This is a generic form for the sale of residential real estate. Please check your state=s law regarding the sale of residential real estate to insure that no deletions or additions need to be made to the form. This form has a contingency that the Buyers= mortgage loan be approved. A possible cap is placed on the amount of closing costs that the Sellers will have to pay. Buyers represent that they have inspected and examined the property and all improvements and accept the property in its "as is" and present condition.

Closing Any Property Within The State In Nevada

Description

Form popularity

FAQ

Closing on the Home The closing process usually takes about a month and a half in Nevada from escrow to close, and you won't gain access to your home until the contracts are signed and recorded.

Nevada – Title or Escrow Companies. New Hampshire – Title and Escrow Companies. New Jersey – New Jersey is a split state. In the northern half of the state, closing are handled by Attorneys but in the south closings are handled by title companies.

After the buyer and seller agree to terms of a sale, the transaction goes into escrow, which can take several weeks (30-45 days or more) to reach closing. Escrow can be opened by the buyer or the seller's real estate agent.

The title transfer process in Nevada involves several steps: completing necessary forms based on the property type, obtaining required signatures (notarization for real estate), calculating applicable fees, and submitting all documentation to the appropriate county office or DMV.

An individual may cancel an agreement before midnight of the third business day after the individual assents to it, unless the agreement does not comply with subsection 2 or NRS 676A. 540 or 676A. 700, in which event the individual may cancel the agreement within 30 days after the individual assents to it.

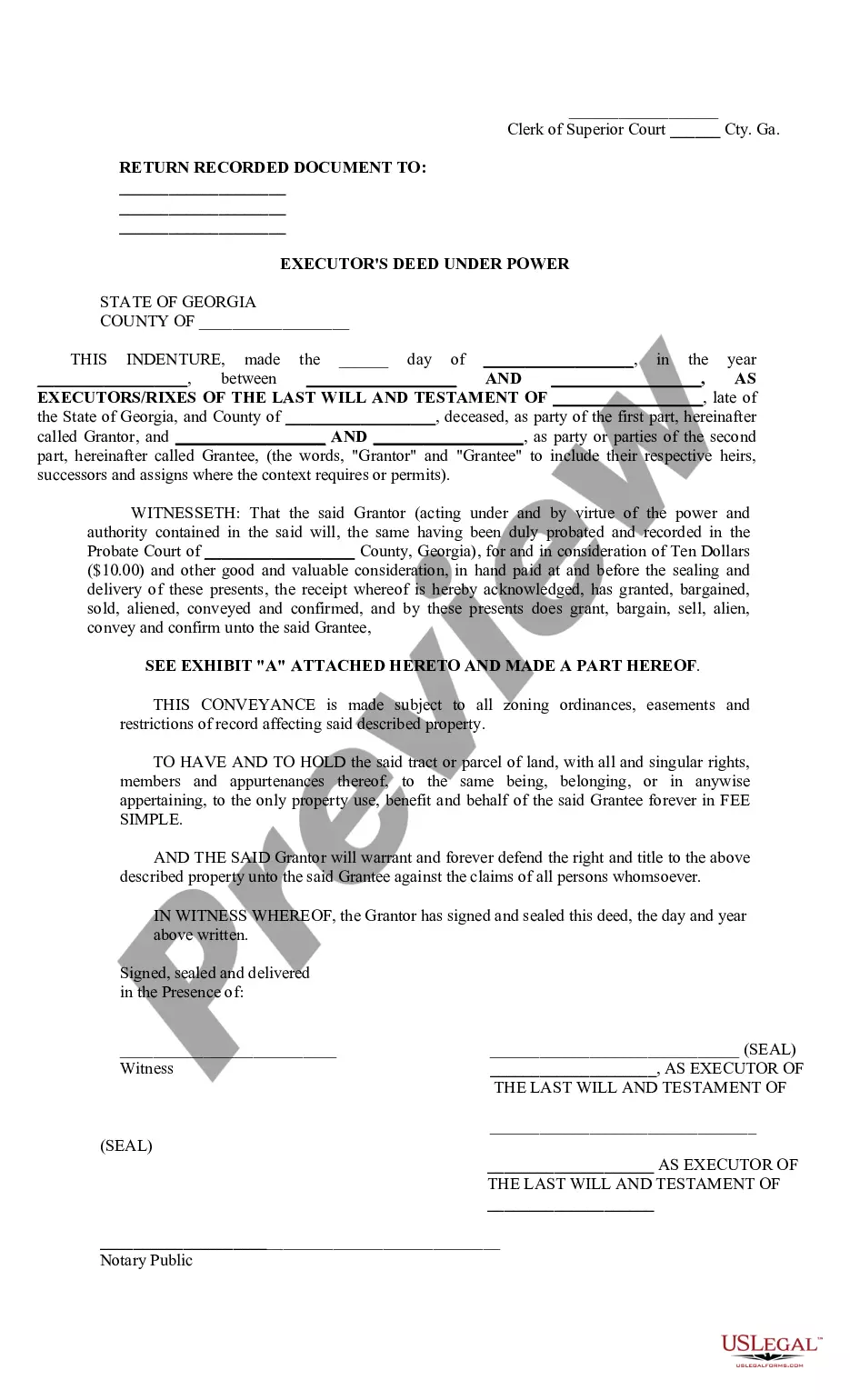

The County Recorder in the county where the property is located is the agency responsible for the imposition and collection of the tax at the time the transfer is recorded. The Grantor and Grantee are jointly and severally liable for the payment of the tax.

– Quitclaim Deed: This deed transfers the grantor's interest in the property without any warranties or guarantees. It is often used for transfers between family members where the grantor may not want to warrant the current status of title.

Mortgage Pre-Approval Is a Good Idea. Open an Escrow Account. Title Search and Insurance. Hire an Attorney. Negotiate Closing Costs. Complete the Home Inspection. Get a Pest Inspection. Renegotiate the Offer.