Basic Bill Of Sale For Camper In Cuyahoga

Description

Form popularity

FAQ

The seller, upon execution of the agreement or contract and before the delivery of the motor vehicle, shall deliver to the buyer a copy of the agreement or contract that shall clearly describe the motor vehicle sold to the buyer, including, where applicable, its vehicle identification number and the mileage appearing ...

No, Ohio doesn't require a bill of sale to register a motor vehicle. However, having a properly executed bill of sale can provide important documentation and protect the rights of both the buyer and the seller.

Yes. Ohio levies sales tax of 5.75% on a state level plus 0.75% to 2.25% on a county level and in some cases there is a 0.5% special sales tax. As of October 2022, the average combined sales tax rate is 7.26%.

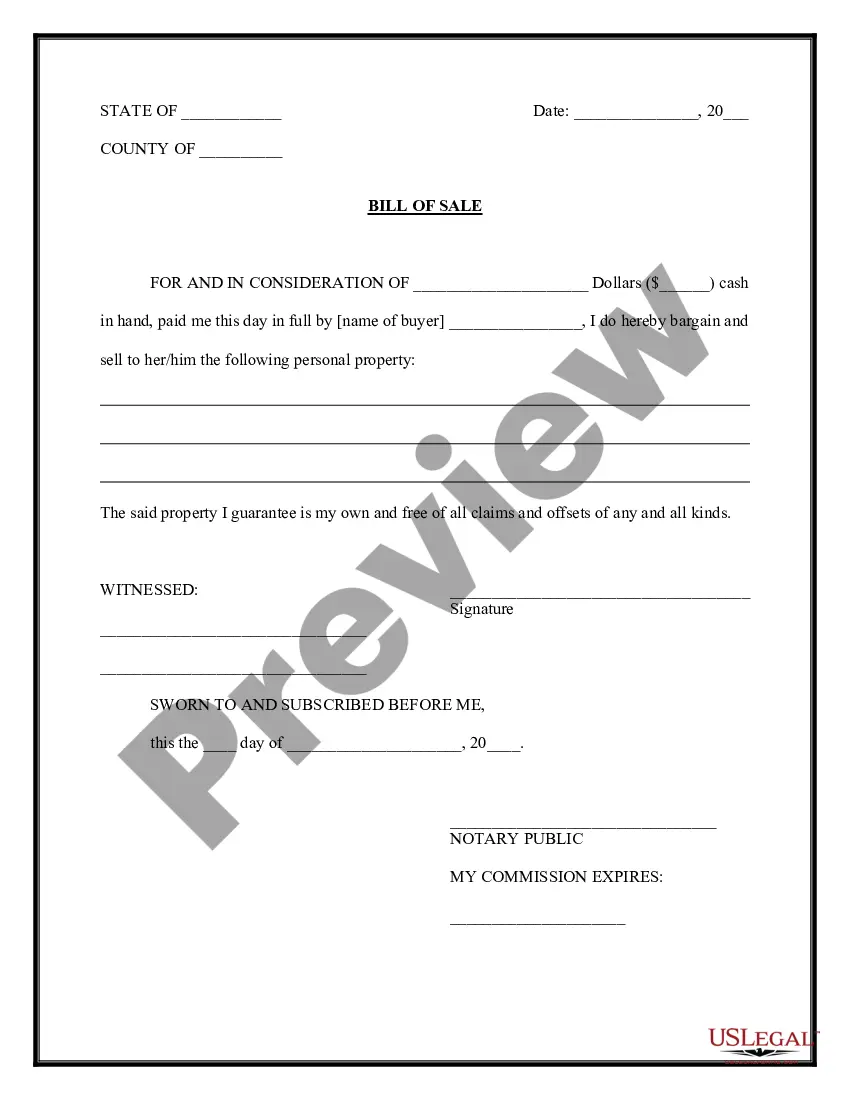

All signatures must be notarized. If two names are to appear on the Title, both signatures are required for all transactions in the State of Ohio. It is required that a State I.D. or Ohio License be presented to the Title Bureau at the time of transfer.

Do I need a title for my utility trailer in Ohio? A new utility trailer should come with a certificate of origin. If the trailer weighs less than 4000 lbs in the state of Ohio ownership can be transferred with a bill of sale and the certificate of origin.

States That Don't Require Notarization States like California, Texas, Florida, Ohio, and New York allow transactions without a notarized document. In these states, a signed bill of sale is often sufficient for legal purposes, provided it includes all required information.

Ohio Title Portal (OTP) This secure online system allows a motor vehicle title to be transferred electronically, from private person to private person. The buyer can apply online 24/7, instead of visiting a title office in person.

The buyer may, but does not have to be, present for the seller to complete the Assignment of Ownership; but the seller MUST have the buyer's name and address in order to complete this section and have the seller's signature notarized.

The state sales and use tax rate is 5.75 percent. Counties and regional transit authorities may levy additional sales and use taxes. For more information about the sales and use tax, look at the options below.