This is a generic form for the sale of residential real estate. Please check your state=s law regarding the sale of residential real estate to insure that no deletions or additions need to be made to the form. This form has a contingency that the Buyers= mortgage loan be approved. A possible cap is placed on the amount of closing costs that the Sellers will have to pay. Buyers represent that they have inspected and examined the property and all improvements and accept the property in its "as is" and present condition.

Closing Property Title Form Texas In Fairfax

Description

Form popularity

FAQ

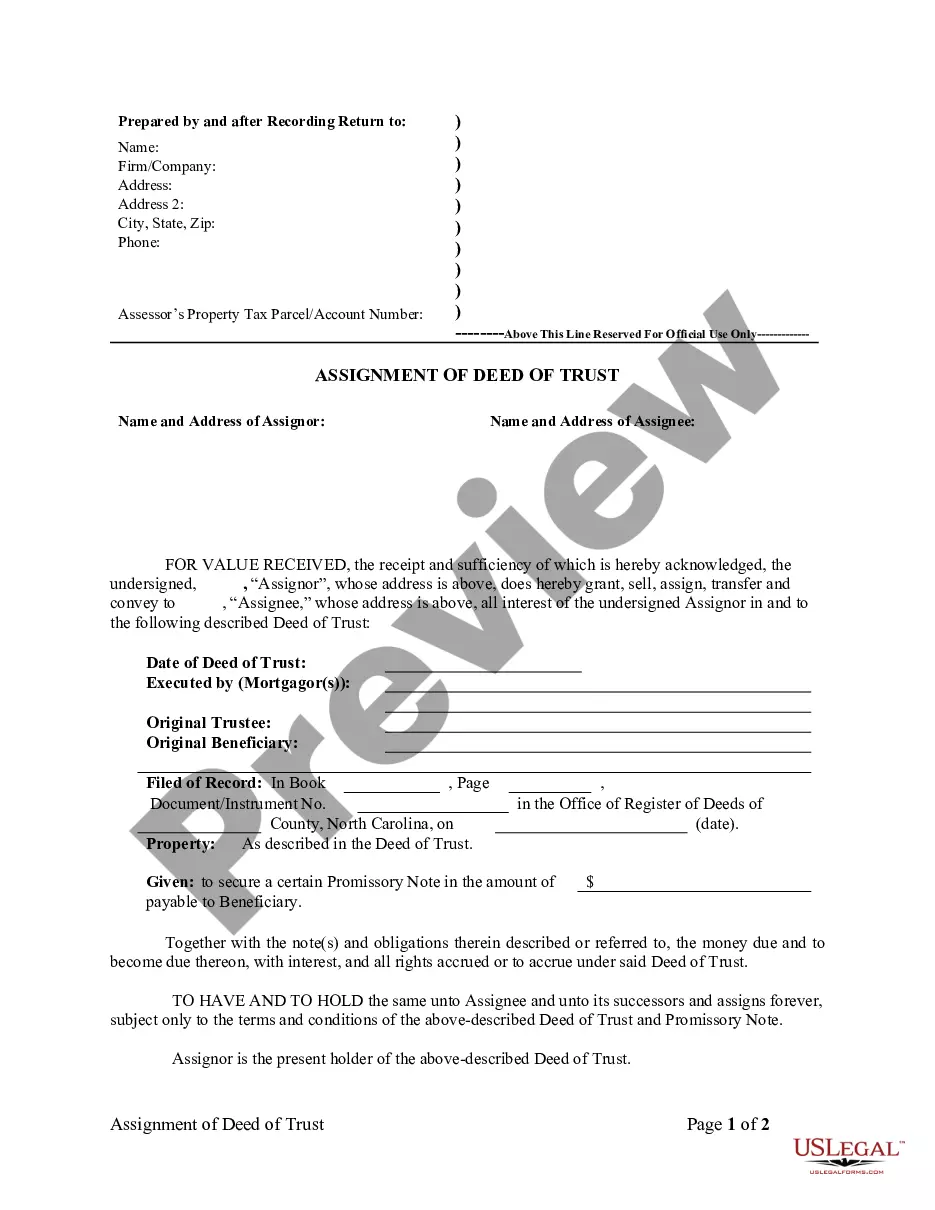

To prove title to real property, you'll need to file certain documents with the county's clerk office. This must be done in the county where the property is located. It will help establish the chain of title, allow you to sell the property, etc. The county cannot add your name to the deed or issue a new deed.

Here are the steps to follow when transferring property ownership in Texas legally: Step 1: Prepare the Deed. The first step is to prepare the deed, but what's the difference between a title vs. Step 2: Sign the Deed. Step 3: Record the Deed. Step 4: Update Property Records.

Transfers of real property must be in writing and notarized. Deeds should be recorded in the county where the property is located. To ensure a legal change to the property title, you'll want the services of an attorney. A qualified attorney will prepare and file the real estate transfer deed.

Send us an email (see links below) or call us at 703-222-8234 (TTY 711) weekdays from 8AM to PM. We are open for walk-in traffic weekdays 8AM to PM.

Real estate taxes are due in two equal installments. The due dates are July 28 and December 5 each year. If the due date falls on a weekend, the due date moves to the next business day. Tax bills are mailed out three to four weeks prior to the due dates.

Contact us! 703-FAIRFAX (703-324-7329) (phone, email and social media) is a contact center for general questions from 8 a.m. to p.m., Monday to Friday.

For information about researching current Fairfax Circuit Court Land Records and Deeds, please visit the Land Records Research Room page or contact the Land Records Division at 703-691-7320 (press 3, then 4) (TTY 711).

If you know the instrument number or deed book and page number, you may request a copy of your deed either by mail or over the telephone by calling 703-691-7320, option 3 and then option 3 again. Send your written request to: Fairfax Circuit Court 4110 Chain Bridge Road, Suite 317 Fairfax, VA 22030.

General Information - Land Records | Circuit Court The Land Records Division of the Fairfax Circuit Court is located on the third floor of the Fairfax County Courthouse at 4110 Chain Bridge Road in Suite 317. Telephone 703-691-7320 (press 3, then 3) (TTY 711).