Agreement Letter For Borrowing Money

Description

How to fill out Sample Letter For Agreement - General?

Whether for commercial reasons or for individual issues, everyone must confront legal circumstances sooner or later in their lifetime. Filling out legal documents demands meticulous focus, beginning with selecting the suitable form template.

For example, if you choose an incorrect version of the Agreement Letter For Borrowing Money, it will be rejected upon submission. Thus, it is crucial to have a reliable source of legal documents like US Legal Forms.

With a comprehensive US Legal Forms catalog available, you no longer need to waste time searching for the correct template online. Utilize the library’s straightforward navigation to find the appropriate form for any occasion.

- Obtain the template you require by utilizing the search feature or the catalog navigation.

- Review the form’s description to confirm it corresponds with your situation, state, and locality.

- Click on the form’s preview to inspect it.

- If it is the incorrect document, return to the search function to discover the Agreement Letter For Borrowing Money template you need.

- Acquire the file if it aligns with your requirements.

- If you currently possess a US Legal Forms profile, simply click Log in to access previously saved documents in My documents.

- In case you do not have an account yet, you can download the form by clicking Buy now.

- Select the appropriate pricing option.

- Complete the profile registration form.

- Choose your payment method: use a credit card or PayPal account.

- Select the document format you prefer and download the Agreement Letter For Borrowing Money.

- Once downloaded, you can fill out the form using editing software or print it and complete it manually.

Form popularity

FAQ

How to Write a Promissory Note Date. Name of the lender and borrower. Loan amount. Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral? ... Payment amount and frequency. Payment due date. Whether the loan has a cosigner, and if so, who.

A Loan Agreement, also known as a Loan Contract or Personal Loan Agreement, is used to loan or borrow money with or without interest included. It typically covers the amount of the loan, the interest rate, the repayment terms, and other specific provisions and terms that will be explained in more detail below.

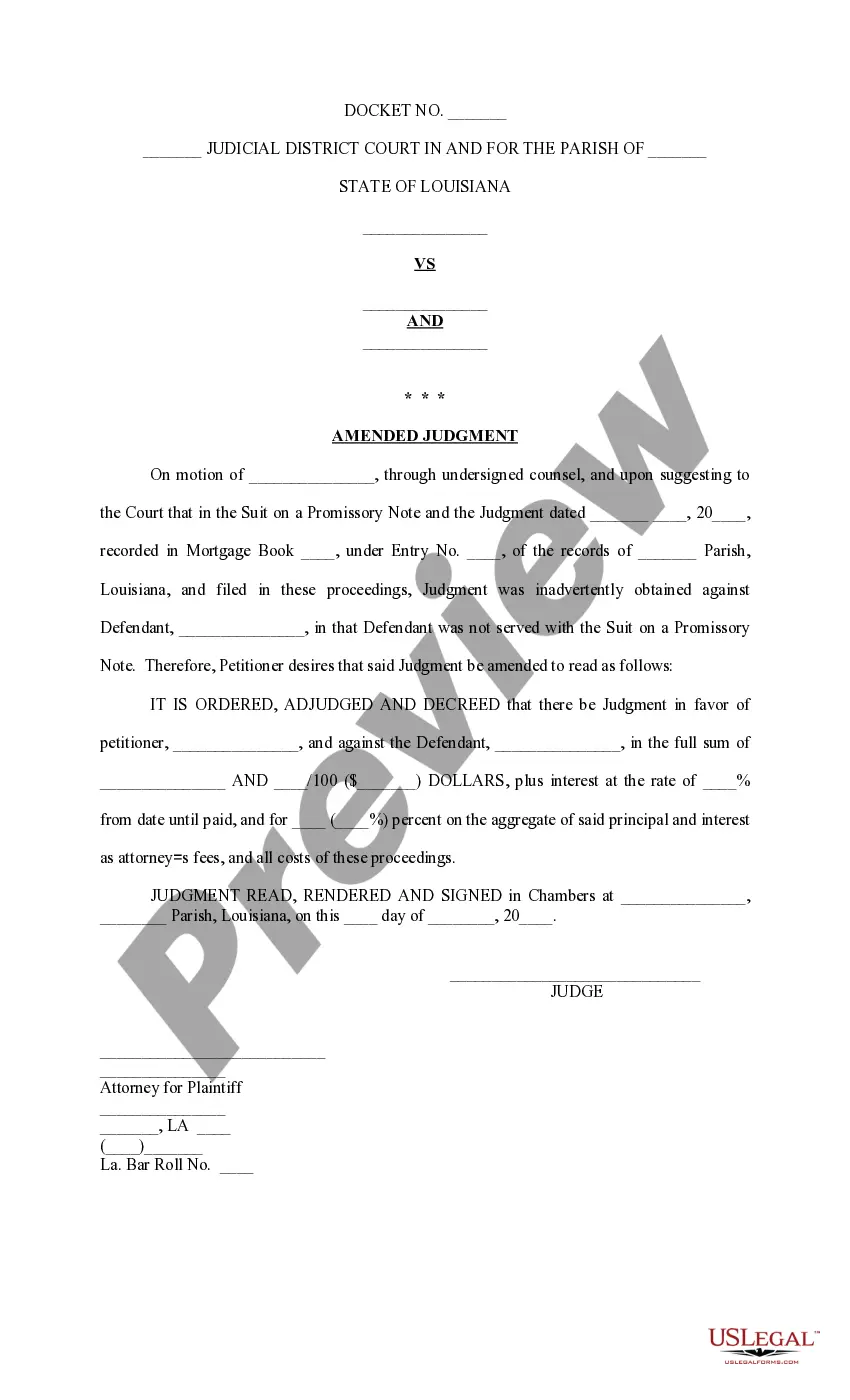

Promissory Notes document financial transactions between two parties. Unlike an IOU that only records a loan amount, a Promissory Note details the consequences of failing to repay the loan. After finalizing the terms and conditions of a loan, the lender will issue a Promissory Note.

Remember, when writing an agreement letter for borrowing money: Clearly state the purpose of the loan. Specify the loan amount and repayment terms. Include details about interest rates, fees, and any collateral involved. Outline consequences for late payments or defaulting on the loan.

Include key terms of the loan, such as the lender and borrower's contact information, the reason for the loan, what is being loaned, the interest rate, the repayment plan, what would happen if the borrower can't make the payments, and more. The amount of the loan, also known as the principal amount.