Bylaws Of The Corporation Form Of Business Ownership In Travis

Description

Form popularity

FAQ

A general business license is not required in Texas. However, it is important to determine necessary licenses, permits, certifications, registrations or authorizations for a specific business activity, at the federal, state and local level.

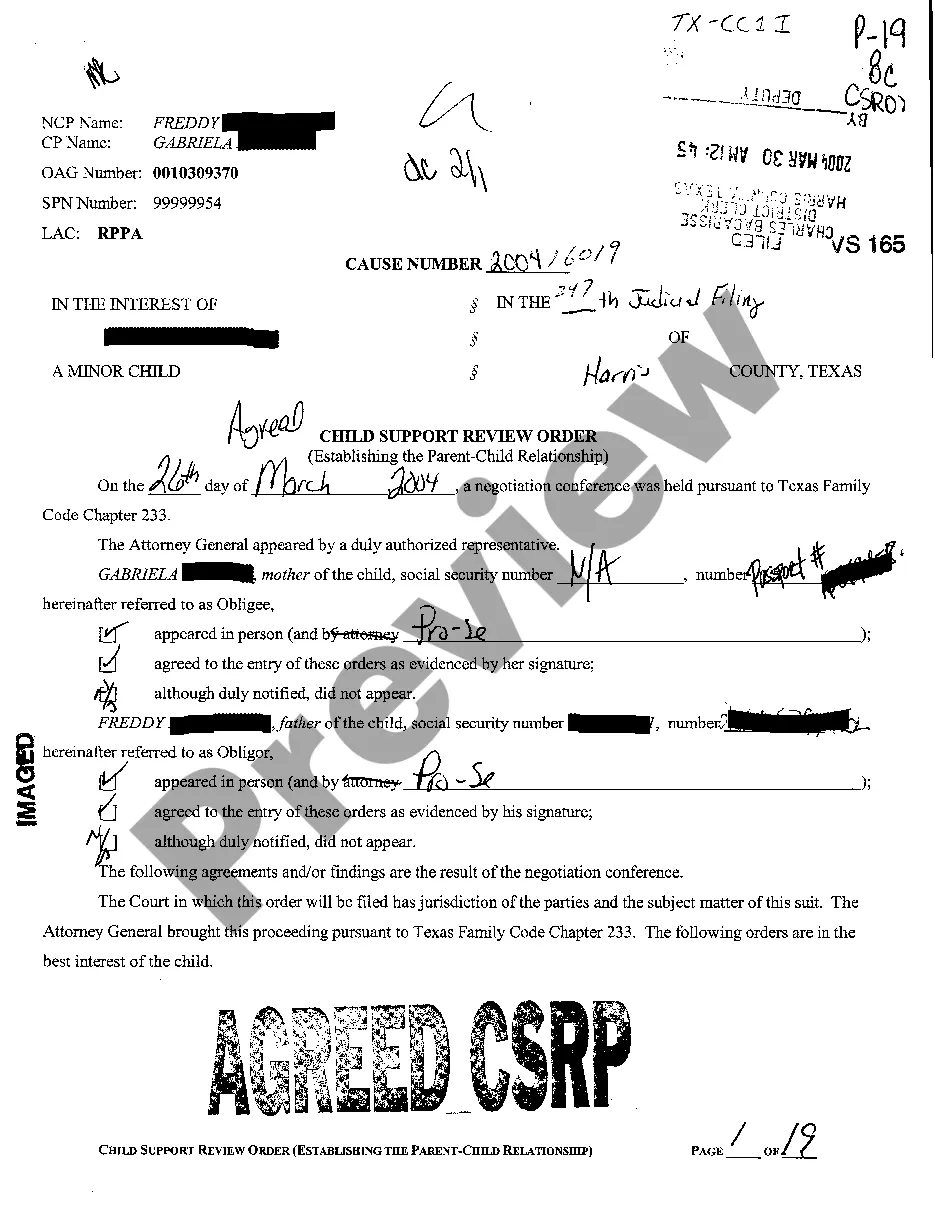

To change LLC ownership in Texas, members may opt for either a partial or full transfer of their interests. The process includes notifying the Secretary of State and other relevant parties to make the transfer official.

Texas business laws, including the Texas Business Organization Code, provide two main legal options for removing a member if the operating agreement does not specify: voluntary dissolution and judicial dissolution. Voluntary dissolution requires a majority vote of the members.

There are two primary methods to modify LLC ownership in Texas - issuing membership interest units or transferring existing units. Issuing membership interest units is carried out through the LLC, and the company agreement usually sets the initial number of units.

Corporate form refers to the legal structure that a business entity takes on. It defines how the business is organized and operated, as well as the rights and responsibilities of its owners.

A company is a type of business structure where your business forms a separate legal entity. This means the company has the same rights as a natural person and can incur debt, sue and be sued. Unlike a sole trader or a partnership structure, you're not liable (in your capacity as a member) for the company's debts.

