Suing An Estate Executor Without A Lawyer In Harris

Description

Form popularity

FAQ

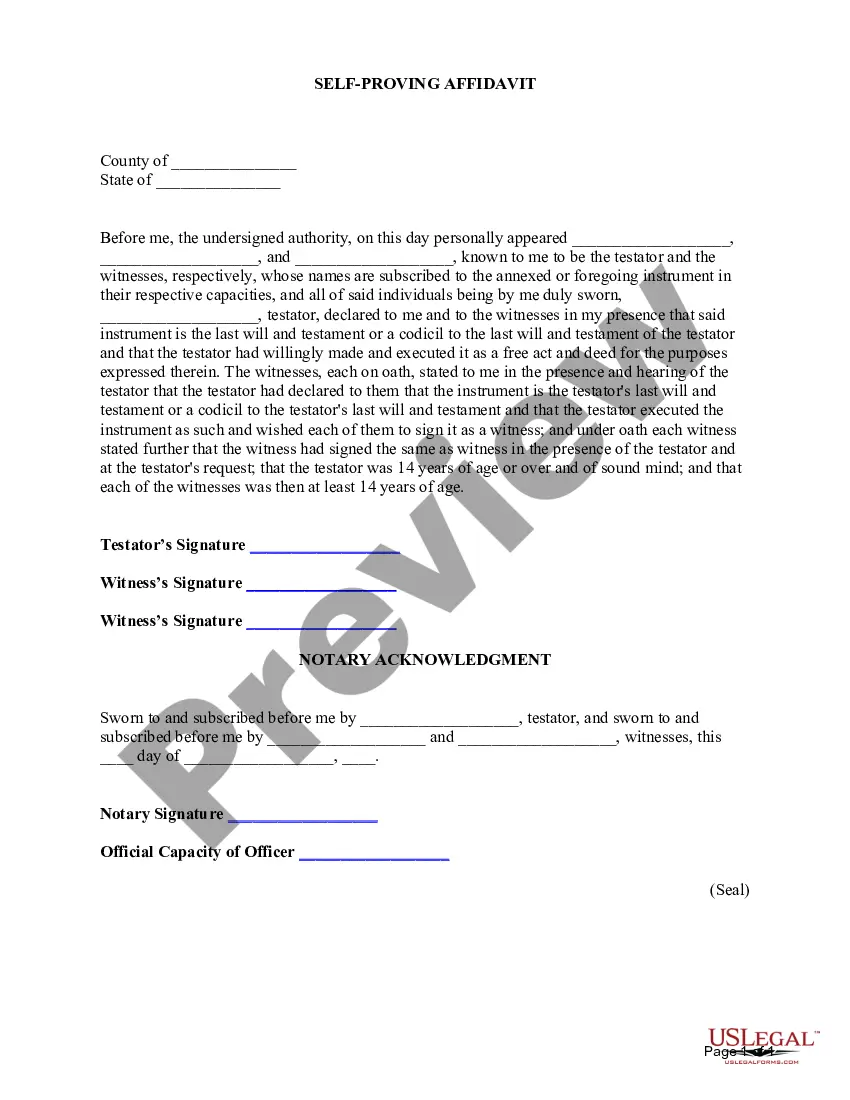

An heir or beneficiary who thinks the executor is not doing as the will directs or is not acting in the interest of the estate has the right to appeal to the probate court.

If an executor does not do their job the right way, the beneficiaries of the Will can potentially sue for “breach of fiduciary duty”. In that instance, the executor can be held personally liable to all of the beneficiaries under the Will.

