Closure Any Property With Example In Maricopa

Description

Form popularity

FAQ

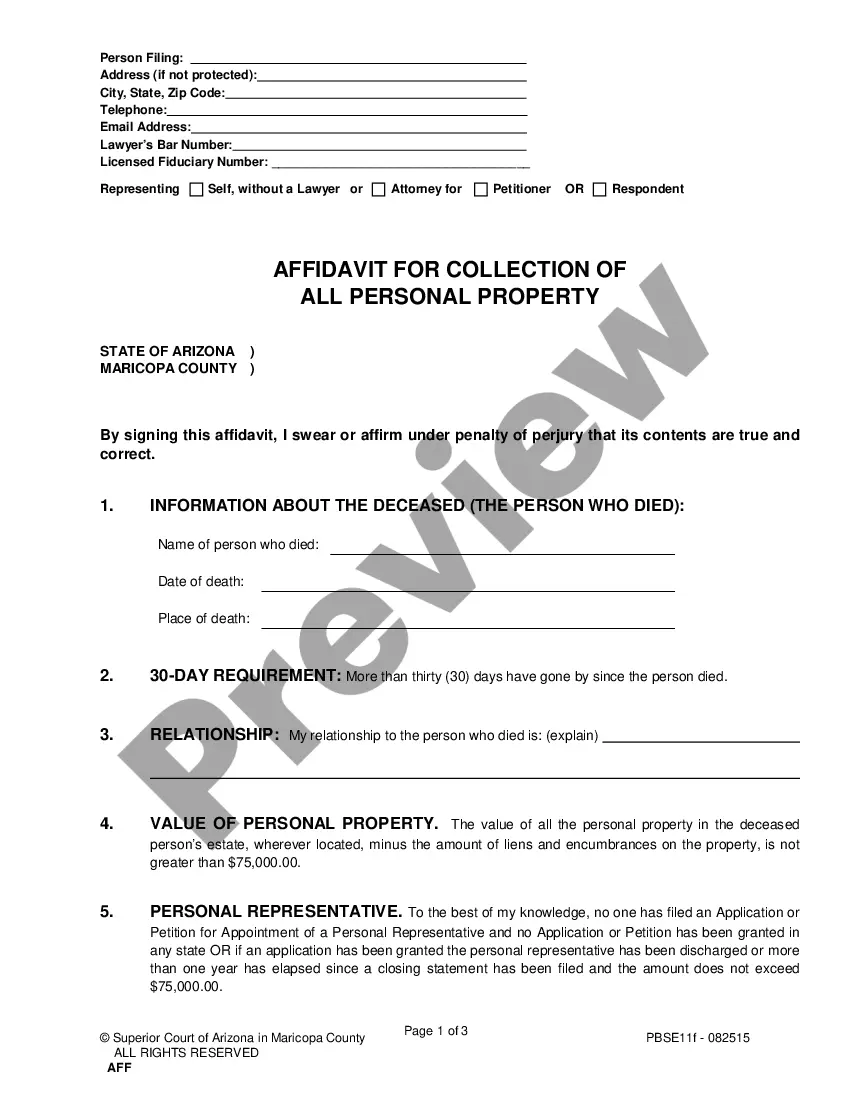

Case initiating documents and subsequent filings for probate case types must be filed in-person, by mail, or via a filing depository box. The ability to eFile probate case documents is currently not available for Maricopa County, but is expected in the near future.

Closing an estate means that the executor has carried out all of their duties and that there's nothing left to do to manage the estate other than distributing assets.

If the Estate has been fully administered and it is ready to be closed, file the original Closing Statement ing to the instructions above. Then send a copy of your conformed Closing Statement along with a note requesting that the hearing be canceled to the Commissioner assigned to your case.

If the decedent has properly positioned all of their property as non-probate assets, probate will not be required. That said, even if all of your assets are positioned to bypass probate, it may still be wise to draft a will, so it's important to discuss your needs with a qualified estate planning attorney.

Although you aren't required to use a residential real estate attorney when buying, selling, or building a home, the law surrounding the process is complicated and it is often wise to at least consult with a lawyer to make sure you're informed about potential issues and roadblocks.

In Arizona probate can take basically as long as it needs. An executor doesn't really have a timeline. There's a recommended start date, which is 60 days after somebody passes away.

If the Estate has been fully administered and it is ready to be closed, file the original Closing Statement ing to the instructions above. Then send a copy of your conformed Closing Statement along with a note requesting that the hearing be canceled to the Commissioner assigned to your case.

The property owner must be 65 or older. Property must be the owner's primary residence. Owner must have resided in the residence for at least two years. Property owner's annual income must be under $35,184 if one owner or under $43,980 if there are two or more owners.

Property Value = NOI / Cap Rate For example, if a property has an NOI of ₹4,80,000 and a cap rate of 7%, its estimated value would be ₹6.86 lakhs (₹4,80,000 / 0.07).