Settlement Against Estate Format In Allegheny

Description

Form popularity

FAQ

Although hiring an attorney isn't required in Pennsylvania, estate administration and probate can present challenges that an experienced lawyer can help you navigate or avoid.

An estate attorney can provide advice, determine whether Administration will be required, and explain what procedures will be involved. If you choose to not consult an attorney to represent you through Estate Administration, you may file Pro Se (on one's own behalf) to be named personal representative.

How long will probate take? Settling an uncontested estate takes anywhere from 9 months to 18 months. However, property can often be transferred before the probate process is fully complete.

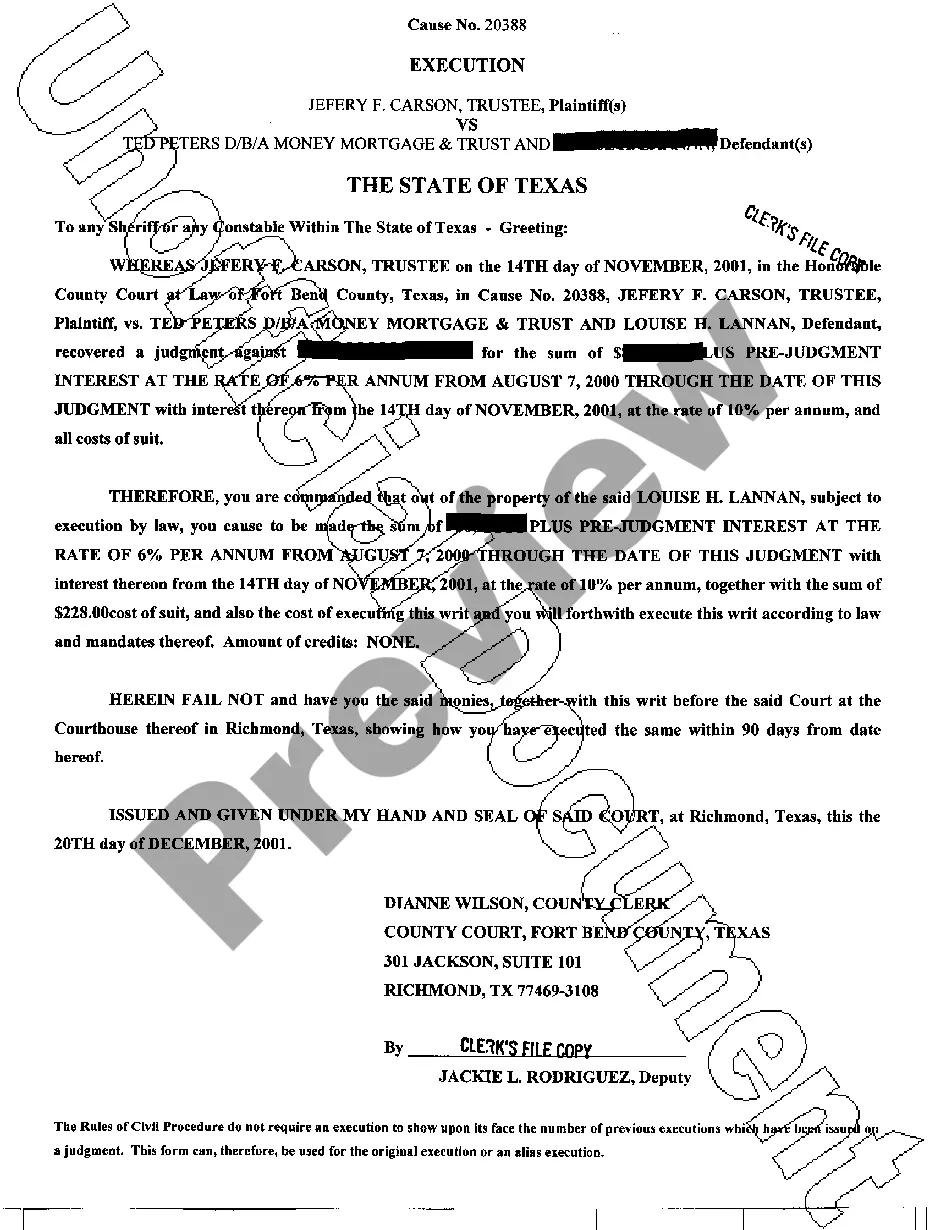

You must file out a form and submit it to the register to make the claim official. If the claim is filed by a creditor with the court, their right to proceed is preserved against what is known as the distributee or who receives assets from the estate only if the real property is considered an estate asset.

How long will probate take? Settling an uncontested estate takes anywhere from 9 months to 18 months. However, property can often be transferred before the probate process is fully complete.

The process of settling an estate in Pennsylvania involves naming a personal representative, collecting estate assets, filing appropriate forms with the Register of Wills, notifying heirs, providing public notice, paying all debts and taxes, and distributing the remaining assets to heirs named in the will or under the ...

The simple answer is - no - you do not need an attorney to buy or sell a home in Pennsylvania. There is no legal requirement that an attorney be involved in any stage of the transaction. However, the proper question to be asked is if it would be advisable for you to be represented by an attorney.

See PEF Code §3532(b)(1). No claimant shall have any claim against distributed real property unless such claimant has, within one (1) year after the decedent's death, filed a written notice of claim with the Clerk of Court.

Tax is imposed at 4.5% for lineal heirs, and 5% discount is permitted since payment was made within 3 months of the date of death.