Rules For Document Retention In Massachusetts

Description

Form popularity

FAQ

Articles of incorporation, meeting minutes, financial statements, annual reports and ownership records should be kept permanently. However, other documents like tax records, financial records, employment records, legal and contractual records and operational records can be disposed of seven years after dissolution.

7 years: Any documents, accounts, books, writings, records or other information required to be retained, e.g. notices and minutes of all shareholders' meetings, resolutions passed at meetings and documents made available to holders of securities. Copies of reports presented at the annual general meeting of the company.

Accounting records Type of recordRetention period Bank statements and deposit slips 7 years Production and sales reports 7 years Employee expenses reports 7 years Annual financial statements Permanently3 more rows

Keep Forever Birth Certificates. Adoption papers. Social Security Card. Custody agreements. Death Certificates. Divorce papers. Marriage certificates. Passports.

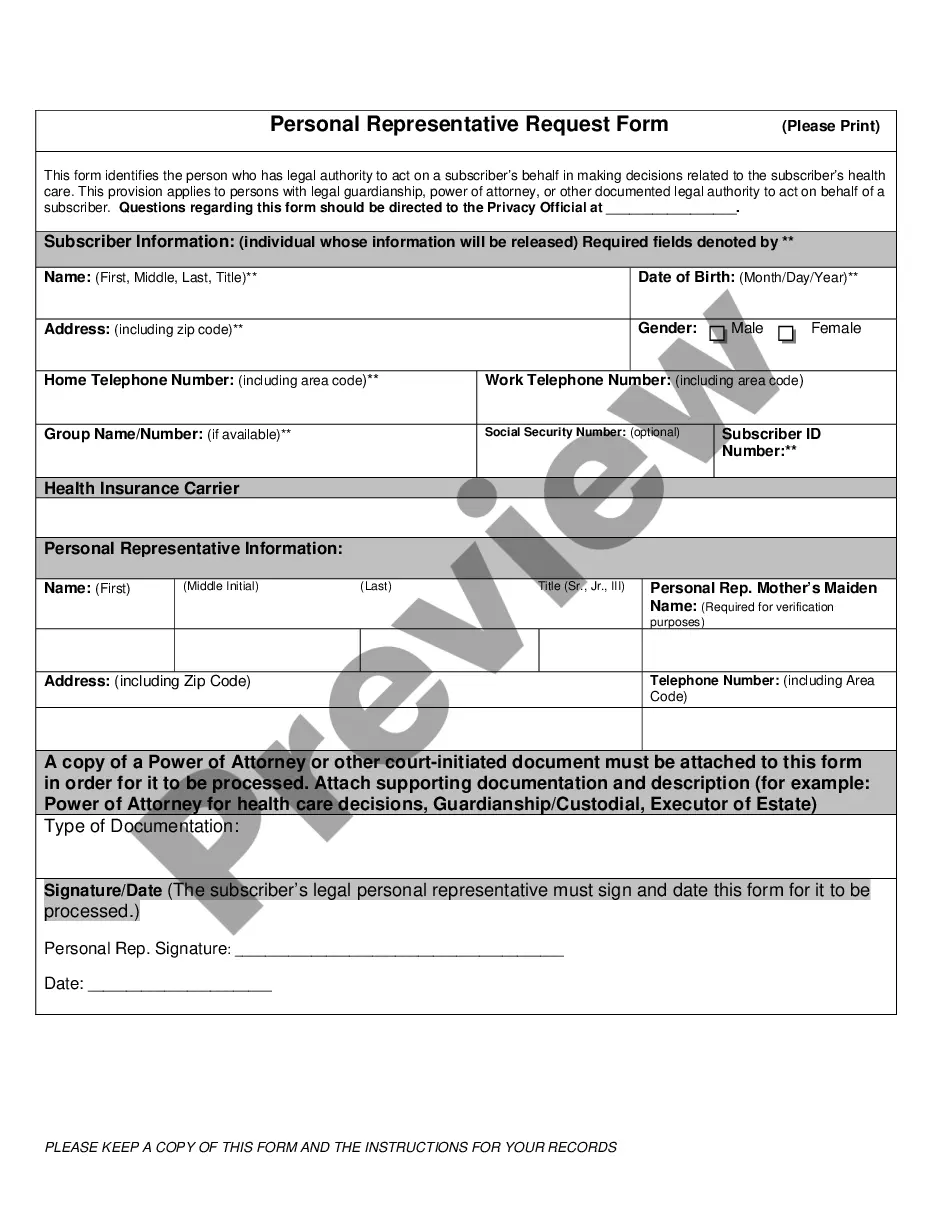

Under the statute, an employer must maintain an employee's personnel file for three years after that employee leaves his or her employment. The file is also to be maintained without any deletions or expungement of information in the file by the employer.

