Owing Money For Taxes In Miami-Dade

Category:

State:

Multi-State

County:

Miami-Dade

Control #:

US-00422

Format:

Word;

Rich Text

Instant download

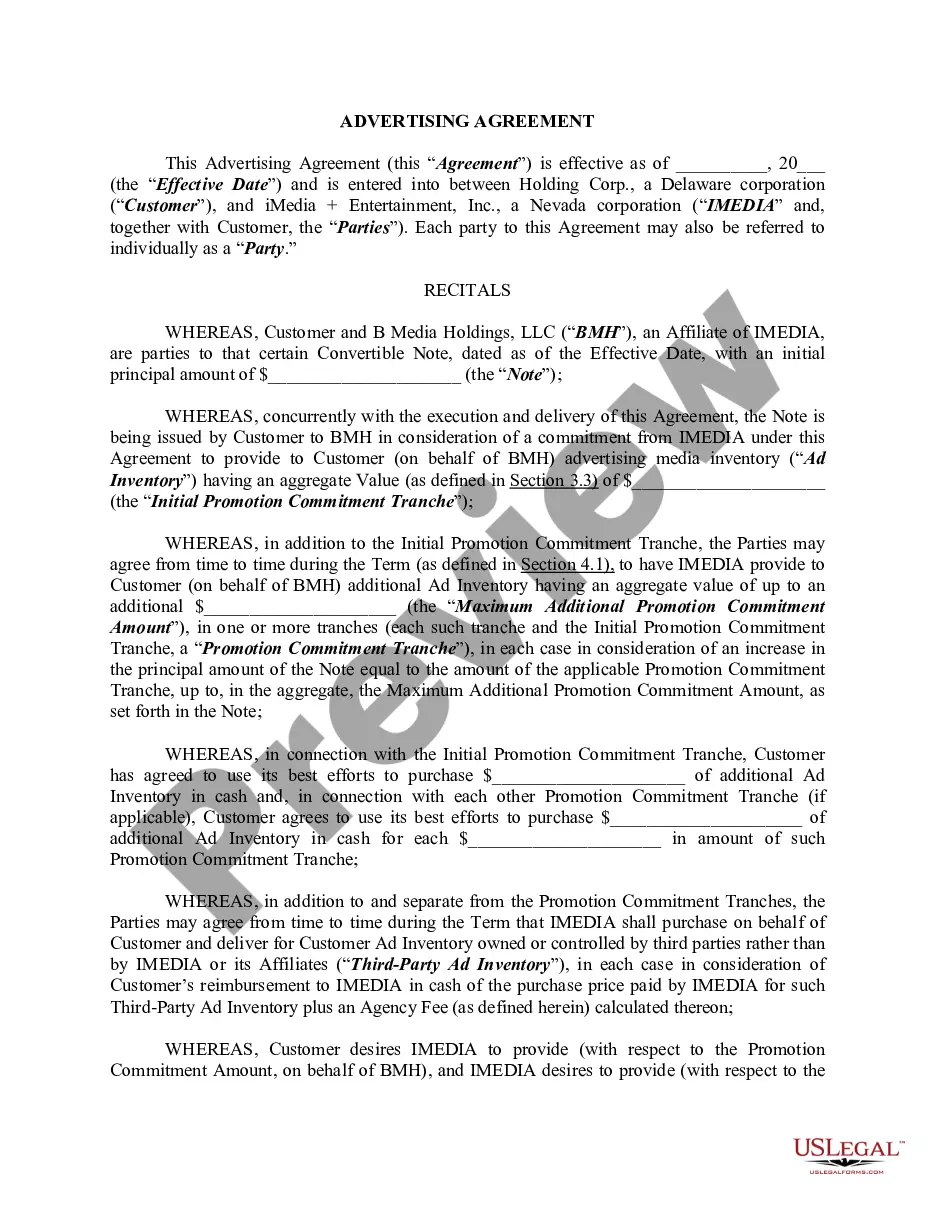

Description

The Assignment of Money Due form is essential for individuals in Miami-Dade who are dealing with owing money for taxes. This document facilitates the transfer of rights to collect on a specific debt, thereby allowing for flexibility in managing tax obligations. Key features of the form include a space for describing the debt, an acknowledgment of receipt, and the assurance that the debt is valid. Users must complete the form by filling in the required sections, notably the details of the debt, and both parties must sign to make the assignment effective. This non-recourse assignment places the responsibility for collection on the Assignee, who must ensure that the debt is collected. Attorneys, partners, owners, associates, paralegals, and legal assistants can utilize this form to streamline the process of debt assignment and ensure compliance with local tax laws. Proper usage of this form can aid in negotiating payment arrangements and managing debts efficiently, catering specifically to clients in need of assistance with tax-related financial obligations.