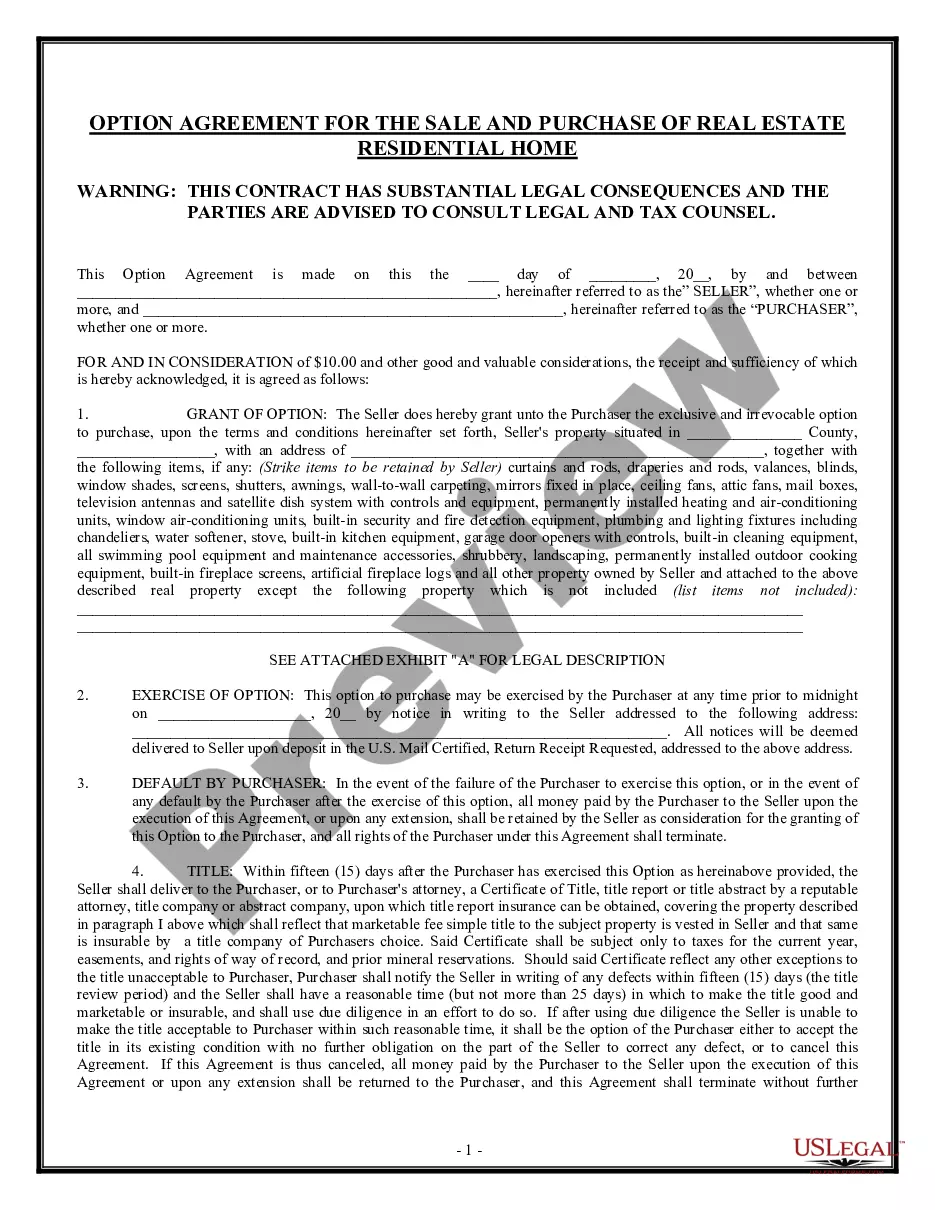

This is a generic form for the sale of residential real estate. Please check your state=s law regarding the sale of residential real estate to insure that no deletions or additions need to be made to the form. This form has a contingency that the Buyers= mortgage loan be approved. A possible cap is placed on the amount of closing costs that the Sellers will have to pay. Buyers represent that they have inspected and examined the property and all improvements and accept the property in its "as is" and present condition.

Closing Property Title For Liens In Cook

Description

Form popularity

FAQ

We would like to release the lien in respect of the below mentioned units pledged in our favour by the Investor, and we therefore, request you to kindly release the lien marked on the below mentioned units.

A lien expires if the claimant fails to file suit within (a) two years of completion of the contract or (b) 30-days receipt of a Section 34 demand to commence suit. Liens do not disappear on their own. The easiest way to remove a mechanics lien is by obtaining and recording a lien release from the lien claimant.

A judgment is a lien on real estate for 7 years from the time it is entered or revived. 735 Ill. Comp. Stat.

The most common examples for voluntary liens are mortgages on a home and liens placed on cars that are financed. Voluntary liens can be placed on any type of property with value. The point of the voluntary lien is for a lender to secure collateral for a debt or service rendered.

And the amount owed. If you are placing a judgment lean. You first need to obtain a judgement </S>MoreAnd the amount owed. If you are placing a judgment lean. You first need to obtain a judgement </S> in court. Once you have a judgment you can file it with the county recorder's.

The most common type of lien is what's usually referred to as a Mechanic's Lien. Sometimes called "construction liens," "laborer liens," or "artisan's liens," they are filed by contractors, subcontractors, or construction firms.

Please contact the circuit clerk or the recorder of deeds in the county in which the lien was filed to receive official information concerning the lien.

How to access the Illinois Tax Lien Registry? You can access the registry through the “Lien Registry” link under the “Quick Links” section on the Illinois Department of Revenue website at tax.illinois, or visit this direct link.

(b) The amount of the tax lien shall be a debt due the State of Illinois and shall remain a lien upon all property and rights to: (1) personal property belonging to the debtor, both tangible and intangible, which is located in any and all counties within the State of Illinois; and (2) real property of the debtor ...

You should file your mechanics lien with the County Recorder of Deeds. You can do this in person, by mail, or electronically. Bridgeview Court Bldg. Hours: a.m. – p.m. Monday – Friday (recordings/purchases accepted until p.m.)