How long to keep records. Records must be kept for 6 years from the end of the financial year they relate. In essence this means you need to keep all records for 7 years (as it's 6 years plus a year to count for the financial year). HMRC has begun a compliance check into your Company Tax Return.

Six Key Steps to Developing a Record Retention Policy STEP 1: Identify Types of Records & Media. STEP 2: Identify Business Needs for Records & Appropriate Retention Periods. STEP 3: Addressing Creation, Distribution, Storage & Retrieval of Documents. STEP 4: Destruction of Documents. STEP 5: Documentation & Implementation.

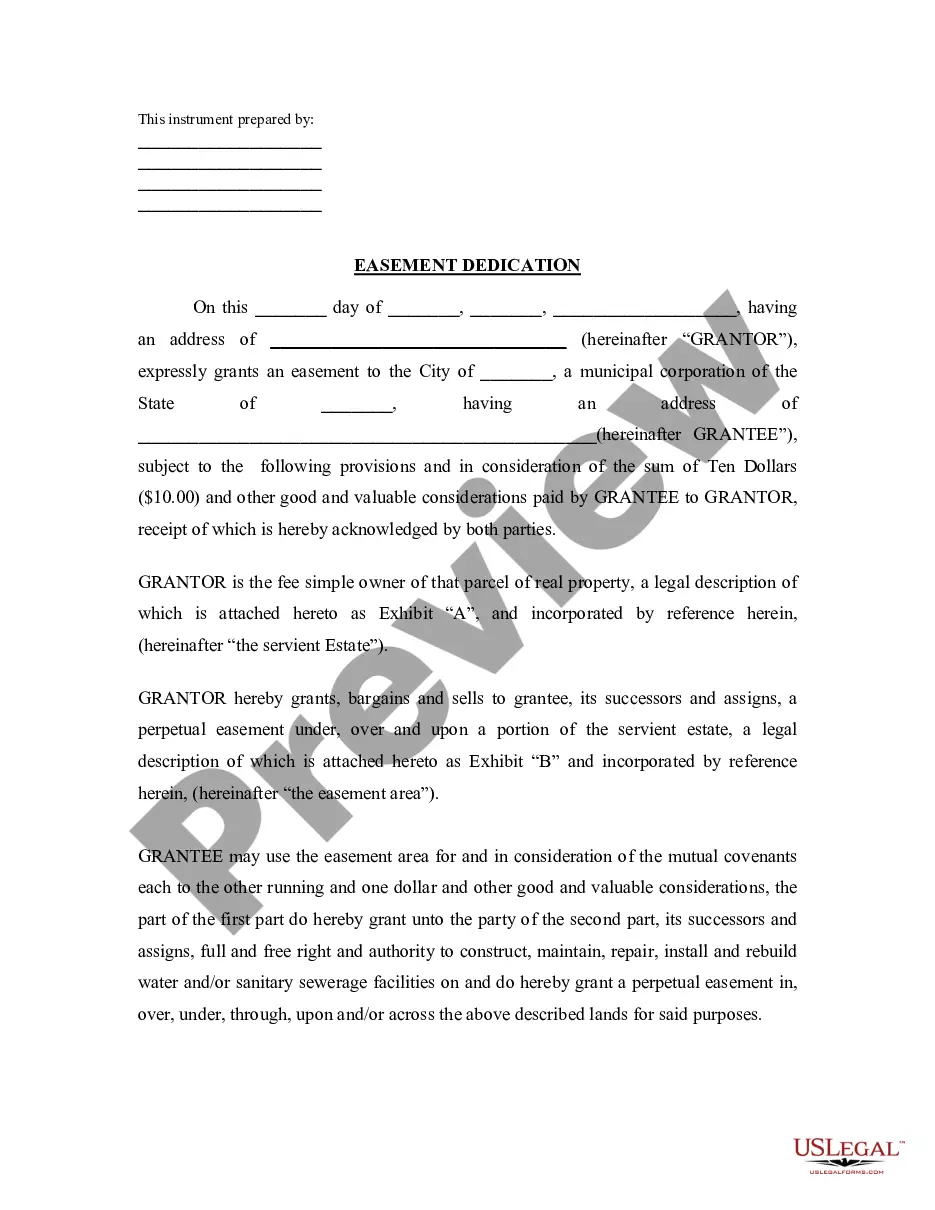

Record Retention Schedule for Businesses DocumentRetention Period Contracts and leases (expired) 7 years Correspondence, general 2 years Correspondence, legal and tax related Permanently Deeds, mortgages and bills of sale Permanently36 more rows

Privacy requirements and customer records Under the AML/CTF Act, you must keep customer identification records for seven years after you've stopped providing any designated services to them. The record-keeping requirements under the AML/CTF Act do not override the credit reporting provisions in the Privacy Act.

The papers in a client's file belong to the client and must be released promptly to the client following termination of the attorney-client relationship if requested by the client.