Balloon Payment Promissory Note Example In Pima

Category:

State:

Multi-State

County:

Pima

Control #:

US-00425BG

Format:

Word;

Rich Text

Instant download

Description

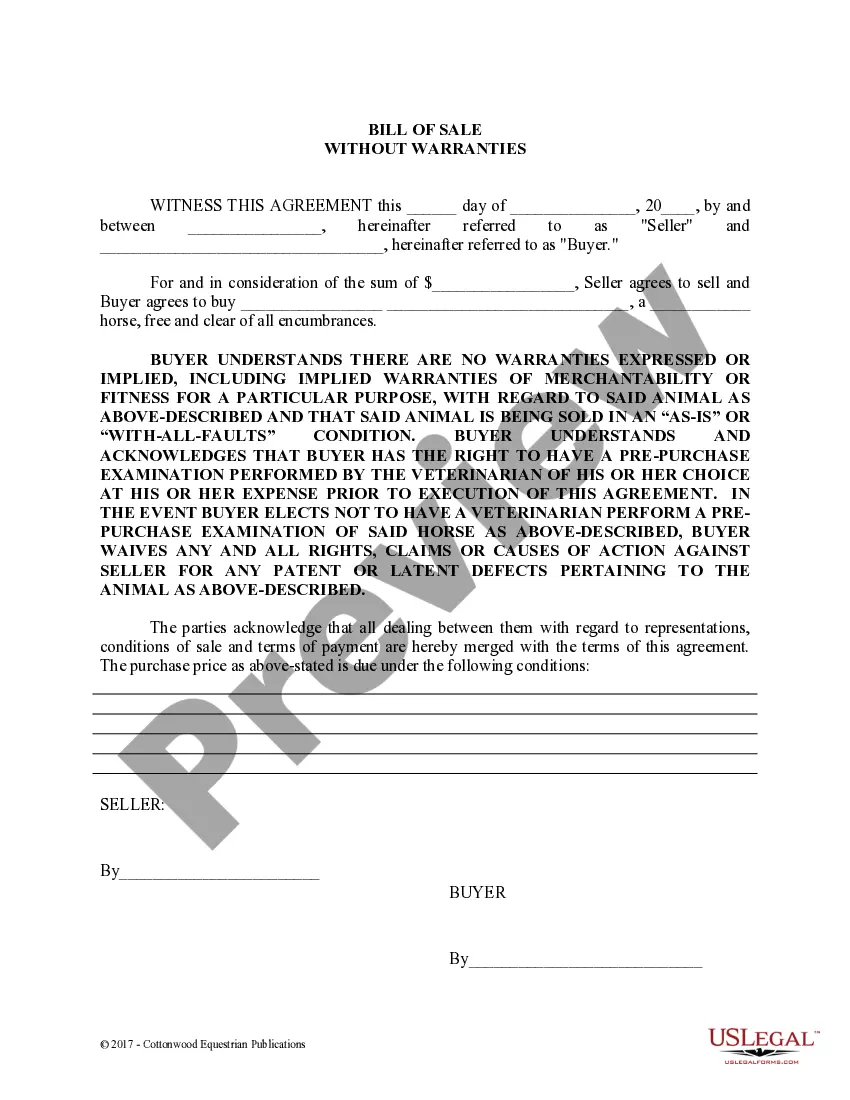

The Balloon Payment Promissory Note example in Pima is designed to facilitate loans with a significant final balloon payment due at maturity. This legal document includes essential details such as the loan amount, interest rate, payment schedule, and provisions for default. Users fill in specifics like the lender's name and address, principal amount, and payment terms. It is important to complete the form accurately to ensure enforceability and clear obligations for all parties. The balloon payment structure allows borrowers to make smaller monthly payments initially, with a larger lump sum due at the end of the loan term. This form serves various professionals, including attorneys and paralegals, by providing a straightforward template that they can customize for client needs. Legal assistants and associates can utilize this form to streamline transactions and ensure compliance with applicable usury laws, which protect against excessive interest rates. Partners and owners benefit from understanding the implications of balloon payment loans, which may be suitable for certain financing scenarios where immediate cash flow is a priority.

Free preview