Overpayment Form 941 In Maricopa

Category:

State:

Multi-State

County:

Maricopa

Control #:

US-0041LTR

Format:

Word;

Rich Text

Instant download

Description

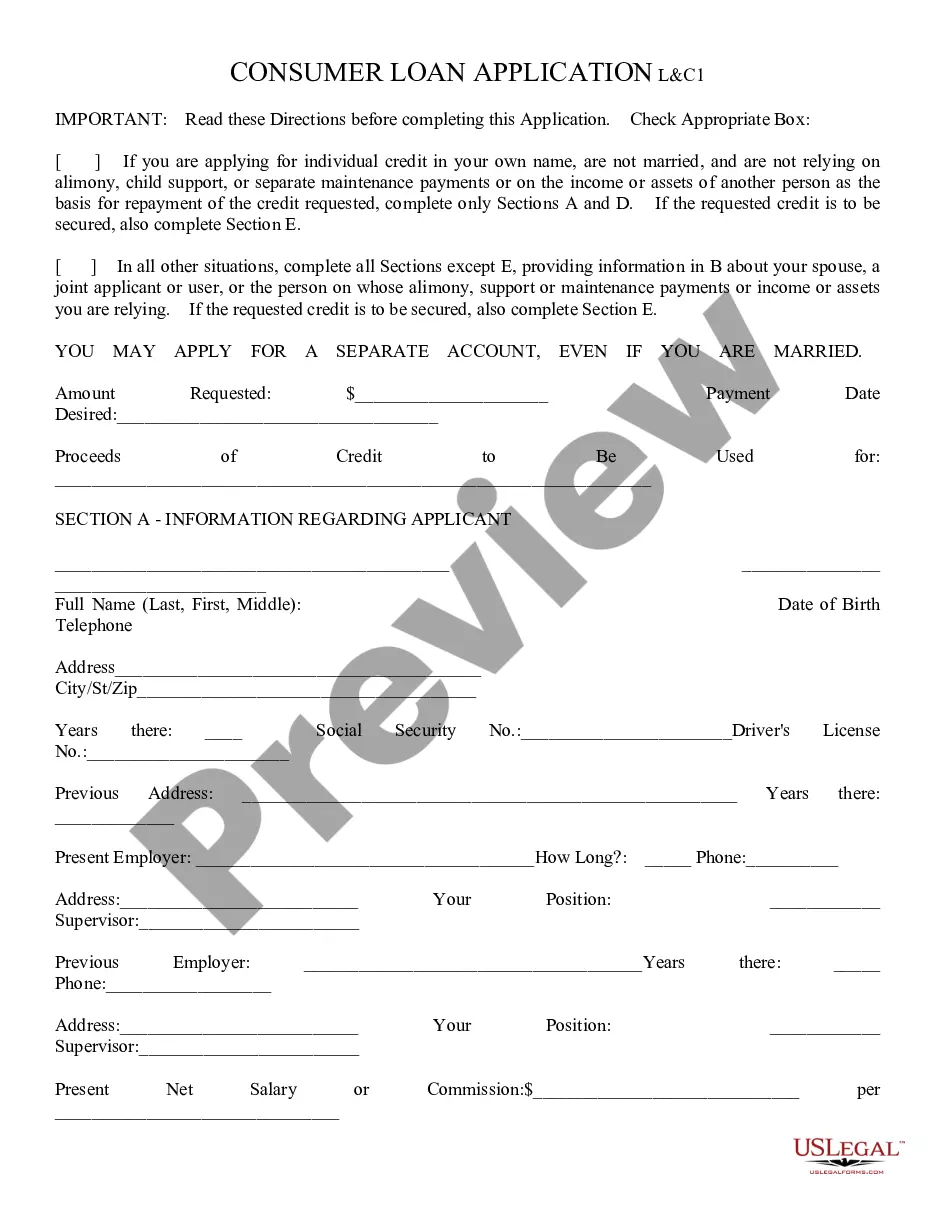

The Overpayment Form 941 in Maricopa serves as an essential document for reporting and rectifying tax overpayments to the relevant authorities. This form is particularly useful for various professionals, including attorneys, partners, owners, associates, paralegals, and legal assistants, facilitating the process of recovering excess payments made during tax submission. Key features of the form include sections to detail the overpaid amount and relevant identification information to ensure accurate processing. Users are advised to fill out the form completely, ensuring that all necessary details are clear and concise to avoid delays. The form may also require supporting documents to substantiate the claim, enhancing its validity. When editing the form, users should ensure that any corrections are clearly marked and that the final version matches the original details to prevent discrepancies. The Overpayment Form 941 is primarily used in situations where individuals or businesses have mistakenly submitted more tax than required, enabling them to reclaim these funds effectively. Understanding its function can aid users in navigating their financial obligations confidently and efficiently.