Agreement Commercial Property With Lease In Pima

Description

Form popularity

FAQ

Commercial tenants should be able to spend 5% to 10% of their gross sales per foot on rent. Your gross sales divided by the location's square footage will give you sales per square foot. For example, you estimate your business will make $300,000 per year in total sales, and you are looking at a 1,500 square foot space.

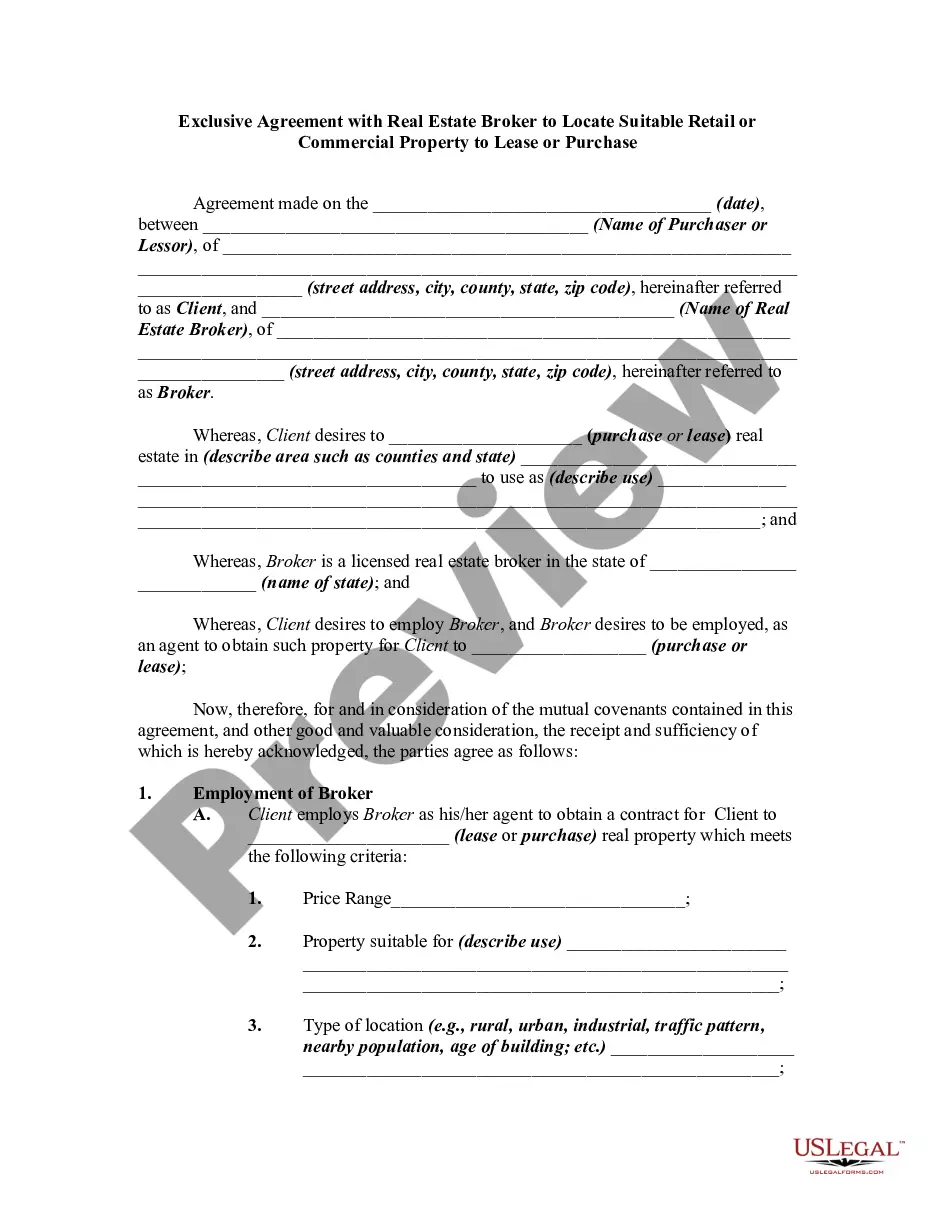

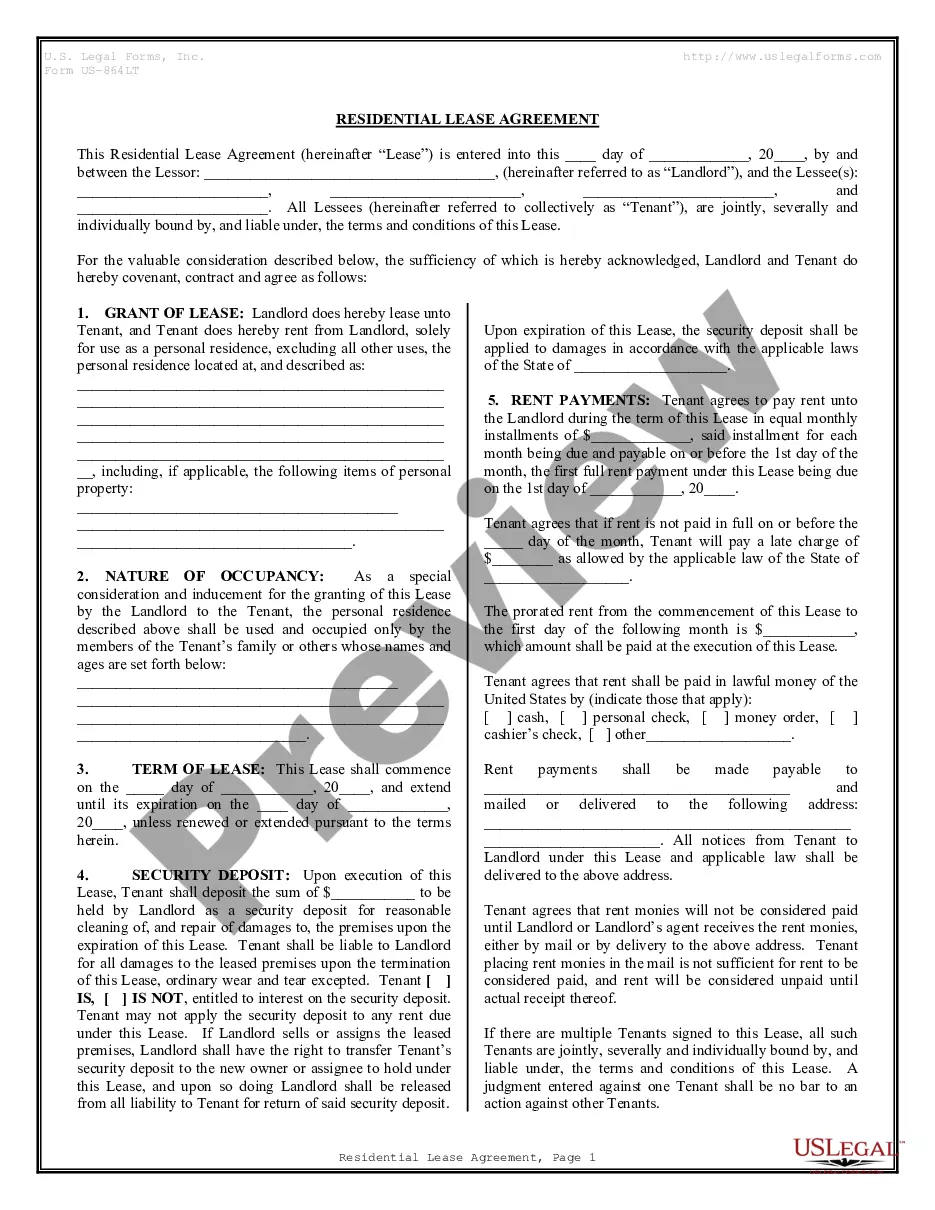

5 Steps to Leasing a Commercial Property Step 1: Assess your business. Step 2: Search for properties that meet your needs and budget. Step 3: Set up Showings. Step 4: Negotiate the Letter of Intent (LOI) or Lease Proposal. Step 5: Executing a Lease.