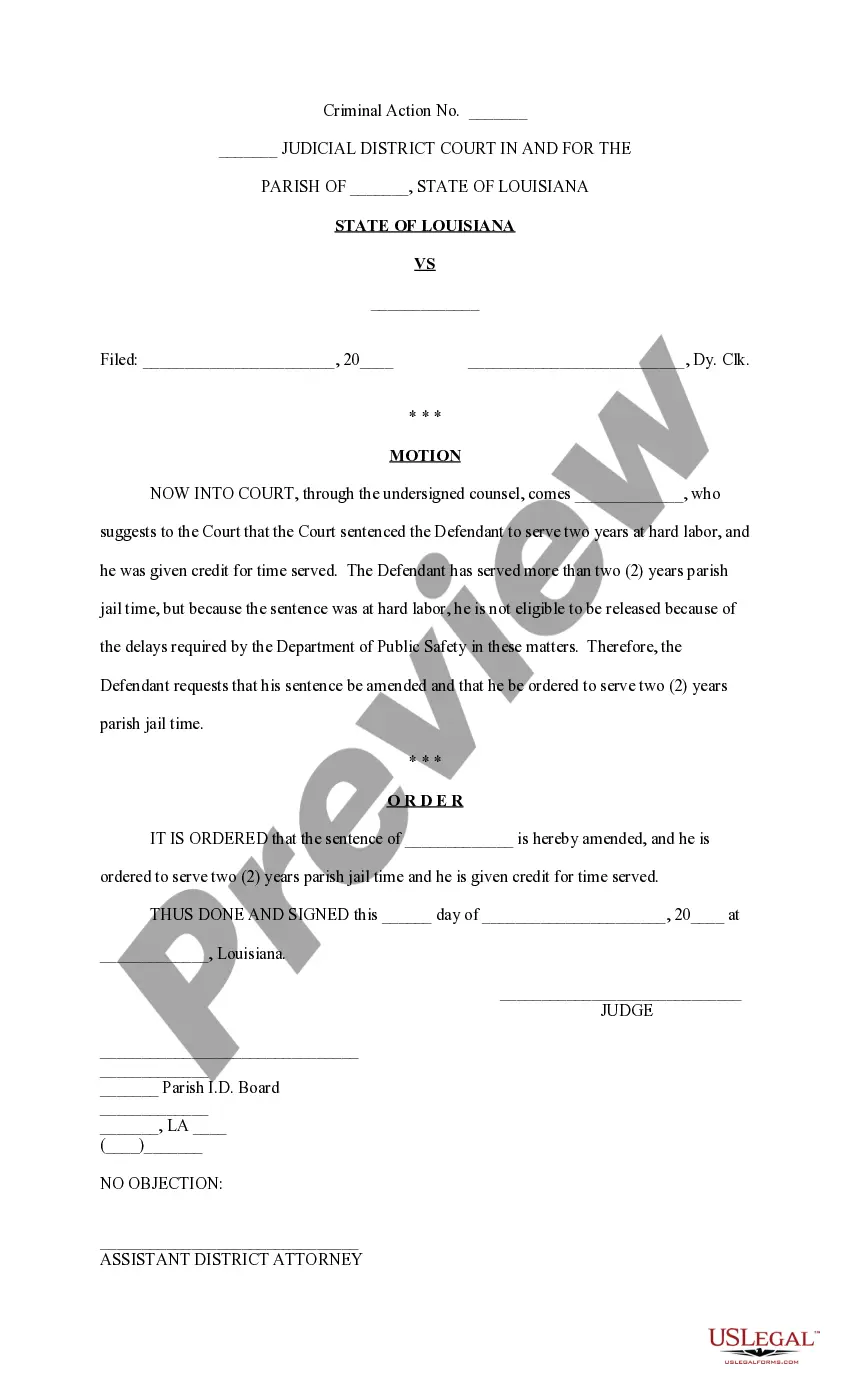

Creating by-laws When incorporating under the Canada Not-for-profit Corporations Act (NFP Act), you have to create by-laws. They set out the rules for governing and operating the corporation. They can be modified at a later date as the needs of the corporation change.

Corporations are legally required to adopt bylaws in Texas – Section 21.057 of the Texas Business Organizations Code states that the board of directors of a corporation shall adopt initial bylaws. So, if your company gets caught in a legal battle without bylaws, you could face some serious legal consequences.

A distinguishing characteristic of a corporation is limited liability. Its shareholders profit through dividends and stock appreciation, but they are not personally liable for the company's debts. Almost all large businesses are corporations, including Microsoft Corporation and the Coca-Cola Company.

The secretary of state does not maintain the bylaws or tax exempt filings of any nonprofit organization. Some organizations that have obtained tax-exempt status from the Internal Revenue Service are required to make certain documents available to the public.