Closure Any Property For Rational Numbers In Bexar

Description

Form popularity

FAQ

In the event a property owner disagrees with their assessed value, a protest may be filed with their appraisal district. For additional information regarding the appeal process, please contact the Bexar Appraisal District at 210-224-8511 to speak to one of their appraisers.

Collect Evidence: Gather evidence that supports your argument that the property's value is inflated. This could include data relating to recent property sales issues, the condition of your property, or other economic factors impacting property values.

The sale will take place on the west side of the Bexar County Courthouse located at 100 Dolorosa, San Antonio, Texas or as designated by the Commissioner's Court. 4.

The Online Services Portal is available to ALL owners that would like to conduct business with the Appraisal District electronically. This service includes filing an exemption on your residential homestead property, submitting a Notice of Protest, and receiving important notices and other information online.

To apply for an exemption, call the Bexar Appraisal District at 210-224-2432. You may also contact their agency directly by email or visit their website to obtain the necessary forms. The exemption will be forwarded to the tax office as soon as the Appraisal District updates their records.

Bexar County Appraisal District will schedule a hearing to give you the opportunity to protest your taxes. At the hearing you will speak to a panel and explain why you think the taxes should be lower. You can attend the hearing in person, virtually or telephone conference phone call.

If you are dissatisfied with your property's appraised value or if errors exist in the appraisal records regarding your property, you should file Form 50-132, Property Owner's Notice of Protest (PDF) with the ARB.

The 10-Month Payment Plan applies to a property the person occupies as a residential homestead, with one of the following exemptions: Disabled person exemption, Age 65 or Over exemption, Disabled Veteran exemption, or.

Closure property For two rational numbers say x and y the results of addition, subtraction and multiplication operations give a rational number. We can say that rational numbers are closed under addition, subtraction and multiplication. For example: (7/6)+(2/5) = 47/30.

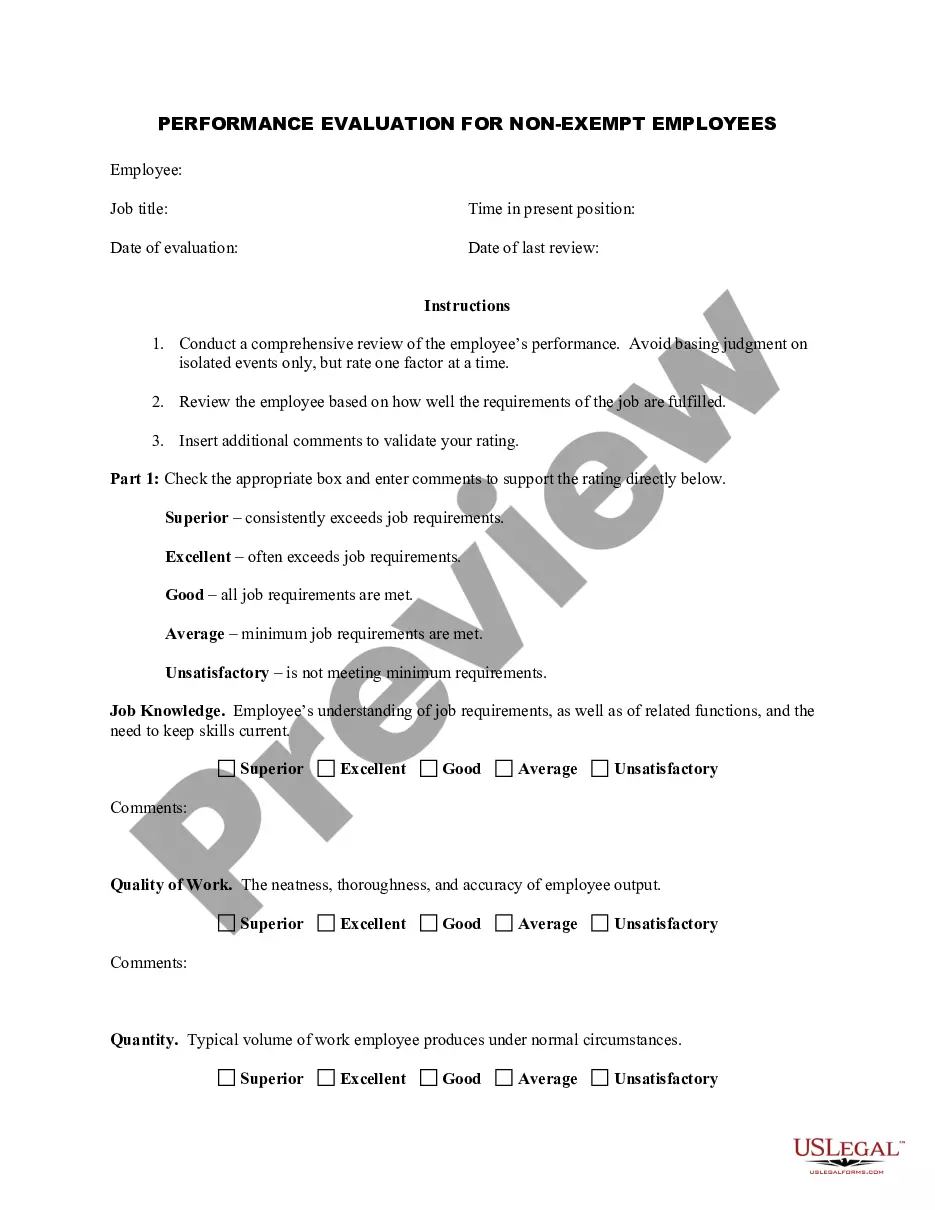

Lesson Summary OperationNatural numbersIrrational numbers Addition Closed Not closed Subtraction Not closed Not closed Multiplication Closed Not closed Division Not closed Not closed