Claiming Dependents For Paycheck In Wake

Description

Form popularity

FAQ

The best approach for this would be to edit your Form W4 and increase the tax withholding so that more amount is being withheld from each paycheck throughout the year, so that when you file taxes next year, you will not owe that much.

Adjust Your W-4 Form: - Increase Allowances: On your W-4 form, you can claim more allowances. The more allowances you claim, the less tax will be withheld. However, this might lead to a tax bill when you file your return if you under-withhold.

The child must be: (a) under age 19 at the end of the year and younger than you (or your spouse, if filing jointly), (b) under age 24 at the end of the year, a full- time student, and younger than you (or your spouse, if filing jointly), or (c) any age if permanently and totally disabled.

If you want to avoid a tax bill, check your withholding often and adjust it when your situation changes. Changes in your life, such as marriage, divorce, working a second job, running a side business, or receiving any other income without withholding can affect the amount of tax you owe.

Withholding will be most accurate if you do this on the Form W-4 for the highest paying job. Step 3. This step provides instructions for determining the amount of the child tax credit and the credit for other dependents that you may be able to claim when you file your tax return.

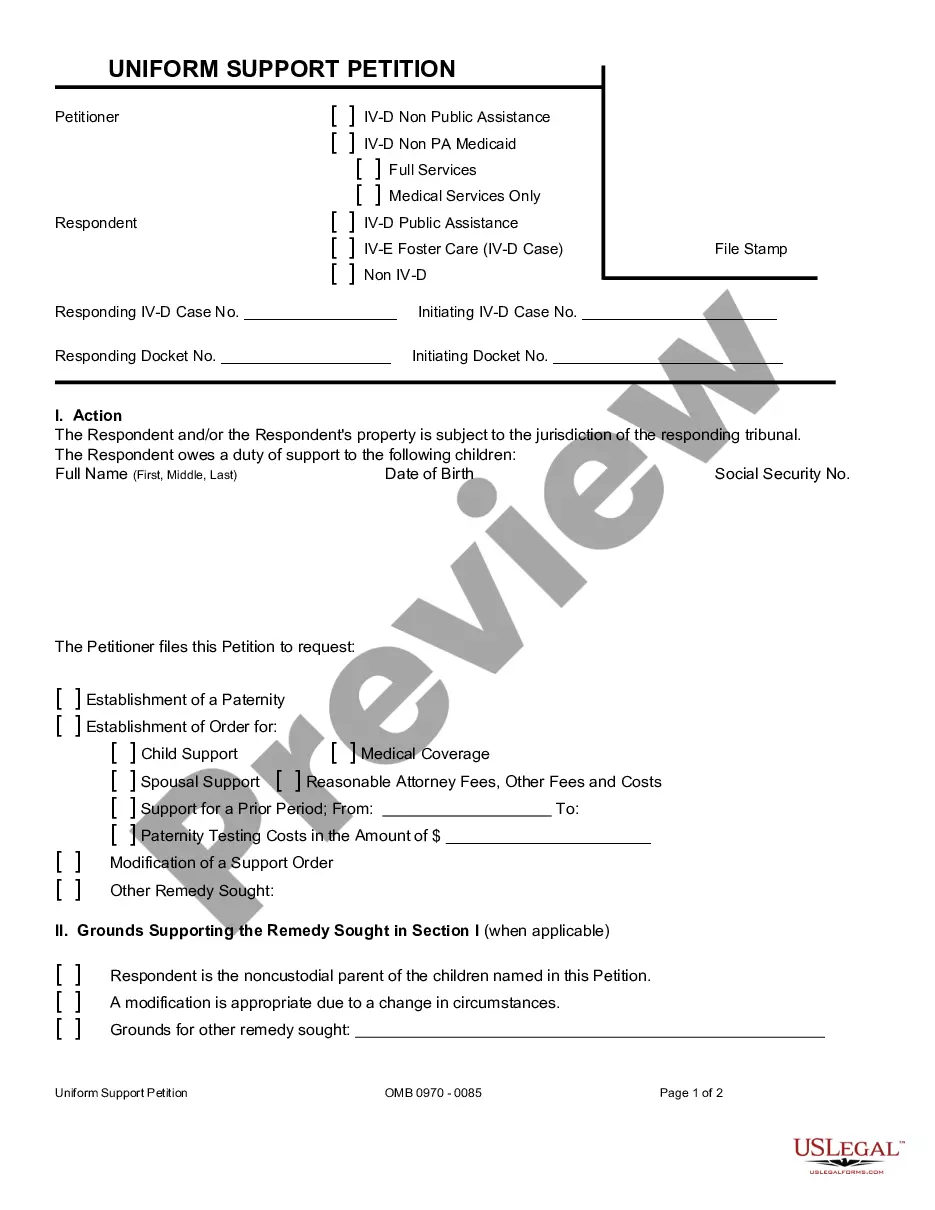

On your W-4 Form you claim allowances, which your employer uses to calculate the tax withheld from your paycheck. The number of dependents you have factors into your overall W-4 allowances. Many people simply count their family members and put that number down as the number of allowances on W-4 Form!

On your W-4 Form you claim allowances, which your employer uses to calculate the tax withheld from your paycheck. The number of dependents you have factors into your overall W-4 allowances.