Made A Director Without Consent In Nassau

Description

Form popularity

FAQ

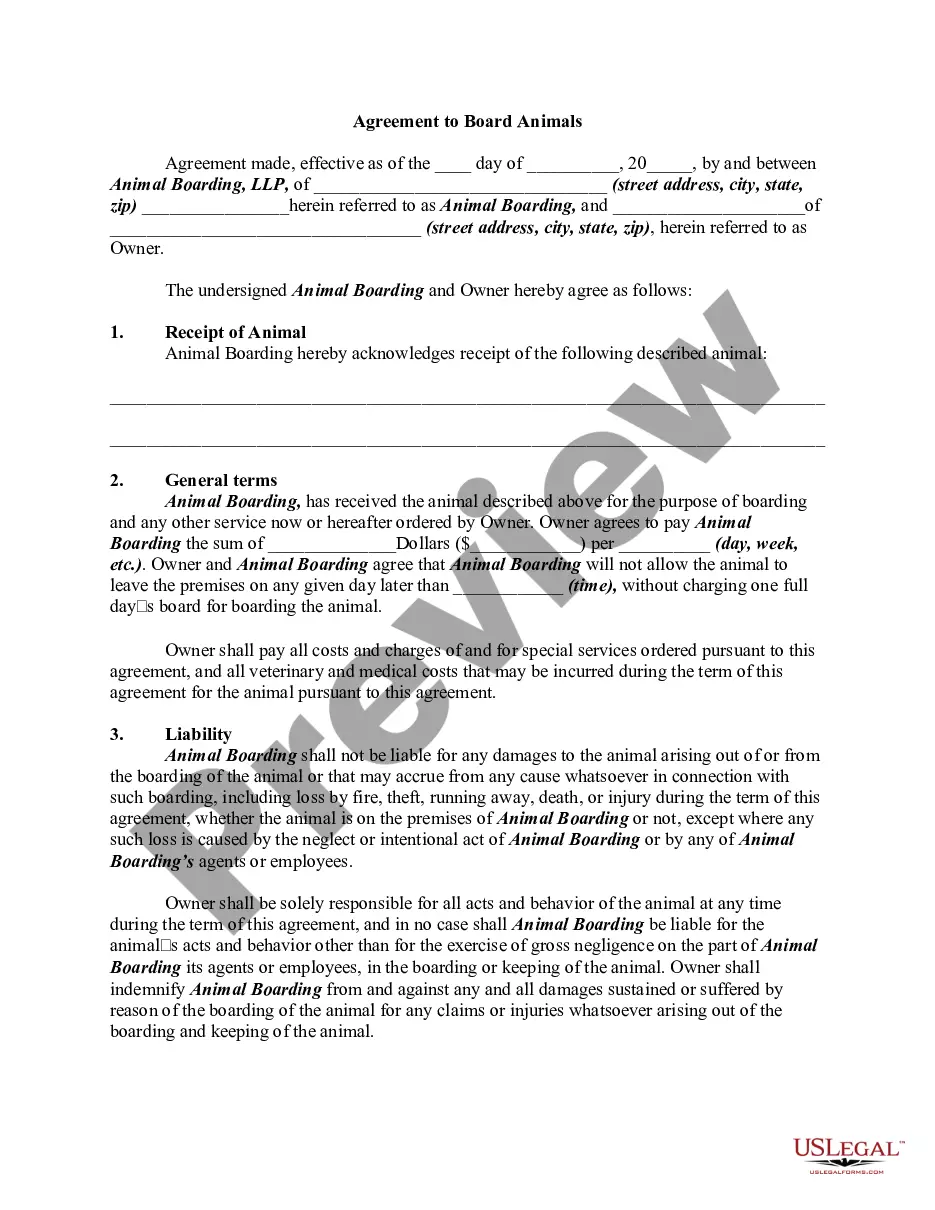

Getting Started. Any person who owns or wishes to operate a business in The Bahamas is required to apply for and obtain a business licence in compliance with the Business Licence Act 2010. Annual Business Licences are renewed annually and it is granted to applicants who regularly carry on a business activity.

