Suing An Estate Executor For Deceased Person In Alameda

Description

Form popularity

FAQ

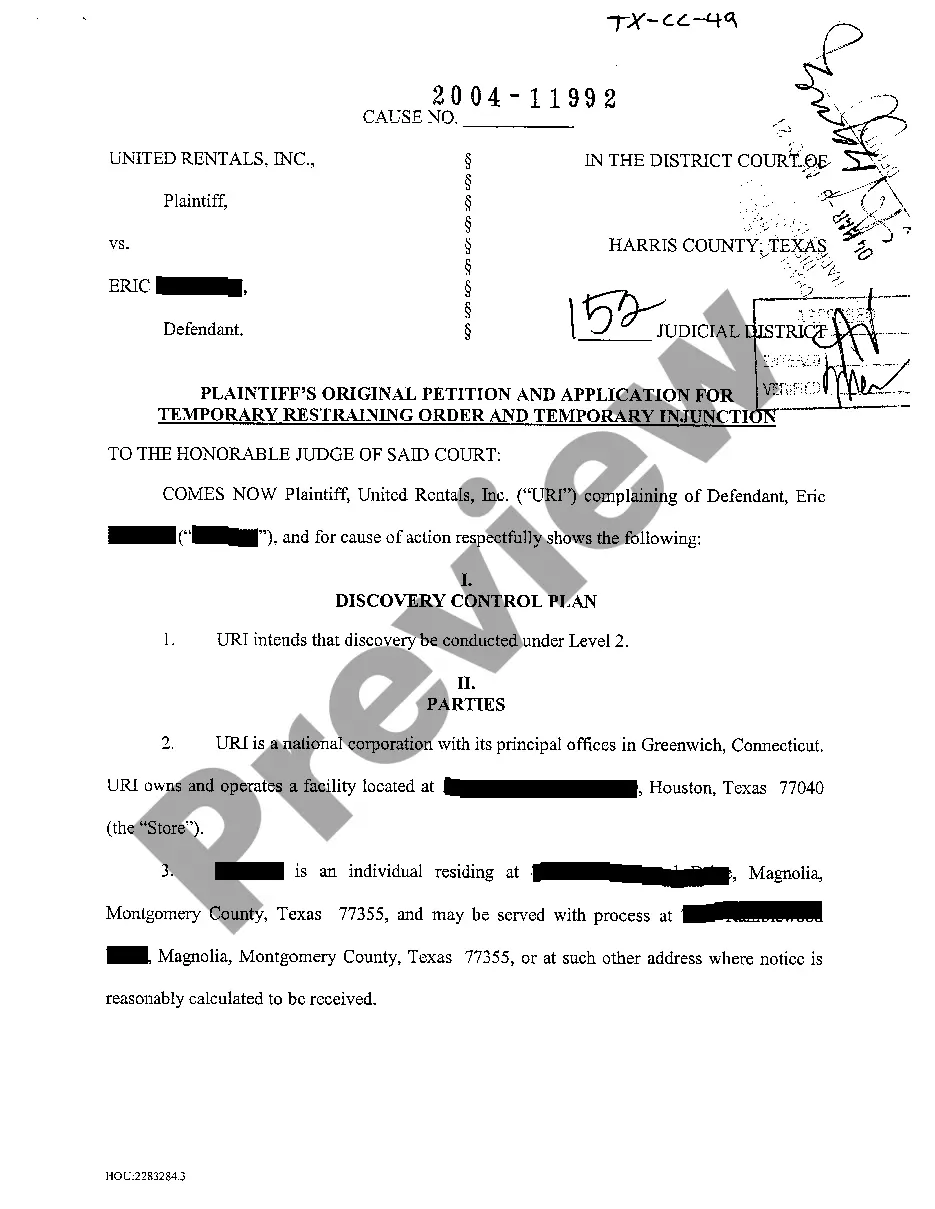

To file the lawsuit, the plaintiff must prove the negligence or wrongful act, file the lawsuit within two years of the date of death, and show that they have suffered damages as a result of the death. Damages and compensation can be calculated based on economic, non-economic, and punitive factors.

Can You Sue a Dead Person? No, you legally cannot sue a dead person. However, you can file a lawsuit and/or creditor claim against their estate to request compensation from the deceased's assets.

Under the LRPMA 1934, eligibility very much depends on if the deceased left a Will. If they did, then the Executor of their Estate, named in the Will, is eligible to bring or continue a claim. If the deceased did not leave a Will, then a set list is followed as outlined in the Administration of Estates Act 1945.

California Probate Codes on Suing an Estate Probate Code 551 allows for filing a lawsuit within 40 days with an additional year if the injured person was unaware of the defendant's demise.

Time Limits for Filing 120-day deadline: A petition for probate must typically be filed within 120 days of the decedent's passing. This step formally begins the probate process, allowing the court to appoint an executor or administrator to handle the estate.

Generally, in California creditors of a decedent's estate have up to one year (365 days) from the decedent's death to file a timely creditor claim. The claim must be filed inside an open probate court proceeding.

– Executors are fiduciaries, meaning they must act in the best interest of the estate and its beneficiaries. They cannot use estate assets for personal gain or benefit from the estate improperly.

Understanding the Deceased Estate 3-Year Rule The core premise of the 3-year rule is that if the deceased's estate is not claimed or administered within three years of their death, the state or governing body may step in and take control of the distribution and management of the assets.