Contingency Removal Form With 2 Points In Virginia

Description

Form popularity

FAQ

(ˈpɪkrə ) noun. medicine. a powder made up of aloes and canella which is used as a laxative or digestive cleanser.

A Home of Choice contingency basically gives you a pre-determined period of time to find a new home before you commit to the sale of your current home (usually 17 days). Escrow officially opens and the time frames start only after you remove your Home of Choice contingency.

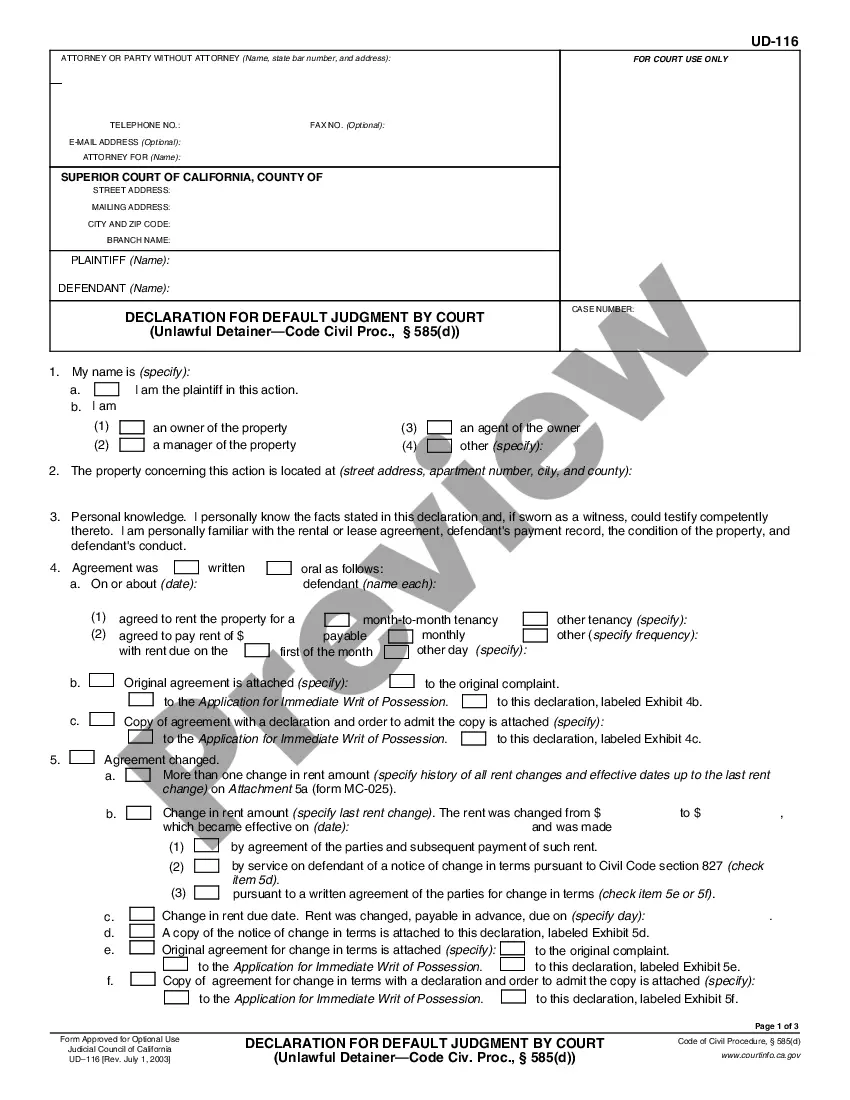

The contingency removal form is actually designed to cover the removal of both buyer and seller contingencies. The first section of the form focuses on contingencies that allow the buyer to back out. The second section deals with the seller's removal of a seller contingency.

A contingency is a potentially negative event that may occur in the future, such as an economic recession, natural disaster, or fraudulent activity. Companies and investors plan for various contingencies through analysis and implementing protective measures.

A home inspection contingency is often the most common real estate contingency. The National Association of Realtors® estimates that about 80% of buyers include a home inspection contingency in their contract.

Here are the minimum down payment requirements for some common mortgage programs, for qualified borrowers: Conventional loans: 3 percent. FHA loans: 3.5 percent (for credit scores of 580 or higher), 10 percent (for credit scores between 500 and 579) VA loans: No down payment if you qualify.

Key takeaways. It's possible to back out of an accepted home offer, but there could be consequences if you don't plan ahead carefully. Building the right contingency clauses into the contract upfront makes it much easier to back out later without penalty.

Buyers can cancel the property sale agreement in Virginia for any reason (or for no reason at all) within 3 days of receiving the disclosure packet.