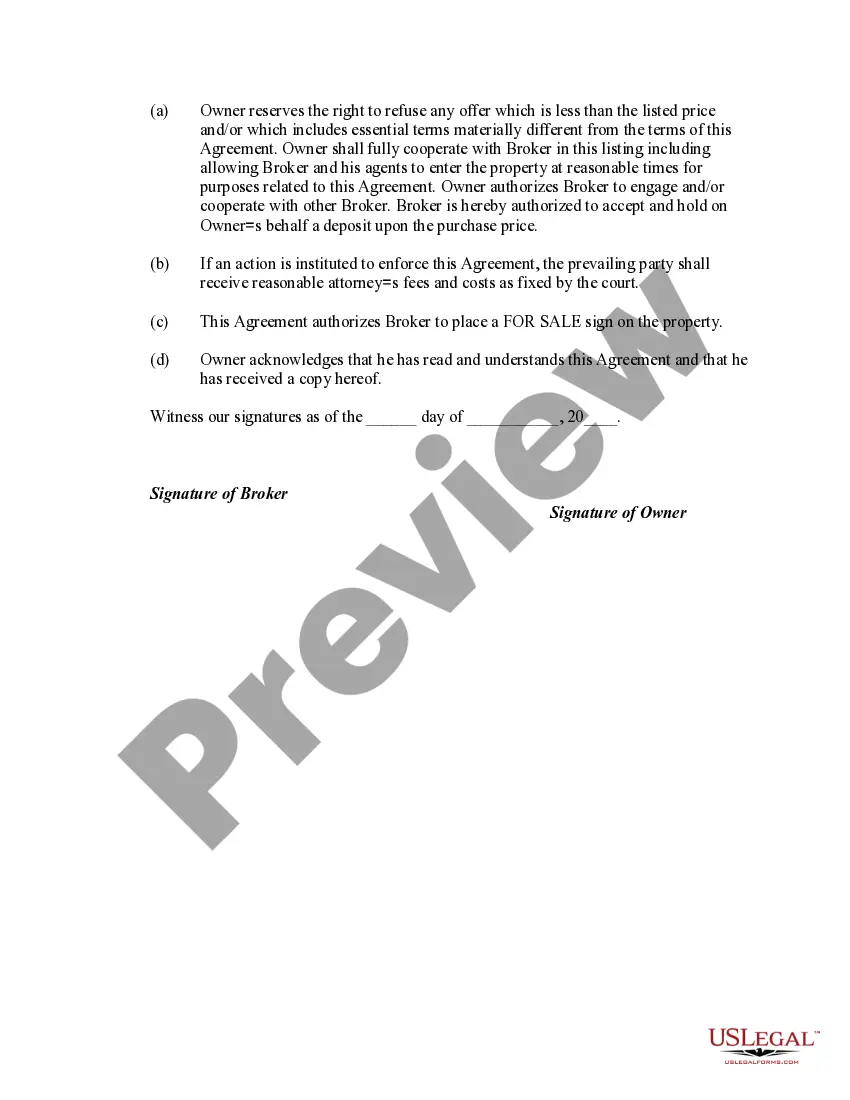

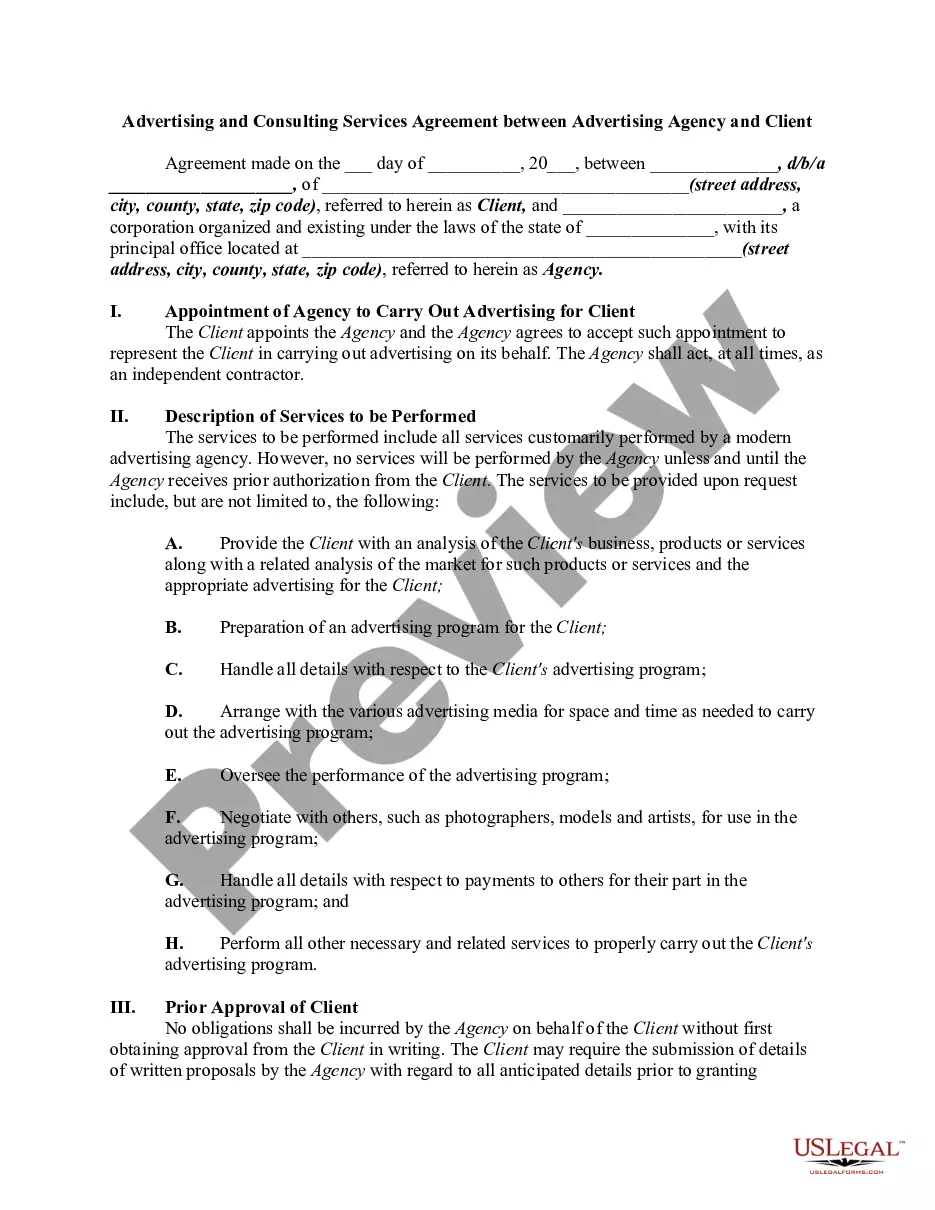

What are the most important steps for drafting a commercial lease agreement? Identify the parties and the property. Determine the rent and the term. Negotiate the improvements and the maintenance. Allocate the taxes and the insurance. Include the clauses and the contingencies. Review and sign the agreement.

Clearly state why you're writing the letter and why the property owner should continue reading. Include the property's address and let the landlord know that you're interested in leasing it under specific terms. Then go over your terms and include the non-binding clause.

