Executor Of Estate Form After Death With No Estate In Phoenix

Description

Form popularity

FAQ

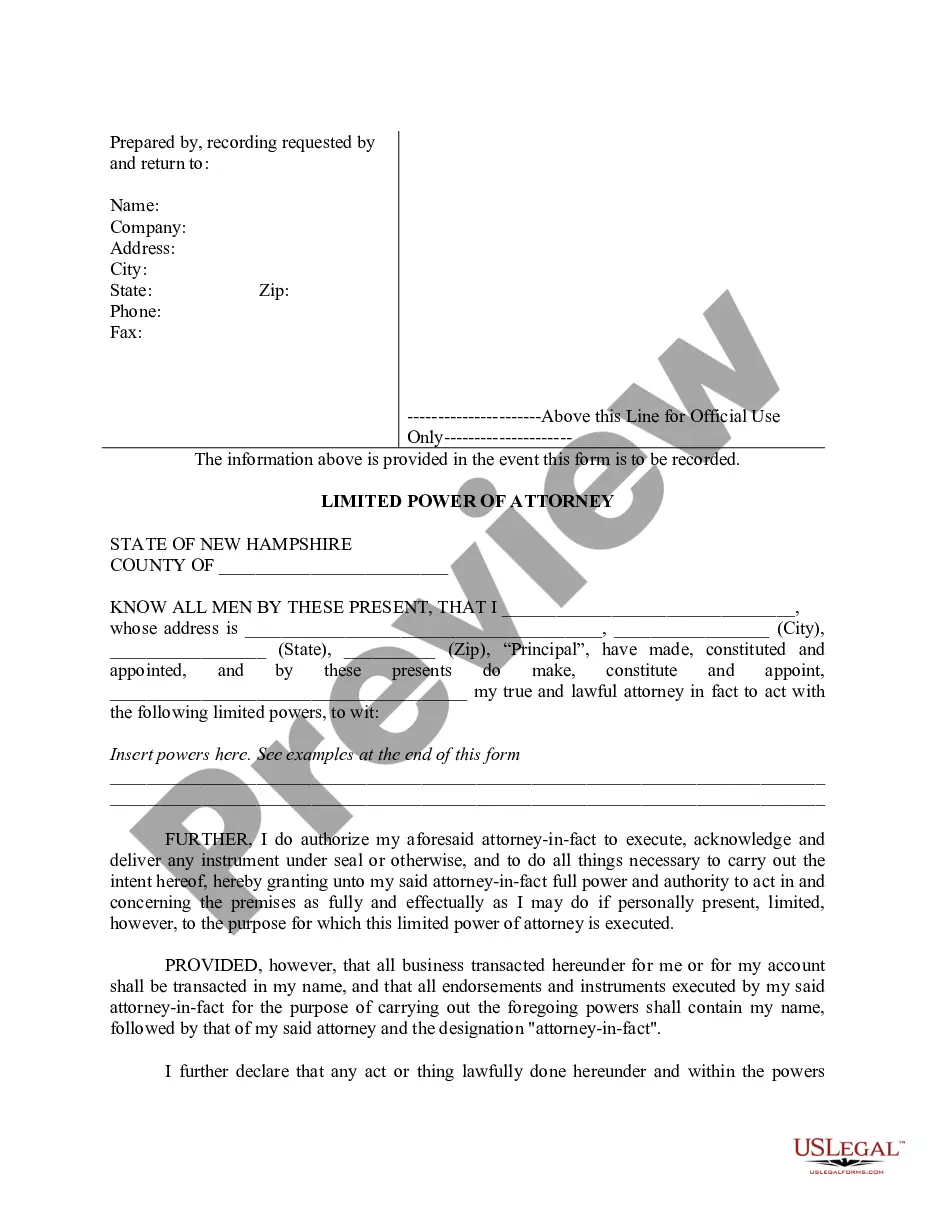

Power of attorney is only valid when the principal is still alive. After an individual passes, their estate representative or executor will be responsible for legal decision-making and distributing property to heirs. If the decedent failed to appoint an executor, the court will appoint one for them.

If you'd like to file as the executor of an estate with no will, we've outlined 6 steps for you to follow: Find out your place in line. Obtain waivers from other family members. Contact the court. File your administration petition. Go to the probate hearing. Get a probate bond.

If the decedent names a personal representative in their last will and testament, they're referred to as an executor. If the decedent did not have a will, or if the will was invalidated, the court will appoint an administrator to serve as personal representative.

Introduction. If you pass on and don't leave a will in Arizona, your closest relatives will receive your assets ing to the state laws on intestate succession. Keep in mind that only the assets you would've included in your will (which are usually in your own name) are impacted by these laws.

If you decide to serve as personal representative, you need to be officially appointed to the position by the Court of the county in which the decedent resided at the time of death or, in the case of a decedent who lived in another state but owned real property in Arizona, in the county in which that real property is ...

Opening Probate While some states allow up to six years to probate an estate, the state of Arizona will only accept probate cases that are opened within two years of the decedent's passing (ARS 14-3108).

Some estates will not need to go through probate, while others qualify for simplified probate. Some types of assets automatically pass to an heir without any oversight from the probate court.

Individually-titled assets will remain frozen in the decedent's name. The estate's assets are subject to losses. Another interested party may petition to open probate. The decedent's creditors may take action.

However, there is a bright line limit in the amount of time when an estate should be closed and some form of Probate can proceed. In Arizona, a Probate case must be commenced within two years after a decedent's death.