A Permit to Acquire Property is required by all non-Bahamians acquiring an interest in land if the property is undeveloped land with two or more adjoining acres. A Permit is also required if the intended use is not as an owner-occupied property.

To incorporate a company in the Bahamas, you must choose a company name, decide on the company structure, register your business with the Registrar General's Department, and comply with all regulatory documentation including shareholder and director information.

A Bahamas Limited Liability Company (LLC) can be incorporated as a local limited liability company under the Companies Act of 1992 or as an international business company under the International Business Companies Act of 2001 with limited liability protection.

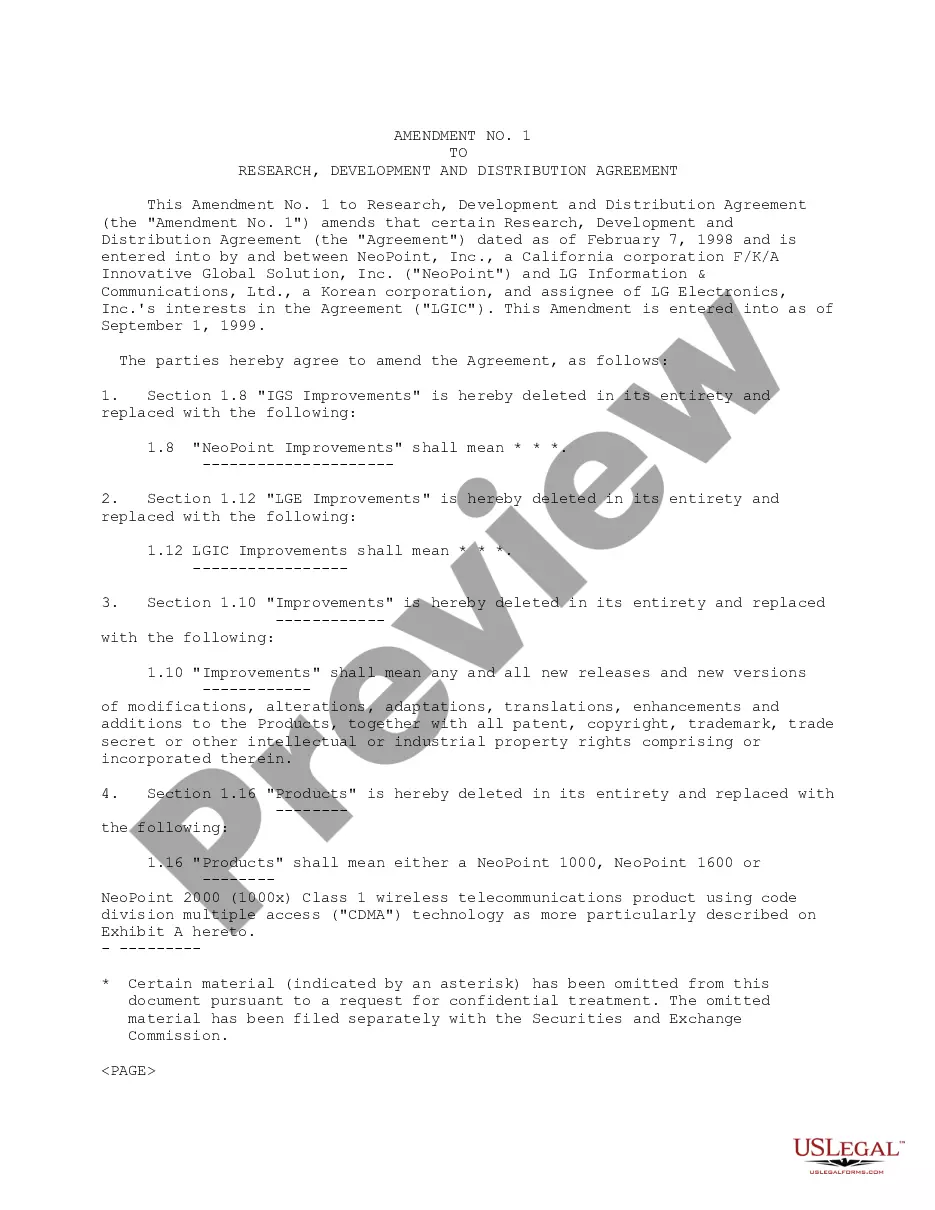

The Commonwealth of The Bahamas welcomes International Investors who wish to establish a business in The Bahamas. All non-Bahamians or Permanent Residents seeking to do business in The Bahamas must submit a Project Proposal to the Bahamas Investment Authority (BIA).

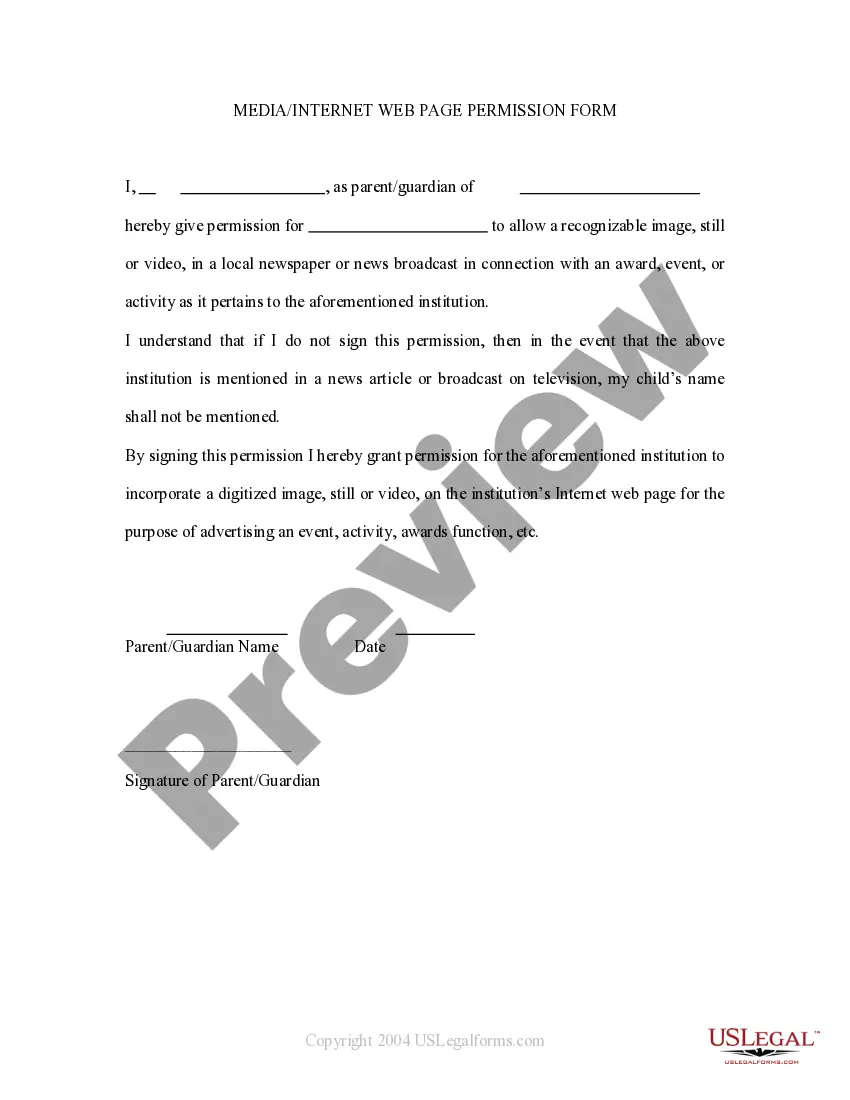

A Consent to Act as a Director is a written consent which should be given by any person who intends to act as a director of a company. Directors have numerous duties which they have to act in ance with under the Corporations Act 2001 (Cth), and these are strictly enforced.

