Overpayment Form 941 In Franklin

Category:

State:

Multi-State

County:

Franklin

Control #:

US-0041LTR

Format:

Word;

Rich Text

Instant download

Description

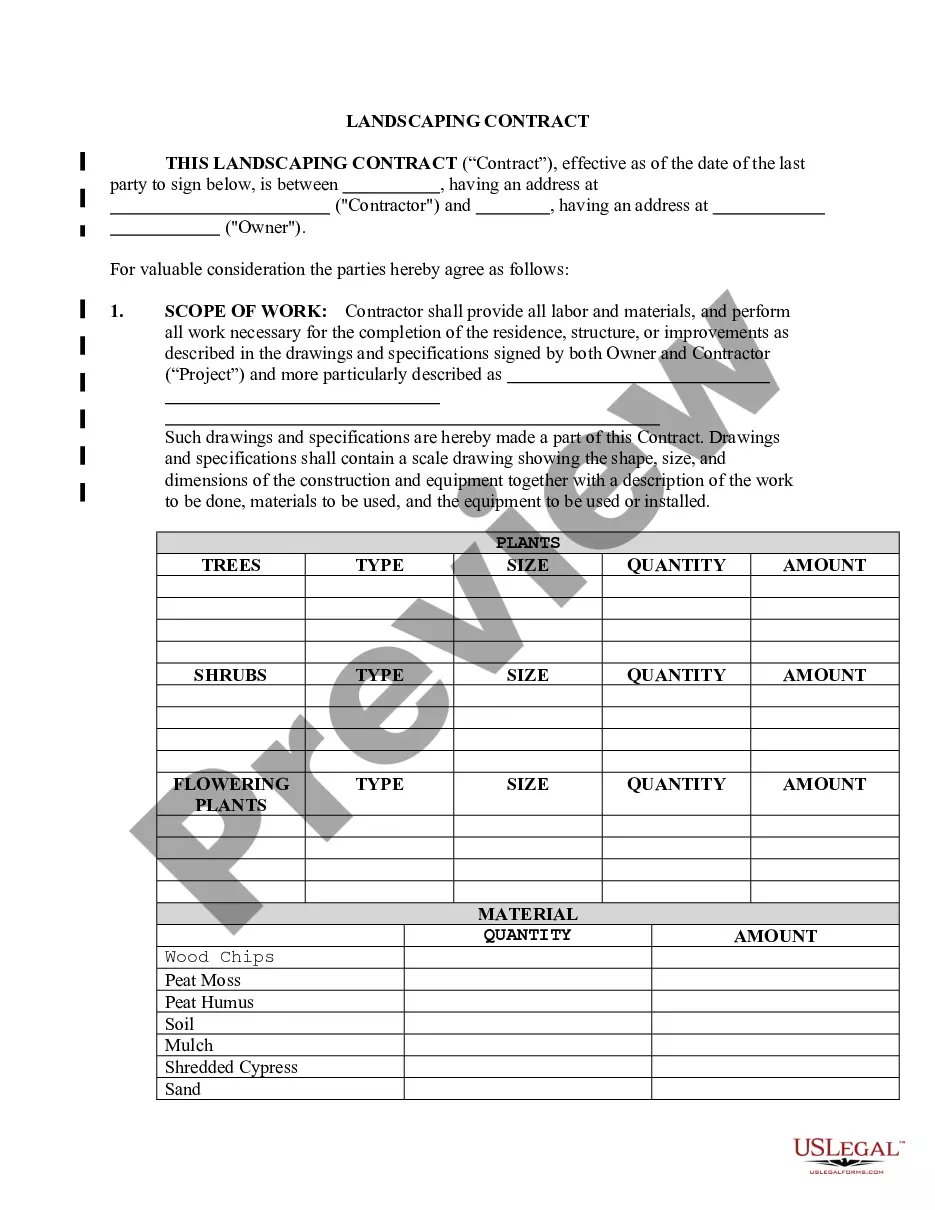

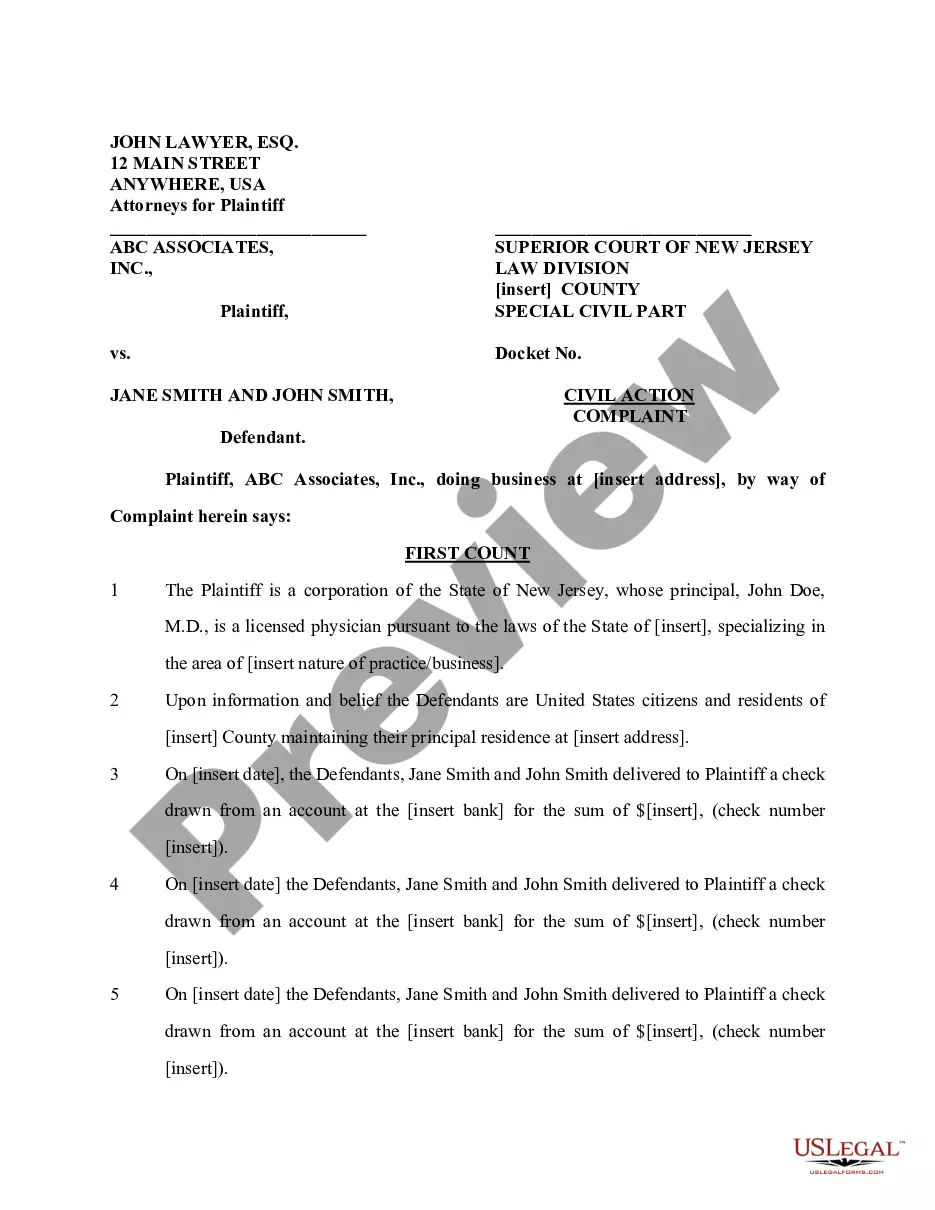

The Overpayment Form 941 in Franklin is designed for individuals and entities who have overpaid their taxes and seek a refund or adjustment. This form is essential for taxpayers who wish to rectify discrepancies in their tax filings, ensuring they receive the appropriate financial compensation for any overpayments made. Key features include the ability to provide detailed information regarding the overpayment, including amounts and relevant dates, as well as instructions for submitting the form to the appropriate state agency. When filling out the form, users should carefully follow the instructions, ensuring accuracy to avoid delays in processing. It is also important to include any necessary supporting documentation, such as payment vouchers or checks. This form is particularly useful for attorneys, partners, owners, associates, paralegals, and legal assistants who may need to assist clients in navigating tax issues. By providing a standardized method for claiming overpayments, the form helps promote compliance and clarity in financial dealings. Overall, the Overpayment Form 941 is a vital tool for ensuring that taxpayers in Franklin can efficiently manage their financial obligations.