Overpayment With Social Security In Travis

Category:

State:

Multi-State

County:

Travis

Control #:

US-0041LTR

Format:

Word;

Rich Text

Instant download

Description

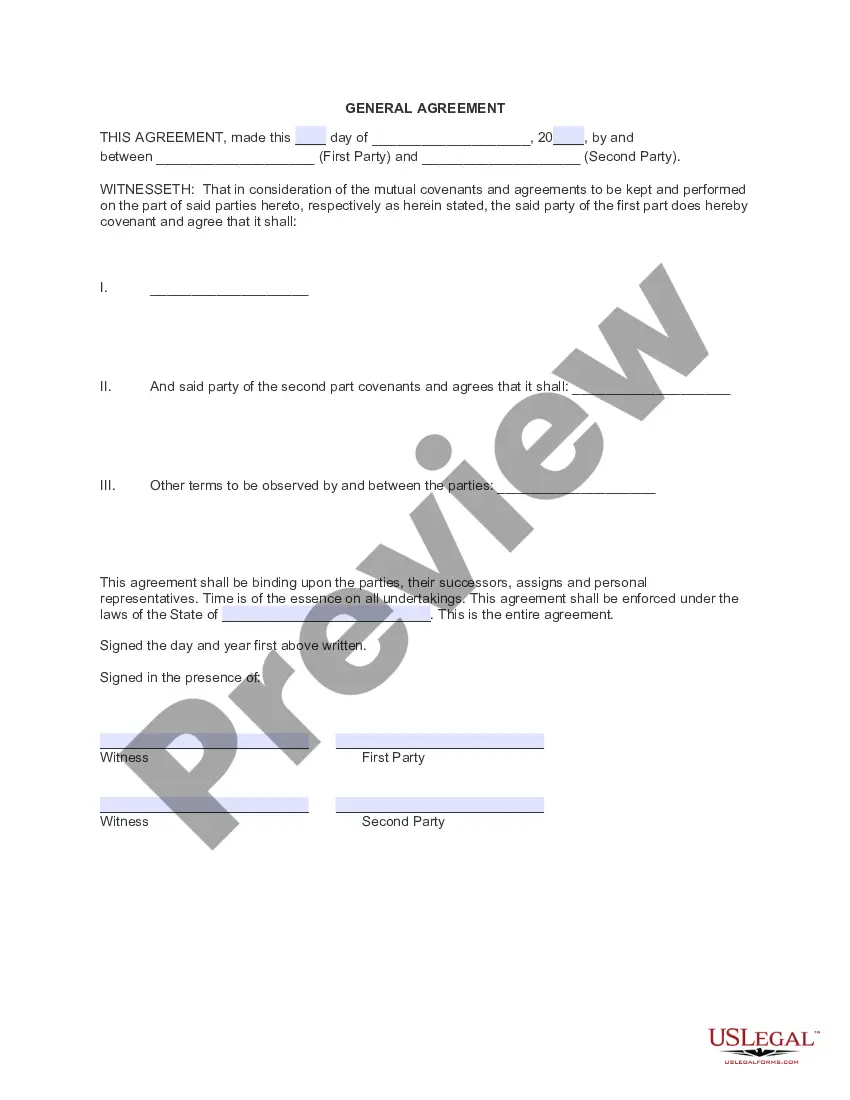

The Overpayment with Social Security in Travis form is designed to address instances where individuals have overpaid their social security taxes or benefits. This form is particularly useful for attorneys, partners, owners, associates, paralegals, and legal assistants, as it helps facilitate the process of reclaiming excess payments from the State Department of Finance and Administration. Key features of the form include a clear structure for documenting the overpayment, allowing users to specify the payment details and relevant amounts. Users should fill out the letter with accurate addresses and personal information, ensuring that all enclosures are included for a complete submission. Specific use cases for the target audience include representing clients who believe they have received an excess charge or assisting in filing for a refund. The utility of this form lies in its straightforward format, making it accessible even for users with little legal experience. It supports clear communication with state agencies and streamlines the process of resolving financial discrepancies related to social security.

Form popularity

FAQ

Obviously, these types of losses attributed to overpayments are both material and significant. Additionally, it is the responsibility of all stakeholders to return any overpayment because every buyer is a seller at some point.