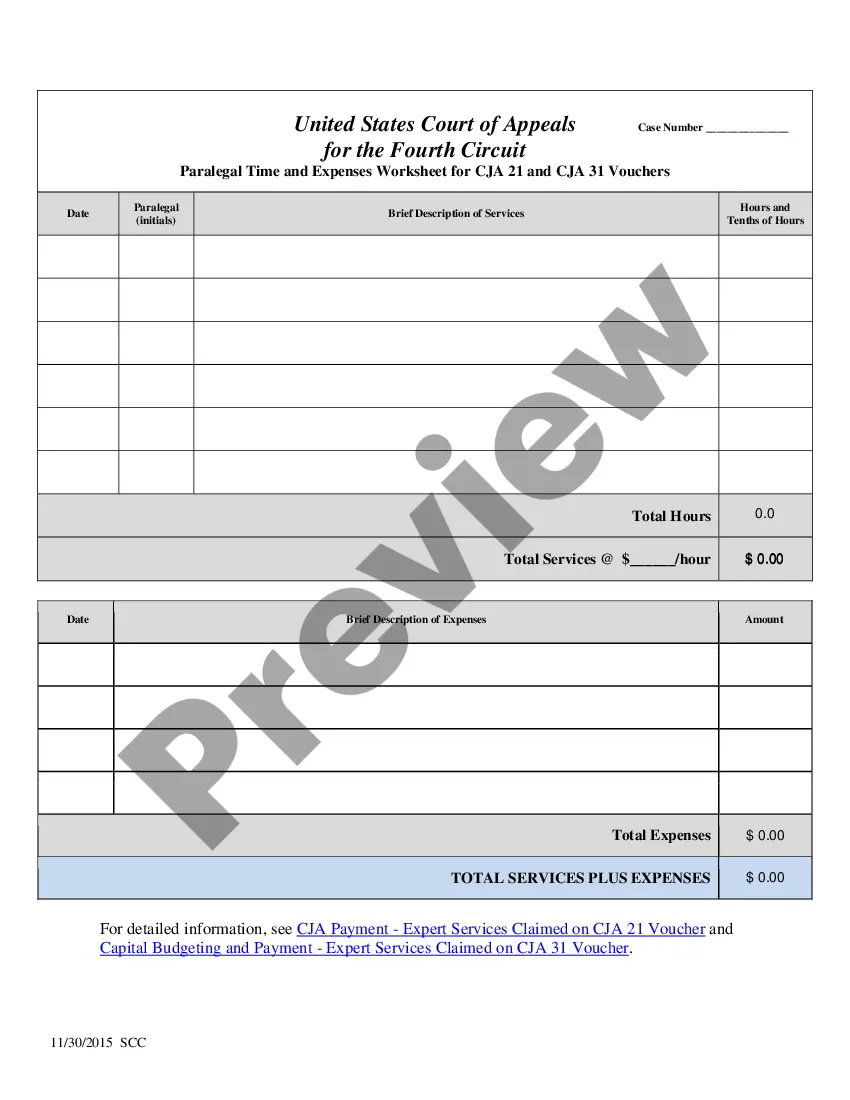

Unless there is a special provision in the company's Articles of Association a director cannot be removed from office by the Board of Directors, and only the shareholders can remove a director. The Articles may provide a procedure for this; otherwise the statutory procedure must be used.

For an ordinary resolution to be passed at the meeting to appoint a director, or directors, such resolution must be supported by more than 50% of the shareholders who are eligible to vote at the meeting.

The statutory provision allowing any director to be removed from office by ordinary resolution of the shareholders is in Section 168 of the Companies Act 2006 (CA06). Importantly, the resolution must be proposed at a formal shareholders' meeting and cannot be passed as a written resolution.

If the shareholders of a public company want to remove a director, they must first give notice of their intention. Shareholders must make this notice to move a resolution for a director's removal at least two months before the shareholders meeting. Shareholders must also give the director notice as soon as practicable.