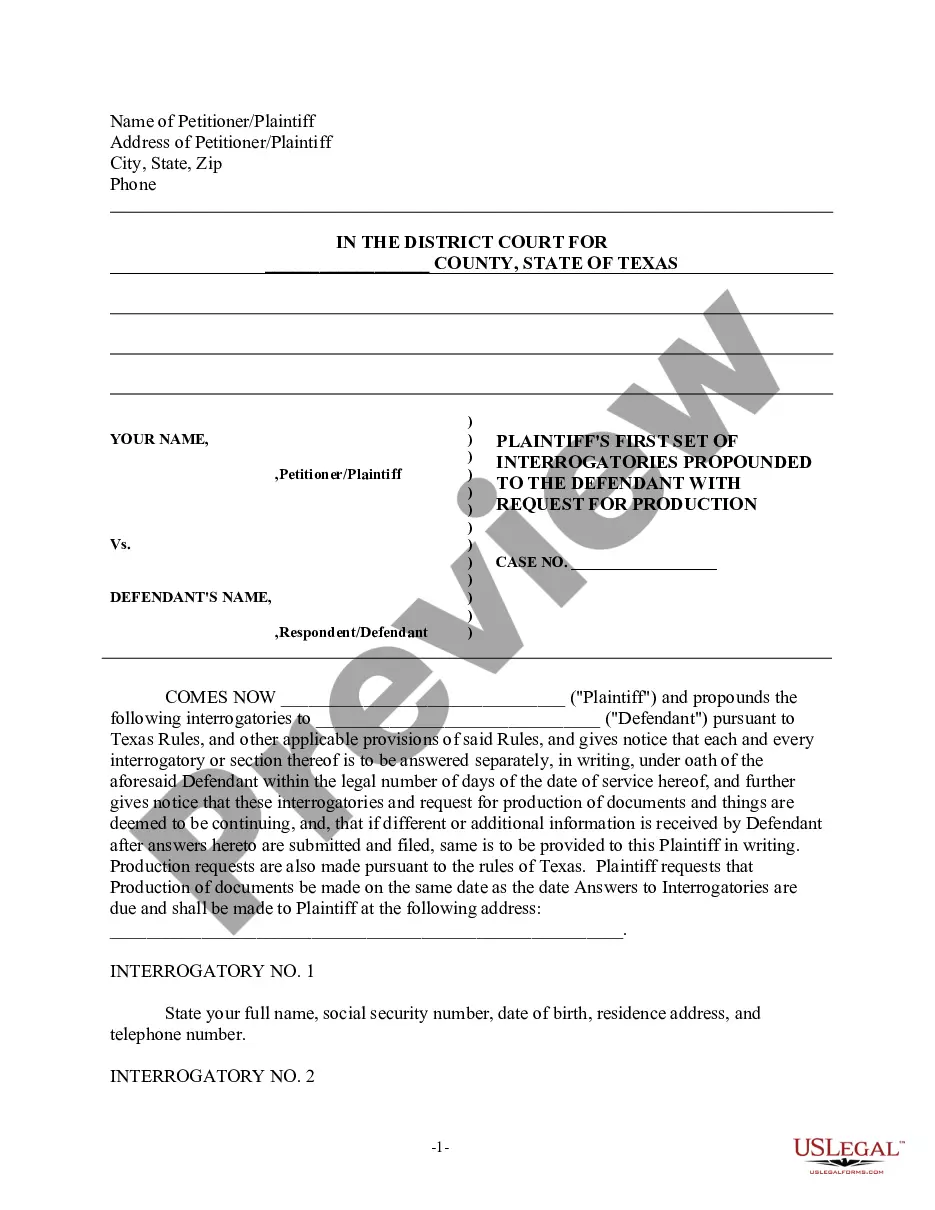

Proving Executor Misconduct Pull the bank statements, transaction records, and communication logs. Beneficiaries or others involved in the probate process can provide detailed accounts of the executor's actions. You need a sharp attorney to gather evidence, file the motions, and fight for your interests.

Here are some common breach of fiduciary duty examples. Misappropriation of Assets. Conflict of Interest. Self-Dealing. Negligent Management of Assets. Inadequate Record-Keeping or Failure to Account. Failure to Distribute Assets.

The standard for proving a breach of fiduciary duty varies from jurisdiction to jurisdiction. Typically, a claim for breach of fiduciary duty includes four elements: 1) the existence of a fiduciary duty; 2) a breach of that duty (through an act or omission); 3) damages; and 4) causation.

An estate beneficiary has a right to sue the executor or administrator if they are not competently doing their job or are engaged in fiduciary misconduct.

If you are dealing with an estate where you are the only beneficiary or heir, you are not legally required to hire an attorney. If the estate has more than you as the beneficiary or heir, then you do have to hire a probate attorney.

Independent Administration Application for Probate of Will and Issuance of Letters Testamentary. Form 7-2. Application for Probate of Copy of Will and Issuance of Letters Testamentary. Form 7-3. Application for Probate of Will and Issuance of Letters of Independent Administration. Form 7-4.

If a creditor wishes to file a claim against the estate, they must do so in writing and provide documentation of the debt. The claim must be filed with the probate court and a copy must be sent to the executor or administrator of the estate.