Closing Property Title Without Paying Taxes In Clark

Description

Form popularity

FAQ

Here's the breakdown property. Tax increases are capped at either 3 percent if it's your primaryMoreHere's the breakdown property. Tax increases are capped at either 3 percent if it's your primary residence. Or eight percent if it's an investment or commercial property.

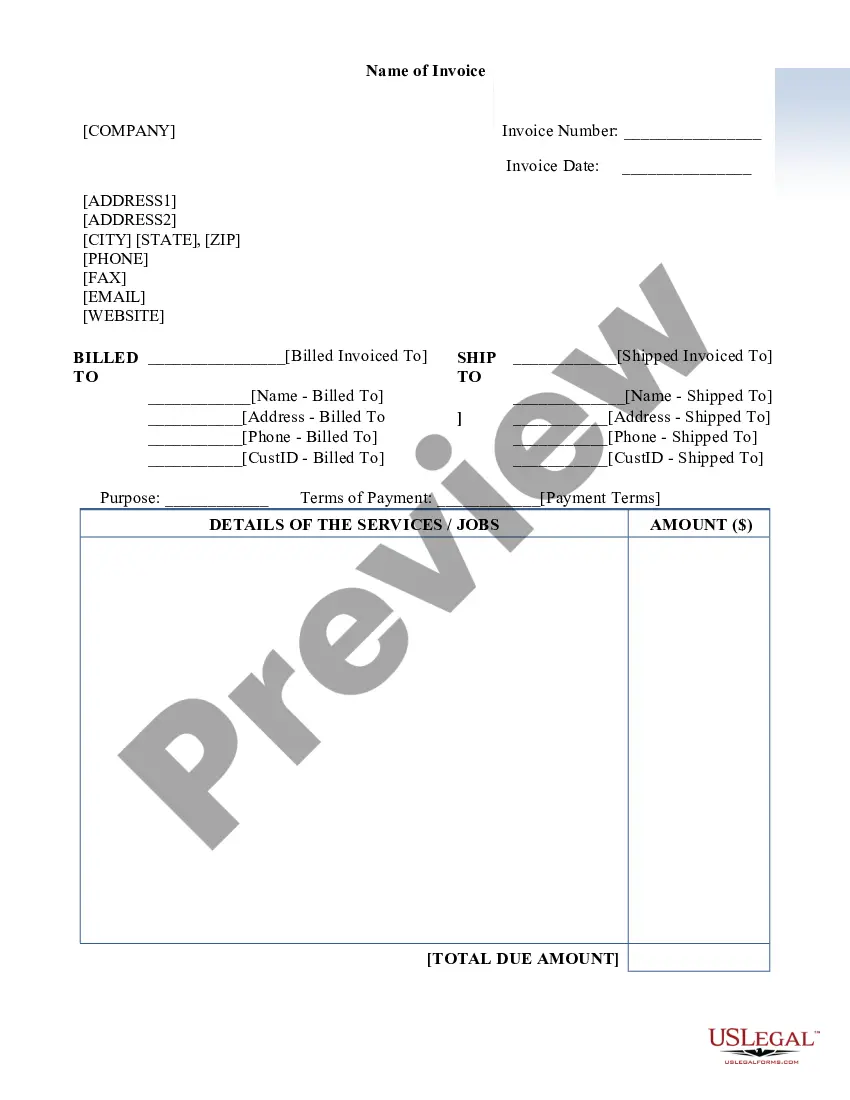

The title transfer process in Nevada involves several steps: completing necessary forms based on the property type, obtaining required signatures (notarization for real estate), calculating applicable fees, and submitting all documentation to the appropriate county office or DMV.

General Rate: For all counties, the rate is $1.95 for every $500 of the property's value or any fraction thereof, as long as the value is over $100.

Clark County sales tax details The minimum combined 2025 sales tax rate for Clark County, Nevada is 8.38%. This is the total of state, county, and city sales tax rates. The Nevada sales tax rate is currently 4.6%. The Clark County sales tax rate is 3.78%.

The title transfer process in Nevada involves several steps: completing necessary forms based on the property type, obtaining required signatures (notarization for real estate), calculating applicable fees, and submitting all documentation to the appropriate county office or DMV.

An unsecured property tax is an ad-valorem (value based) property tax that is the liability of the person or entity assessed for the tax. Because the tax is not secured by real property, such as land, the tax is called "unsecured."

There is no redemption period on property acquired through the tax auction. Once you receive the recorded absolute deed the property is yours. There is a 2 year period where the previous owner may protest the sale and during which title companies do not issue title insurance.