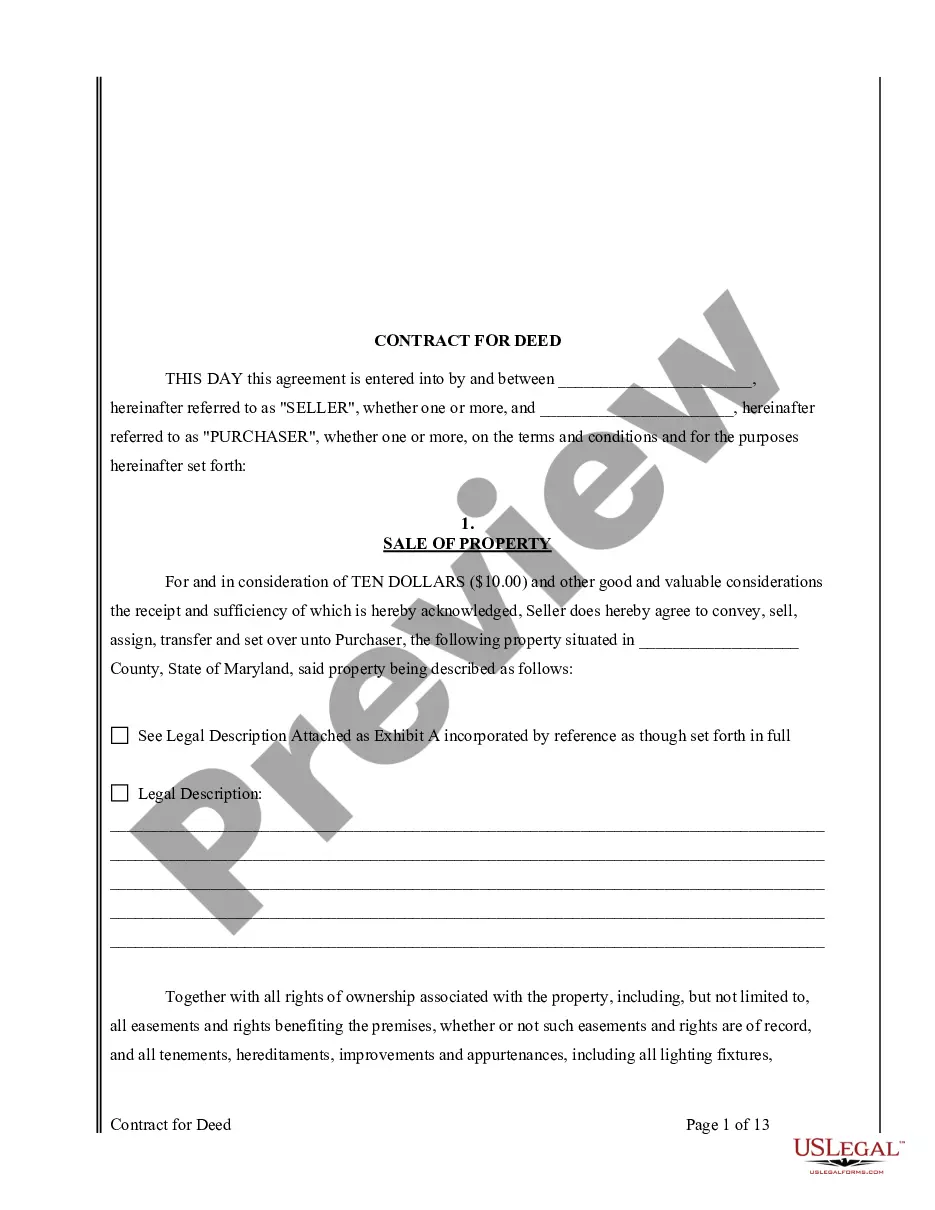

To summarize, title is the legal concept of ownership over property. A deed is the actual document that transfers ownership rights from one party to another party. While this may seem like a subtle and highly technical difference, it is also very important.

How Long Does Closing Take? Closing on a home usually takes place 3-6 weeks after the offer is accepted. The actual closing appointment is allotted a 60 minute time slot. If both the buyer and seller are in full agreement and both understand all the documents they will be signing, then it should go quickly.

When you sell property, everyone on the deed must sign the deed to transfer title. In the case of properties that you owned before you married, North Carolina law still requires your current spouse to sign the deed to relinquish any martial interest they may have acquired by becoming your spouse.

Is a Survey Required in North Carolina? No. Technically, there is no legal requirement to get a new survey for any transaction, mortgage, or project. There is also no legal requirement to get an ALTA/NSPS survey in North Carolina when you do decide to have your property evaluated.

And then and only then okay the proceeds be dispersed. I think that's an important thing to clarifyMoreAnd then and only then okay the proceeds be dispersed. I think that's an important thing to clarify settlement. And closing have have very different meaning settlement is part of closing.

In North Carolina, it is not required for a purchaser of real property to obtain a survey. In fact, most people believe that there are only a few reasons why they should consider having a survey of their property. These reasons include resolving boundary disputes with their neighbor or when building a new home.

And then and only then okay the proceeds be dispersed. I think that's an important thing to clarifyMoreAnd then and only then okay the proceeds be dispersed. I think that's an important thing to clarify settlement. And closing have have very different meaning settlement is part of closing.

Settlement is the first step in the process. Closing can be the same day as Settlement and usually entitles the buyer to possession.

In 2015, borrowers began getting what's now called a closing disclosure — a newer, more streamlined version of the previously used settlement statement. Lenders are required to provide this information to homebuyers at least three days before the closing date.