Hoa Bylaws Template With Calculator In Palm Beach

Description

Form popularity

FAQ

A Lady Bird Deed is most beneficial for simple estates with simple property ownership and is a viable choice to transfer property in Florida while avoiding probate. There are many financial and tax-related benefits to a Lady Bird Deed. There are no tax consequences, and it avoids the Federal Gift Tax.

A Ladybird deed is an enhanced life estate deed. Real estate may be sold, used, mortgaged, or leased utilizing this type of deed without the future beneficiaries' approval. When you use a standard life estate deed, you relinquish complete control over a property even before your death.

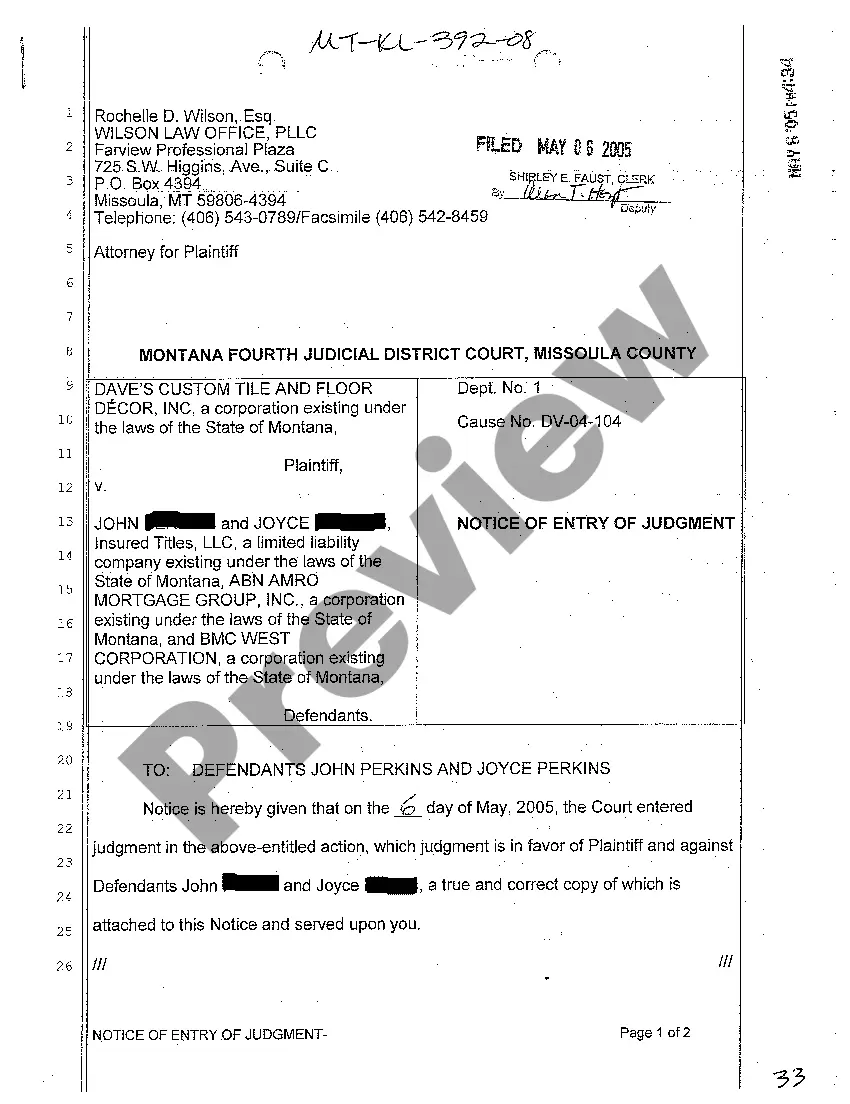

The Notice of Commencement shall be recorded in the office of the Clerk where the real property is located. A certified copy of the Notice of Commencement must be posted on the property. The property owner must sign the Notice of Commencement and no one else may be permitted to sign in his or her stead.

To submit the Quit Claim Deed, first ensure all relevant parties have signed the document and included the necessary details. The completed form should be mailed or delivered in person to the county recorder's office where the property is located.

What is the Florida Lady Bird deed? A Florida Lady Bird deed, formally known as an Enhanced Life Estate Deed, is designed to allow property owners in Florida to transfer property to others automatically upon their death while maintaining use, control and ownership while alive.

The main disadvantage of a Lady Bird deed in Florida is its limited protection against creditors during the owner's lifetime. Additionally, title insurance or financing may be more challenging to secure. It also requires careful planning to avoid unintended Medicaid consequences or disputes among beneficiaries.

In response to a change in Florida law, the following is required when recording deeds: Government-issued photo identification of grantees and grantors. Mailing addresses noted below each witness name or signature on the document.