Bylaws Of A Corporation With Ordinary Income In Hennepin

Description

Form popularity

FAQ

DEFINITIONS. LEGAL RECOGNITION OF ELECTRONIC RECORDS AND SIGNATURES.

Bylaws are not required, but they can help define the organization and its governance structure.

To start a corporation in Minnesota, you'll need to do three things: appoint a registered agent, choose a name for your business, and file Articles of Incorporation with the Secretary of State's Business Services office. You can file this document online, by mail or in person.

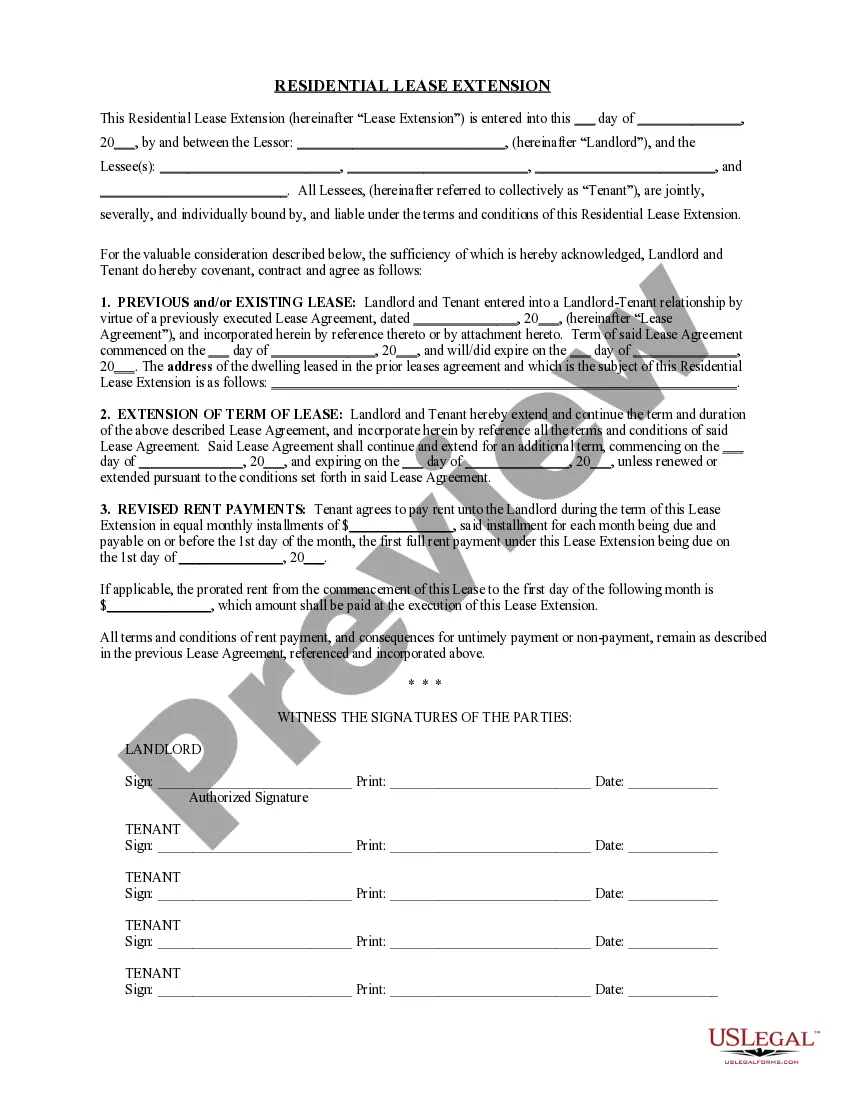

Corporate bylaws are a company's foundational governing document. They lay out how things should run day-to-day and the processes for making important decisions. They serve as a legal contract between the corporation and its shareholders, directors, and officers and set the protocol for how the organization operates.

You are subject to MinnesotaCare taxes if you have taxable presence, or nexus, in Minnesota. Taxable presence means you either have physical presence or economic presence in the state.

Minnesota | #44 Overall CategoryRankScore Individual Income Taxes 44 4.35 Sales Taxes 34 4.38 Property Taxes 26 5.10 Unemployment Insurance Taxes 42 4.312 more rows

Minnesota has a 9.8 percent corporate income tax rate. Minnesota also has a 6.875 percent state sales tax rate and an average combined state and local sales tax rate of 8.04 percent.

Minnesota's income tax is a graduated tax, with four rates: 5.35 percent, 7.05 percent, 7.85 percent, and 9.85 percent. The rates are applied to income brackets that vary by filing status.

Economic nexus Remote sellers and marketplace facilitators that have retail sales of more than $100,000 or 200 or more separate retail transactions in any 12 consecutive months must collect and remit Minnesota sales and use tax on taxable sales.

A flat tax rate of 9.8 percent applies to Minnesota taxable income. Many corporations operate in more than one state. Under the U.S. Constitution, a state can legally tax only the income of a business that is “fairly apportioned” to its activity in the state.