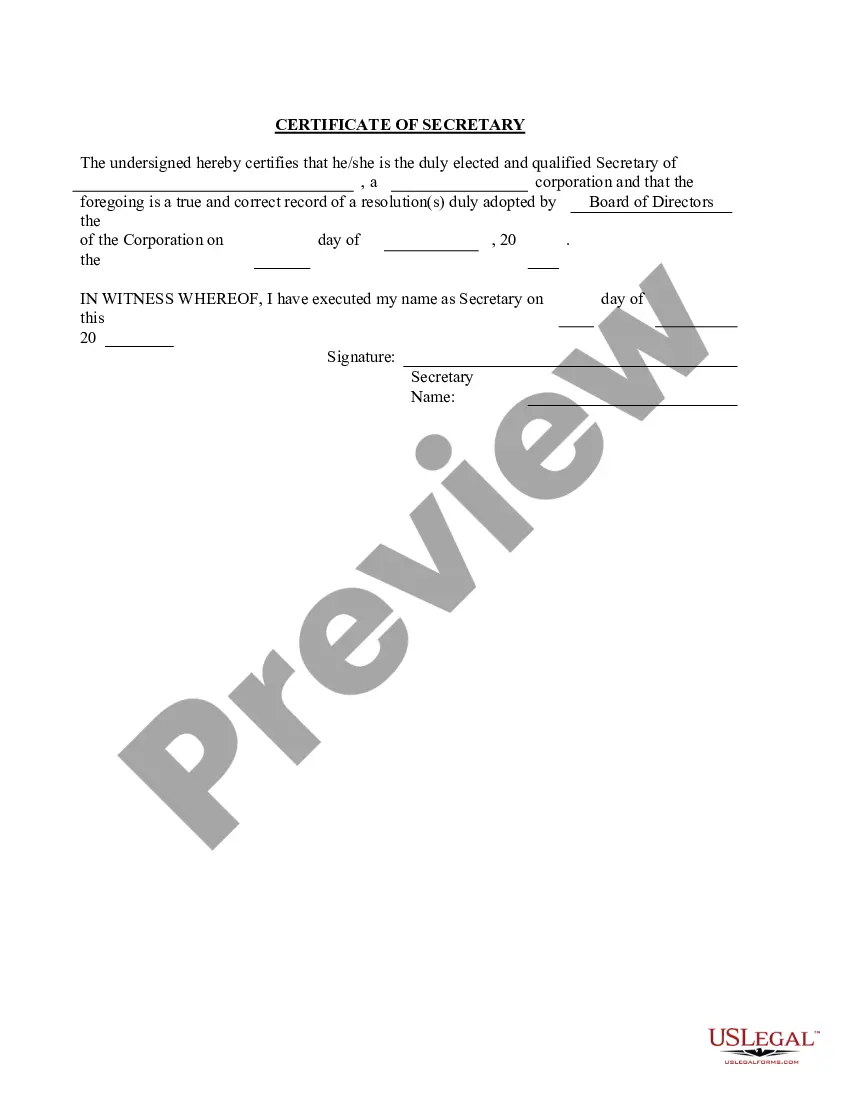

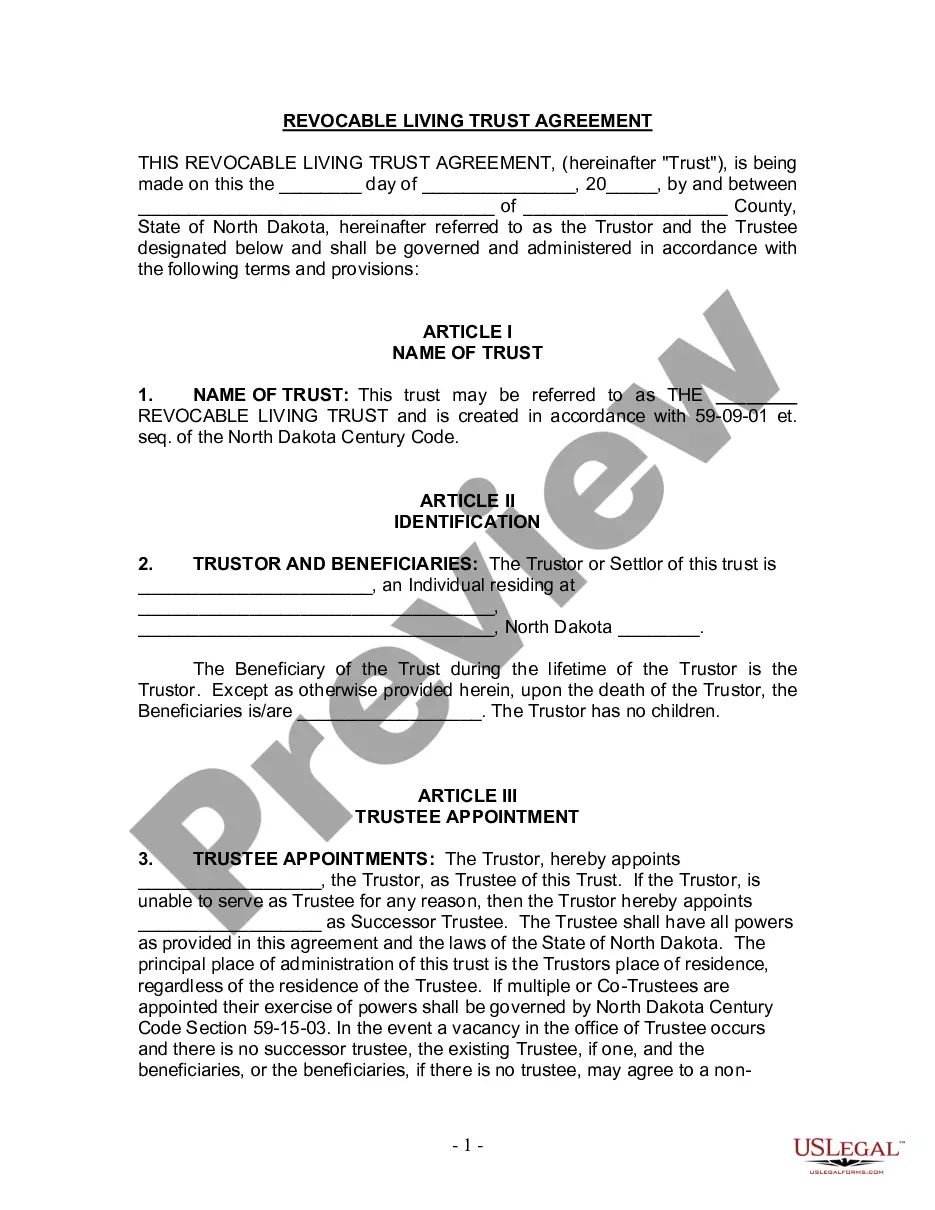

Form with which a corporation may resolve to authorize an officer or representative to loan a specific amount of funds to another party.

Form Corporation Corporate With Irs In Kings

State:

Multi-State

County:

Kings

Control #:

US-0043-CR

Format:

Word;

Rich Text

Instant download

Description

Free preview