Bylaws Of A Corporation With The Irs In Salt Lake

Description

Form popularity

FAQ

To give your business S Corp tax status, you complete Form 2553 with the Internal Revenue Service (IRS). If you start your business as a Utah LLC, you have to complete Form 8832 to elect corporation status before you can begin filing Form 2553 to elect S Corp status.

How do I file the Utah Articles of Incorporation? Mail: Division of Corporations and Commercial Code. PO Box 146705. Salt Lake City, UT 84114-6705. In person: Division of Corporations and Commercial Code. 160 E. 300 S. 2nd Floor. Salt Lake City, UT 84111. Fax: (801) 530-6438.

Corp Election teps for Corporations tep 1 Name your Utah corporation. tep 2 Appoint directors. tep 3 Choose a Utah registered agent. tep 4 File the Utah Articles of Incorporation. tep 5 Create corporate bylaws. tep 6 Draft a shareholder agreement. tep 7 Issue shares of stock.

Most management actions are protected from judicial scrutiny by the business judgement rule: absent bad faith, fraud, or breach of a fiduciary duty, the judgement of the managers of a corporation is conclusive.

One class of stock An S corporation may issue only one type of stock. A corporation will not be treated as having more than one class of stock purely because there is some discrepancy in the voting rights among the shares of the common stock.

An S corporation is not subject to Utah income tax. However, shareholders are liable for Utah income tax in their separate or individual capacities.

7 Steps to dissolve your Corporation in Utah: Step 1: Review your Corporation Operating Agreement and State Laws. Step 2: File the necessary dissolution documents. Step 3: Resolve outstanding debts and obligations. Step 4: Notify tax authorities an cancel licenses. Step 5: Distribute remaining assets to members.

Corp Election teps for Corporations tep 1 Name your Utah corporation. tep 2 Appoint directors. tep 3 Choose a Utah registered agent. tep 4 File the Utah Articles of Incorporation. tep 5 Create corporate bylaws. tep 6 Draft a shareholder agreement. tep 7 Issue shares of stock.

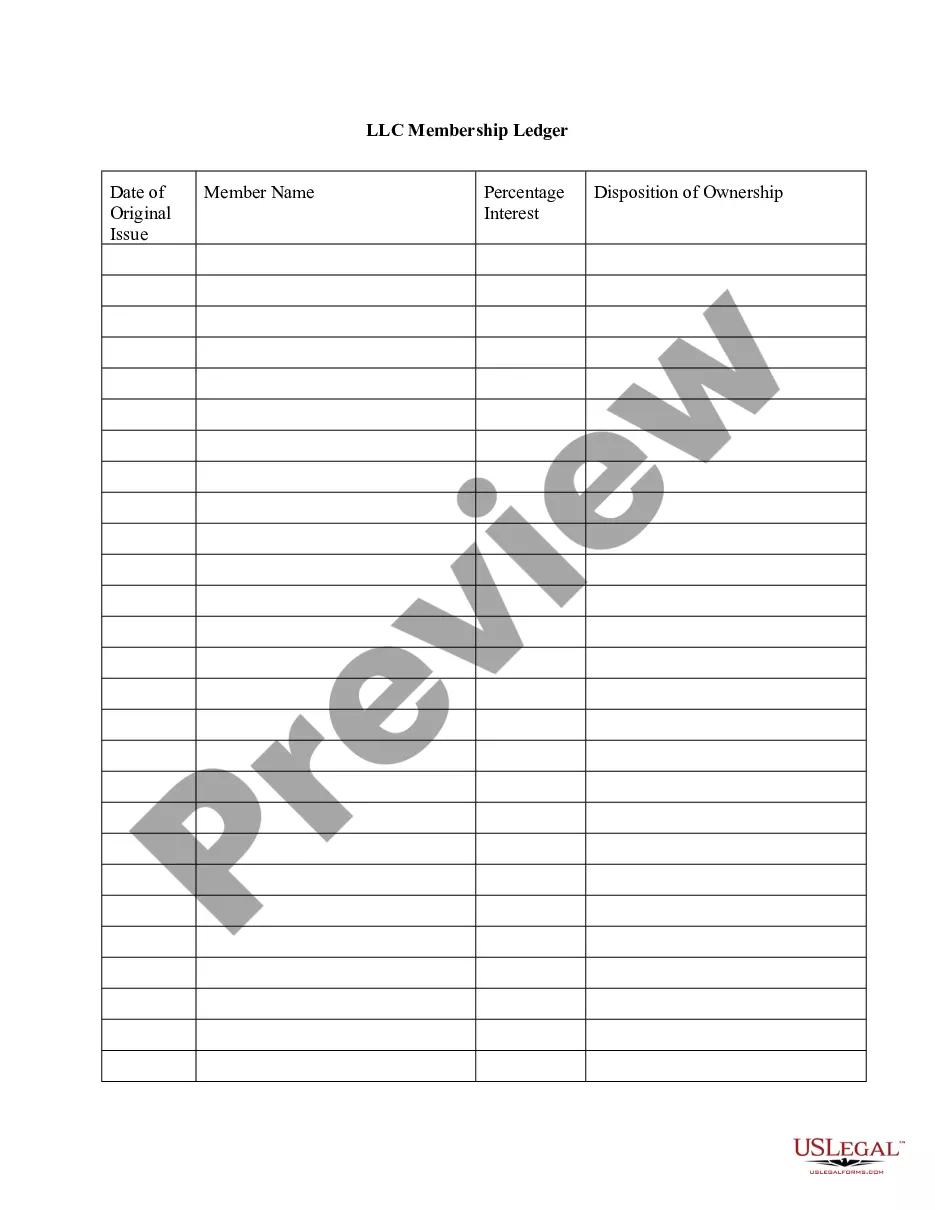

Private limited companies are owned by one or more individuals (human or corporate) known as 'members'. The members of limited by shares companies are called shareholders. The members of limited by guarantee companies are known as guarantors.