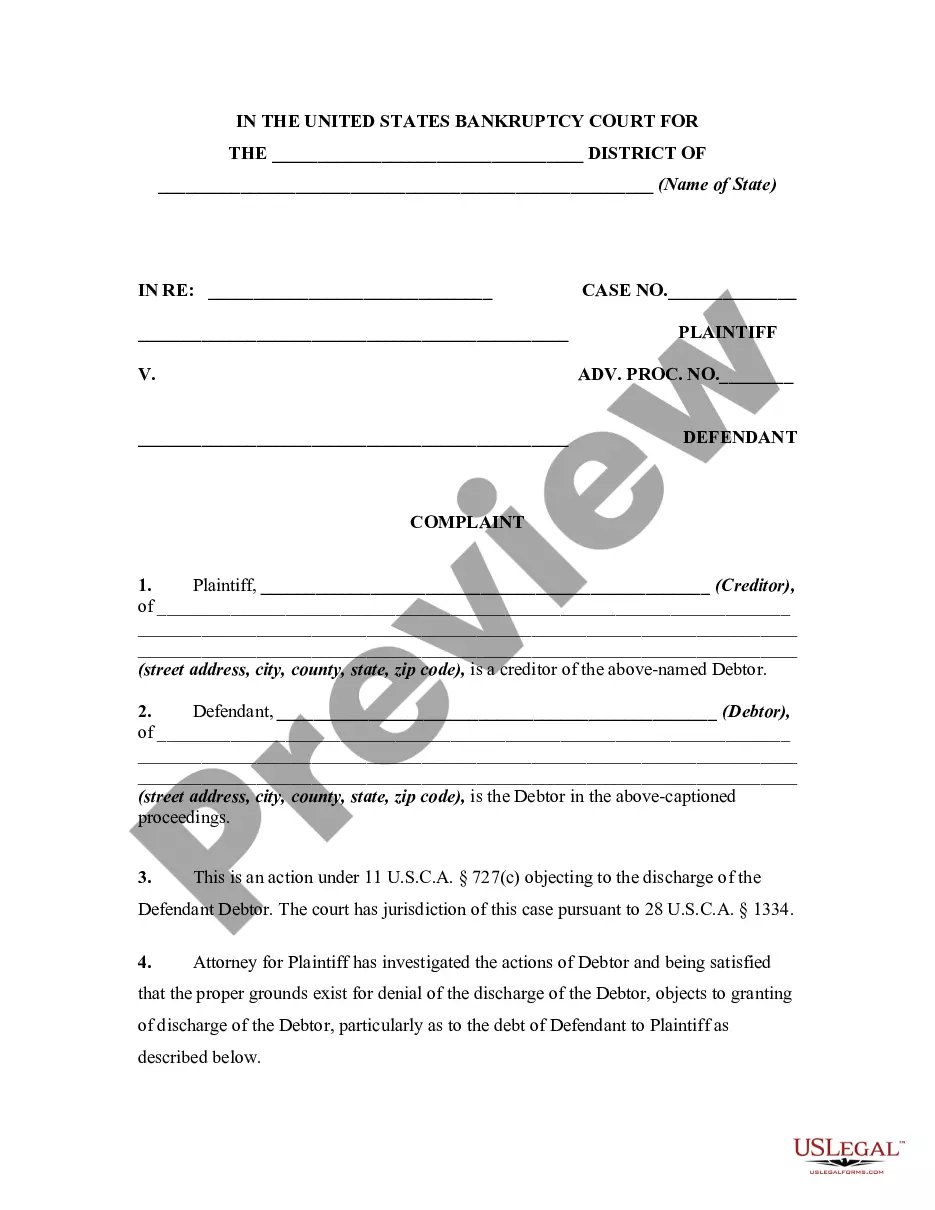

In order to be a landlord in Arizona, there are certain licenses and permits that you need to obtain. This includes a business license and a residential rental license from the City of Phoenix. These licenses are essential to ensure compliance with local regulations and to legally operate your rental property.

Transaction Privilege Tax License – A transaction privilege tax (TPT) license (commonly referred to as a sales tax, resale, wholesale, vendor or tax license) is required for businesses selling a product or engaging in a service subject to transaction privilege tax in the state.

This will be done using a Land Registry form known as a TR1. If the lease is for less than 7 years, then the lease can be assigned by using a deed of assignment. Both these documents have the same effect and will generally be executed by both you as the current tenant and the assignee.

Individual owners of taxable rental properties are required by law to obtain a TPT license with ADOR regardless if the owners rent the property themselves or employ a property management company (PMC).

Obtain necessary licenses and permits: In Phoenix, landlords are required to obtain a business license and a residential rental license from the City of Phoenix. You can obtain these licenses by completing an application and paying the required fees (under $100).

1. Gross Lease. Gross leases are most common for commercial properties such as offices and retail space. The tenant pays a single, flat amount that includes rent, taxes, utilities, and insurance.