Settlement Against Estate With Deed Of Donation In Philadelphia

Description

Form popularity

FAQ

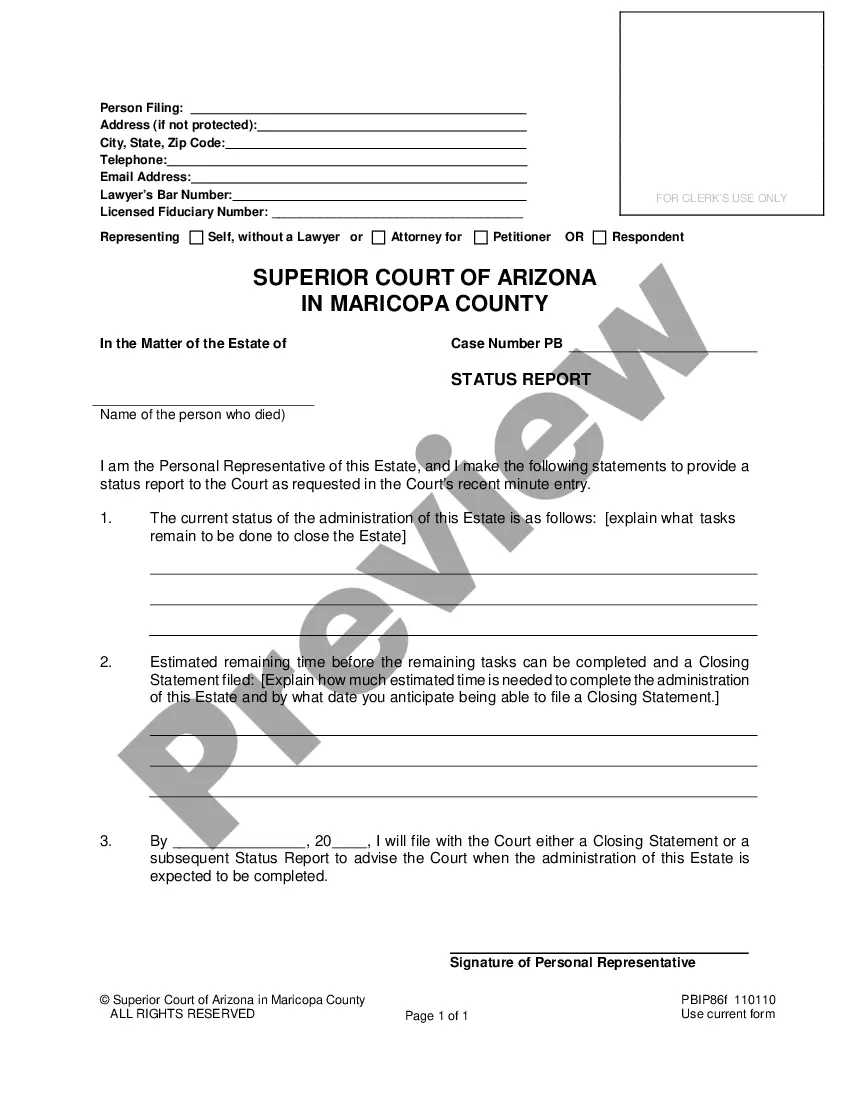

If you own property jointly with someone else, and this ownership includes the "right of survivorship," then the surviving owner automatically owns the property when the other owner dies.

To add, remove, or change a name on a deed, have a lawyer, title company, or other real estate professional prepare the deed. Then, record the new deed with the Department of Records. Note: We recommend that you do not prepare a deed on your own.

