Bill Sale Art Sample For Composition Scheme In Wayne

Description

Form popularity

FAQ

Yes, artworks are depreciable assets. Provided the art works are used or displayed in business premises then presently those artworks may be depreciated.

You only need to register to collect VAT if your income is over a certain amount. You get charged VAT on: Products. This includes artworks or other physical things you make.

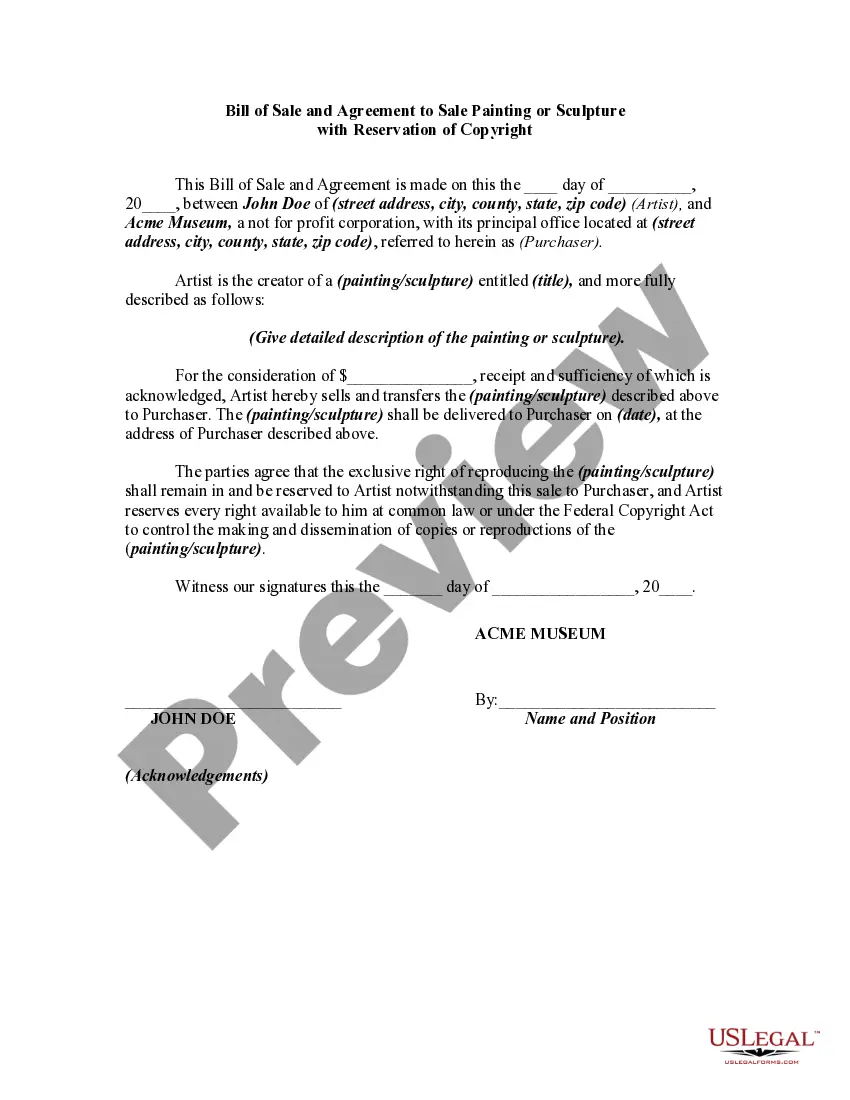

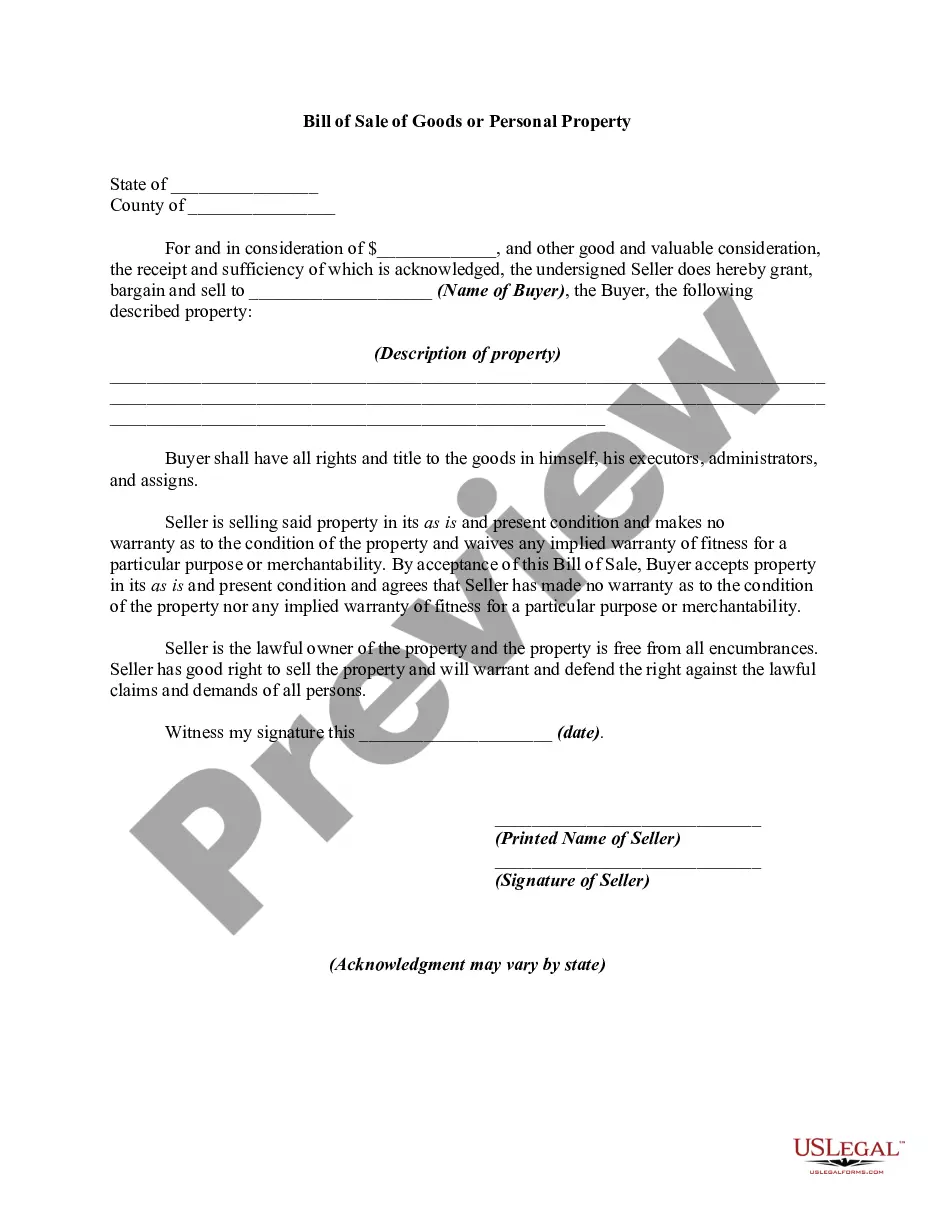

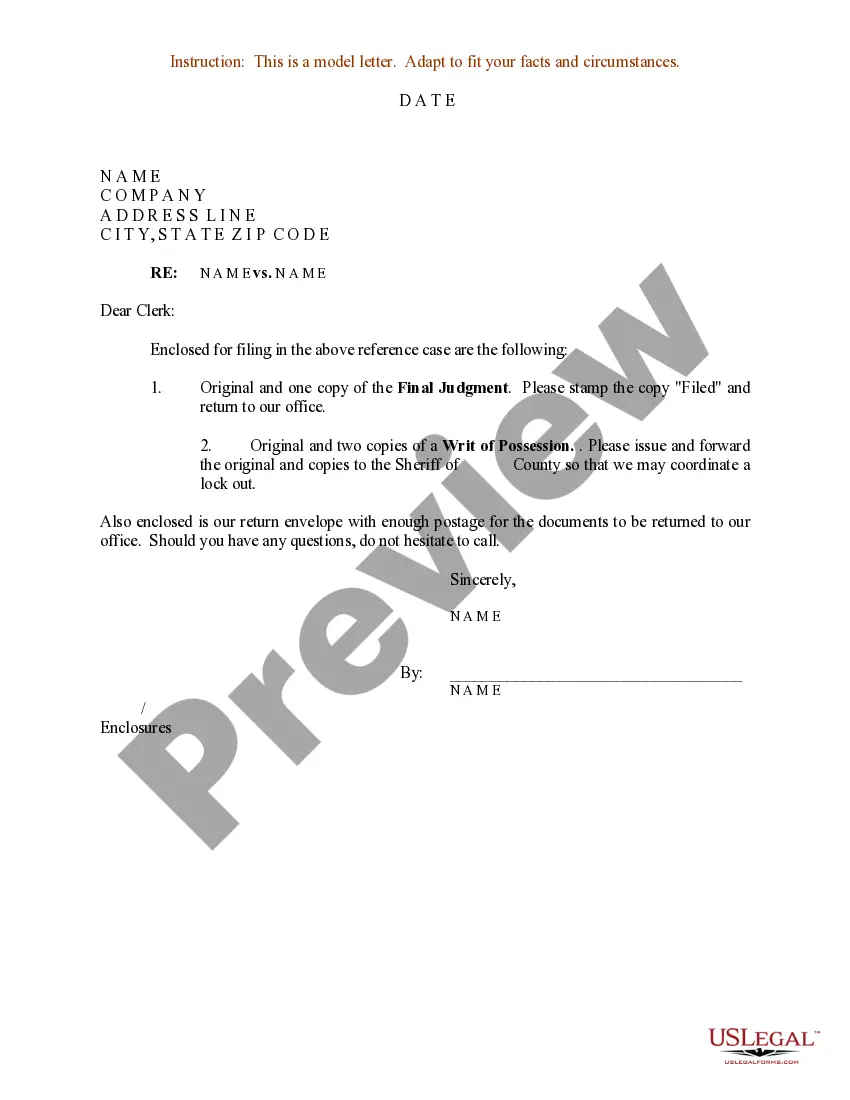

Artist's Bill of Sale Date of sale and invoice number. Invoice numbers can be used as a unique reference ID and will prove very helpful should you need to quickly find the documentation later. Artist's contact information. Buyer's contact information. Artwork sold. Subtotal. Taxes. Other charges. Total.

