Note Balloon Sample With Sound In Oakland

Category:

State:

Multi-State

County:

Oakland

Control #:

US-00425BG

Format:

Word;

Rich Text

Instant download

Description

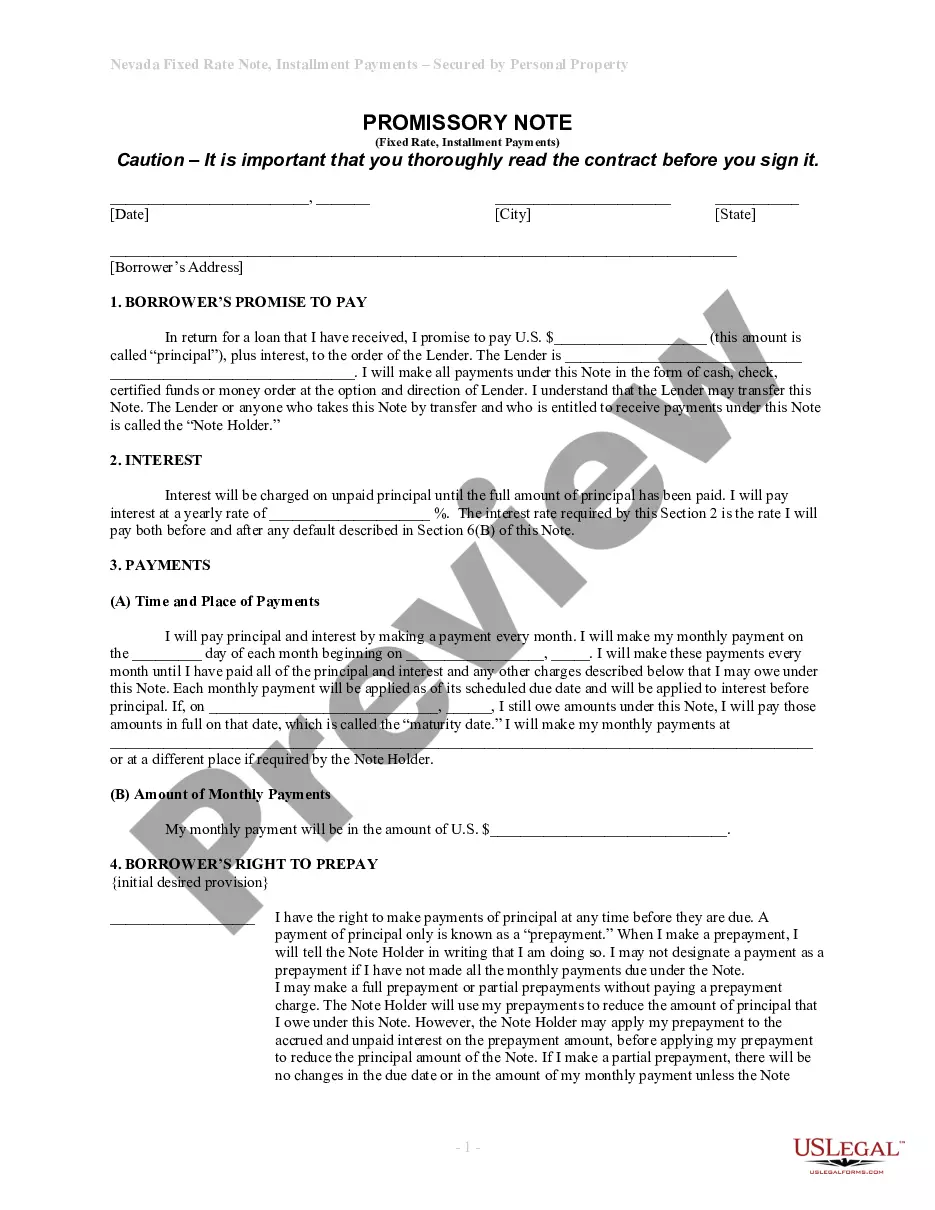

The Promissory Note, specifically the Balloon Note version utilized in Oakland, outlines the borrowing agreement between the Maker and the Lender. This form requires the borrower to repay the principal amount, with specified interest over a defined term, culminating in a balloon payment due at the end of the loan period. Key features include the payment schedule, an interest rate section, and penalties for late payment. Users must fill in details such as the loan amount, interest percentage, payment frequency, and the final balloon payment date. The form serves various purposes, catering to the needs of attorneys, partners, owners, associates, paralegals, and legal assistants, enabling them to draft, review, or file loan agreements effectively. Filling out the document accurately is essential, and users should ensure all financial terms are correctly stated. Legal professionals can also utilize this form to ensure compliance with usury laws and protect their clients' interests. Additionally, it allows for prepayment options with specified penalties, further guiding users in structured loan management.

Free preview