Artwork in tangible form is personal property. Transfer of title can therefore be made by a Bill of Sale. A Bill of Sale also constitutes a record of the transaction for both the artist and the person buying the artwork. It can provide the seller with a record of what has been sold, to whom, when, and for what price. The following form anticipates that the seller is the artist and therefore reserves copyright and reproduction rights.

Bill Of Sale For Artwork Form In Florida In Philadelphia

Description

Form popularity

FAQ

To help you get started, take a look at a few basic components to include in your contract so you can better protect your art business. Client Info. Project Info and Terms. Project Timeline. Costs and Payment Terms. Itemization. Artist's Rights. Cancellation Terms. Acceptance of Agreement.

Artist contracts usually include details regarding payment terms, compensation rates, royalties, and commissions. A contract also protects the intellectual property of the artist and may include rights to license, use, and exhibit the artwork or performance created.

It is important to make sure all the requirements for the respected state law are included in the bill of sale. As, with any legal written document a bill of sale can be handwritten.

The “Artist's Contract,” or “The Projansky Agreement,” as it is known in art and legal circles respectively, is a model contract for artists to use when selling their work or transferring ownership. Its most enduringly controversial aspect is the inclusion of an artist's resale royalty.

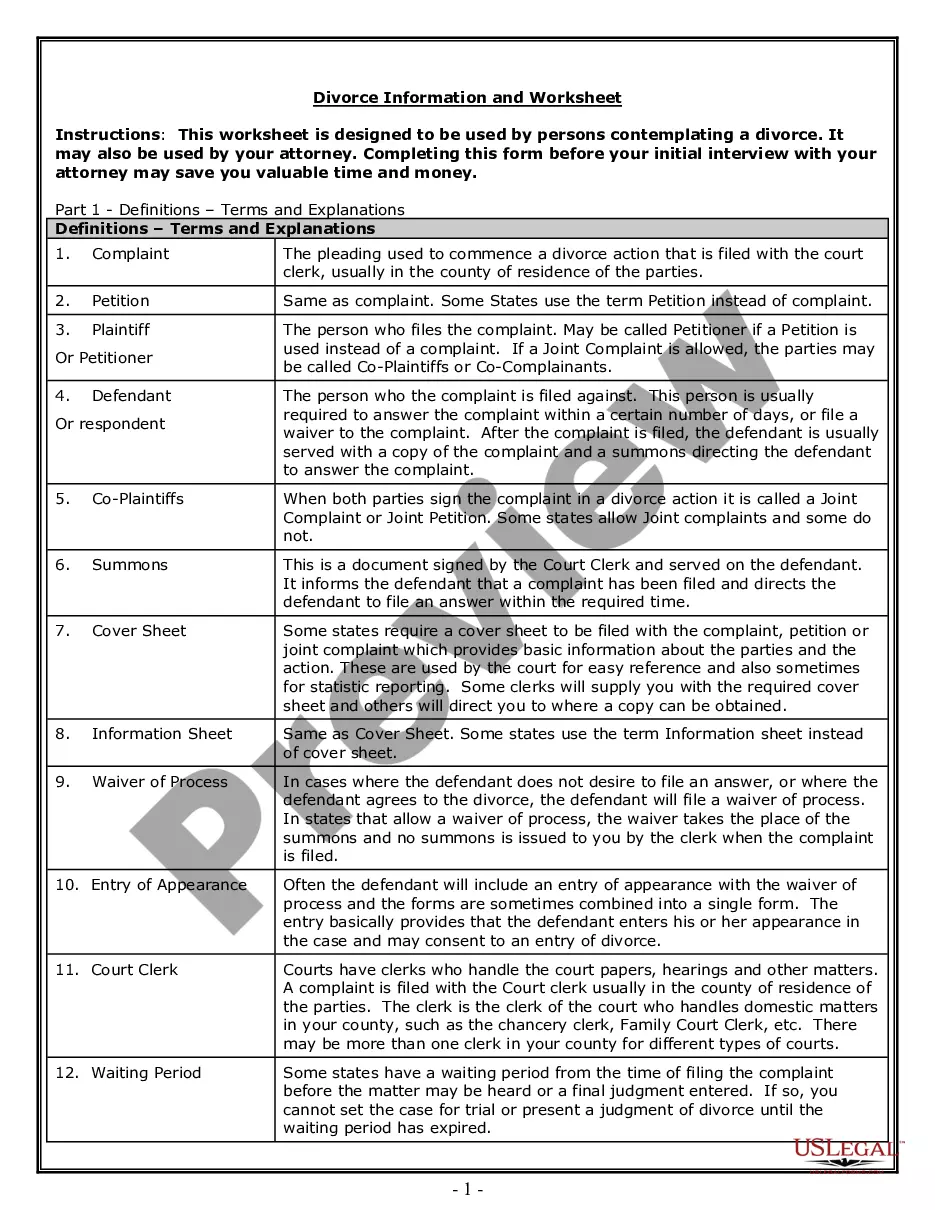

A word or phrase that has a special meaning in a particular context. "Legal terms of art" denote "words or expressions that have through usage by legal professionals acquired a distinct legal meaning".

QUESTION: WHETHER THE PAINTING SERVICES/INSTRUCTIONS ARE SUBJECT TO FLORIDA SALES TAX. ANSWER: TAXPAYER'S PAINTING SERVICES/INSTRUCTIONS ARE NOT SUBJECT TO FLORIDA SALES TAX.

What are non-taxable items or sales tax exemptions in Florida? Prescription drugs. Food. Certain services (ex. Non-prepared food items sold at a substantial grocery or market. Sales or rentals of medical equipment. Sales or rentals of mobility or prosthetic devices. Farm equipment. Software as a Service (SaaS)

The form also documents the sale and is the legal receipt. Keep copies of the bill of sale (FLHSMV recommends having it notarized), certificate of title or other type of transaction document showing it was sold.

Invoices should contain information about: you the artist. your billing address. your client or customer. their taxable address. your tax reference code (UTR - unique tax reference code if in the UK) the tax date for the product or service rendered. description of the artwork provided or artistic service rendered.