On your invoice, you should include: Your details. Your business name and address. Your buyer's details. Your buyer's name and address. Information about the artwork. Separate line items for each product or service delivered. Information about the payment terms. Your hourly rate, if relevant.

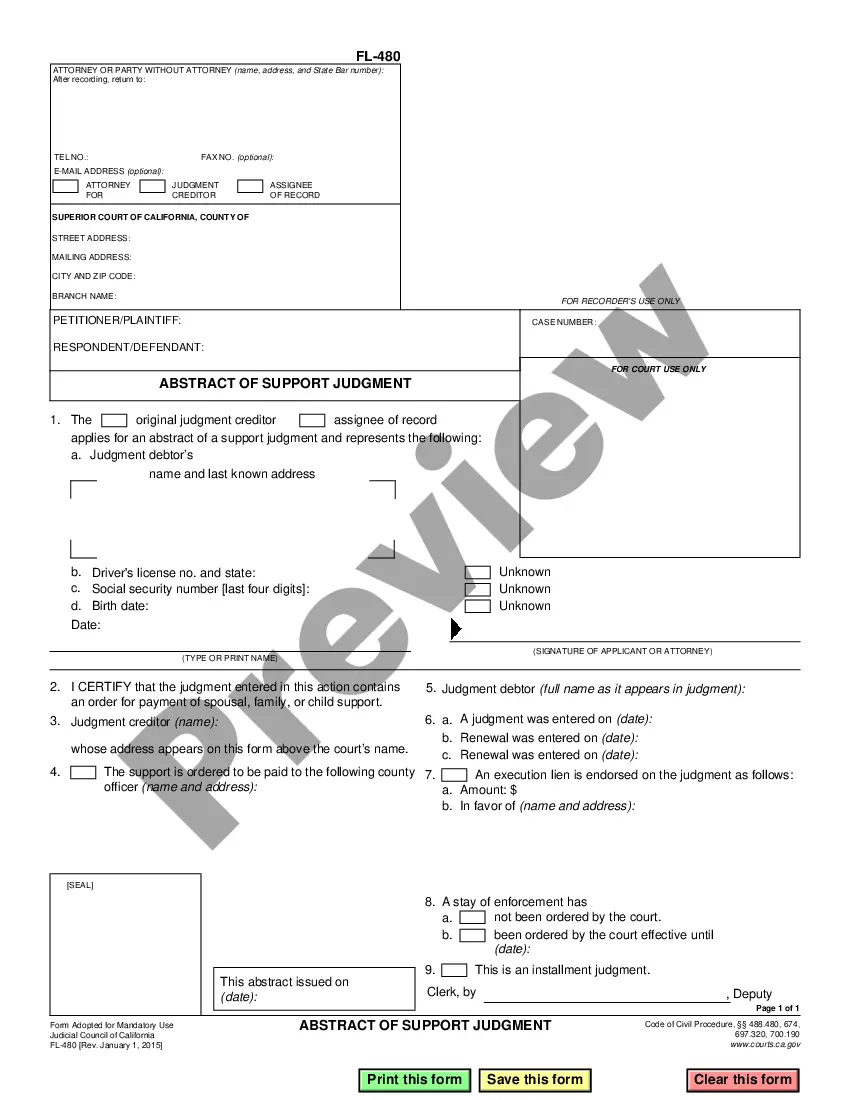

Components of a GST Invoice Bill Unique invoice number and date of issue of invoice. Supplier name, address, and GSTIN. Customer name. Shipping and billing address details. Taxpayers' and customers' GSTIN number. Place of supply and delivery locations. HSN code for goods and SAC code for services.

The GST limit for composition schemes in India is Rs. 1.5 crore turnover per annum. Composition schemes are voluntary schemes available for small businesses with annual turnovers up to Rs. 1.5 crore who can opt for fixed tax rates instead of regular GST rates.

The Composition Dealer Invoice Format may vary depending on local tax laws and regulations, but generally, it should include the following information: Name, address, and GSTIN of the supplier. A unique invoice number and date of issue. Name, address, and GSTIN of the recipient, if registered.

Can composition dealers avail Input Tax Credit? No, a composition dealer is not allowed to avail input tax credit of GST on purchases.

1% is the GST composition scheme rate for manufacturers and traders. 5% is the GST composition rate for restaurants not serving alcohol whereas 6% is the GST composition scheme rate for other service providers. GST composition scheme turnover limit is currently Rs.1.5 crore.

For goods manufacturers and traders: 1% GST, divided as 0.5% CGST and 0.5% SGST. For restaurants not serving alcohol: 5% GST, divided as 2.5% CGST and 2.5% SGST. For service providers: 6% GST, divided as 3% CGST and 3% SGST.