Directors Consent Form Cipc In Bronx

Description

Form popularity

FAQ

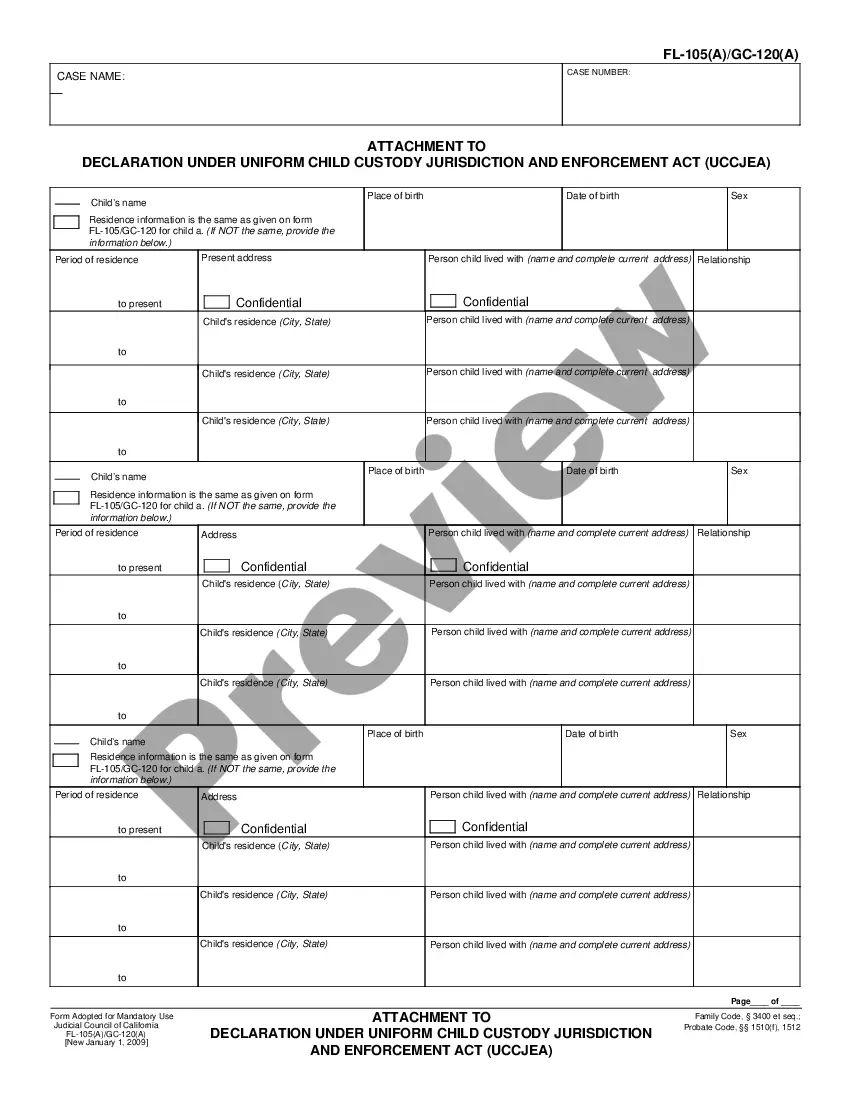

About this Form This form is issued in terms of section 70 (6) of the Companies Act, 2008, and Regulation 39 of the Companies Regulations, 2011. • This form must be filed within 10 business days after any change of the information or the composition of the Board of Directors. •

The statutory procedure allows any director to be removed by ordinary resolution of the shareholders in general meetings (i.e., the holders of more than 50% of the voting shares must agree). This right of removal by the shareholders cannot be excluded by the Articles or by any agreement.

The CIPC does registration of companies, co-operatives and intellectual property rights (trade marks, patents, designs and copyright) and maintenance thereof. Disclosure of Information on its business registers. Promotion of education and awareness of Company and Intellectual Property Law.

CoR39 certificate received from CIPC after registration.

The Companies and Intellectual Property Commission (CIPC) is an agency of the Department of Trade, Industry and Competition in South Africa. The CIPC was established by the Companies Act, 2008 (Act No.

The Companies and Intellectual Property Commission (CIPC) would like to remind customers that the words COMPANIES AND INTELLECTUAL PROPERTY COMMISSION as well as the abbreviation CIPC and the logo of CIPC have been declared a prohibited mark under the Merchandise Marks Act, Act 17 of 1941.

Since the launch of the new system the CIPC now does a real-time verification with the Department of Home Affairs (DHA) to confirm if details captured are correct. All historic data, if incorrect, must be amended to match the details that appear on ID documents or cards.

What is CoR 39? This document contains the Notice of Change concerning a Director. This form is issued in terms of section 70 (6) of the Companies Act, 2008, and Regulation 39 of the Companies Regulations, 2011.

The Director Amendments process is integrated to the Foreigner Assurance process. A Passport Holder will need to be verified before they can be appointed as a Director in a Company.