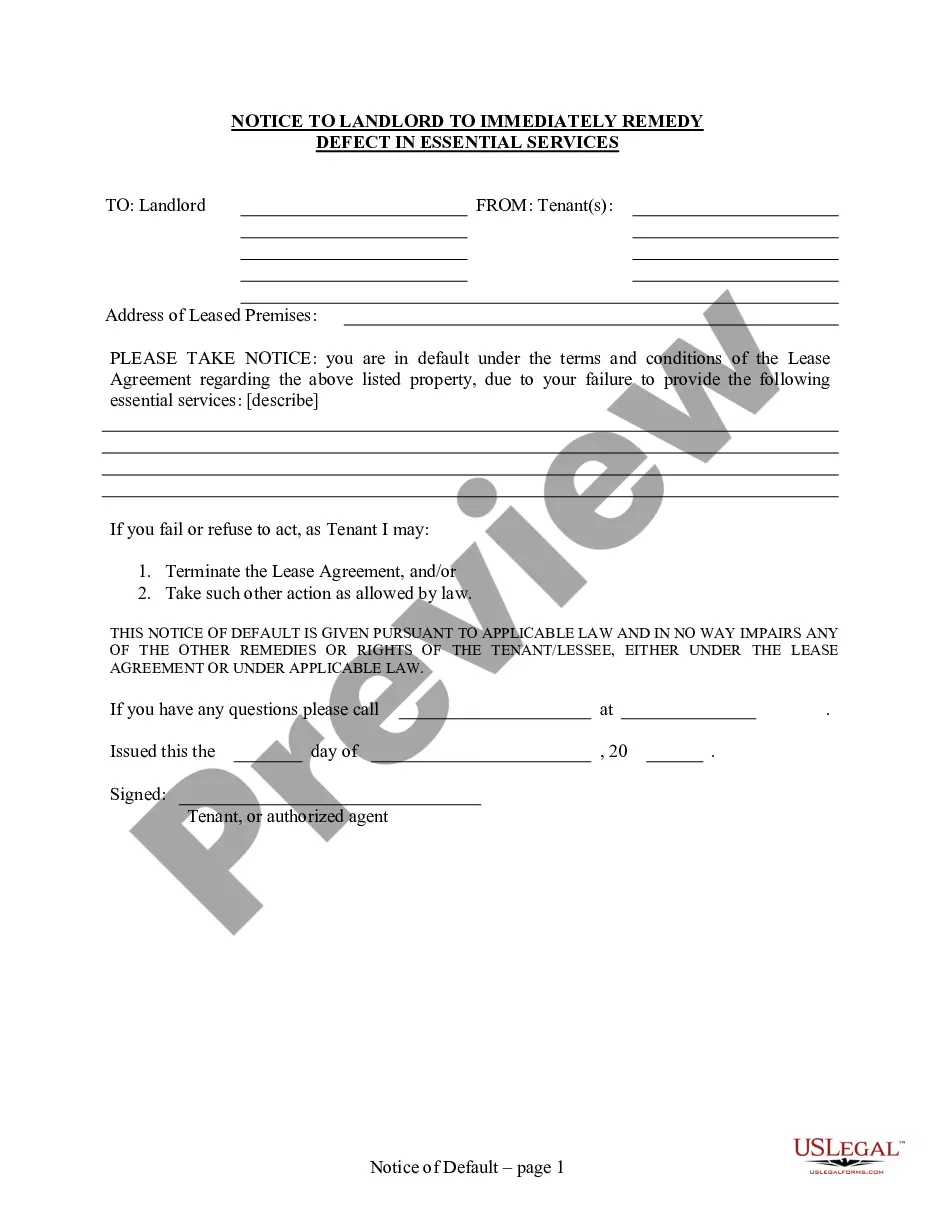

A creditor against an estate files a claim by providing the personal representative of the estate with written notice. This can be done by submitting a completed Notice of Claim form with the court register. The filing of a claim preserves the creditor's right to collect from the estate.

See PEF Code §3532(b)(1). No claimant shall have any claim against distributed real property unless such claimant has, within one (1) year after the decedent's death, filed a written notice of claim with the Clerk of Court.

An attorney can help you sue their estate for your damages. It is not possible to literally file a lawsuit against someone who has passed away. Instead, your lawyer can help you sue the estate of the person you believe is responsible for your injuries and damages.

To add, remove, or change a name on a deed, have a lawyer, title company, or other real estate professional prepare the deed. Then, record the new deed with the Department of Records. Note: We recommend that you do not prepare a deed on your own. We also recommend that you get title insurance.

Pennsylvania realty transfer tax is imposed at a rate of 1 percent on the value of real estate (including contracted-for improvements to property) transferred by deed, instrument, long-term lease or other writing. Both grantor and grantee are held jointly and severally liable for payment of the tax.

Property transfers can be complex, and legal, financial, or tax implications may arise. It's advisable to consult with professionals such as real estate attorneys, accountants, or financial advisors to navigate any potential issues. Capstone Land Transfer is here to help with your Pennsylvania deed transfer.