Overpayment Form Sss In California

Category:

State:

Multi-State

Control #:

US-0041LTR

Format:

Word;

Rich Text

Instant download

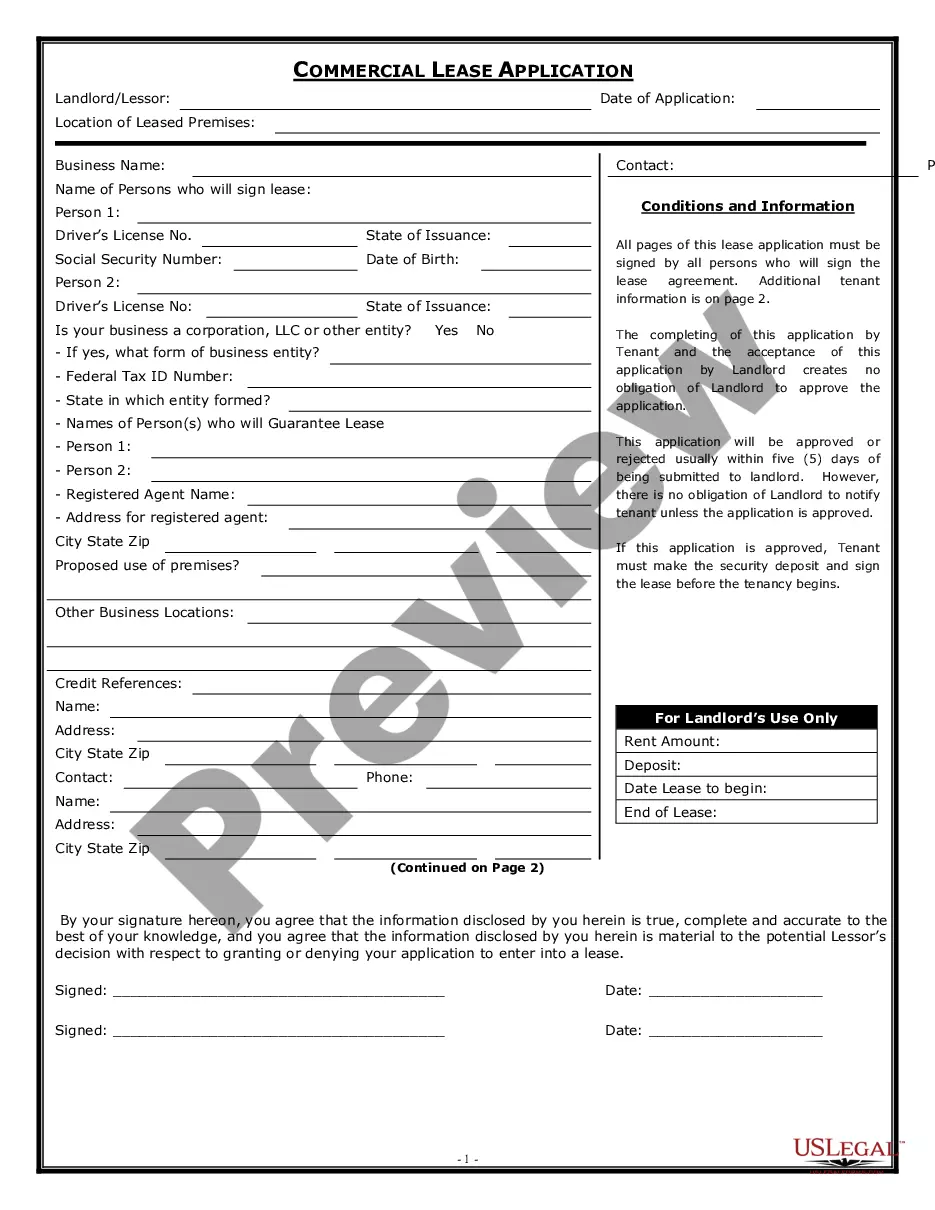

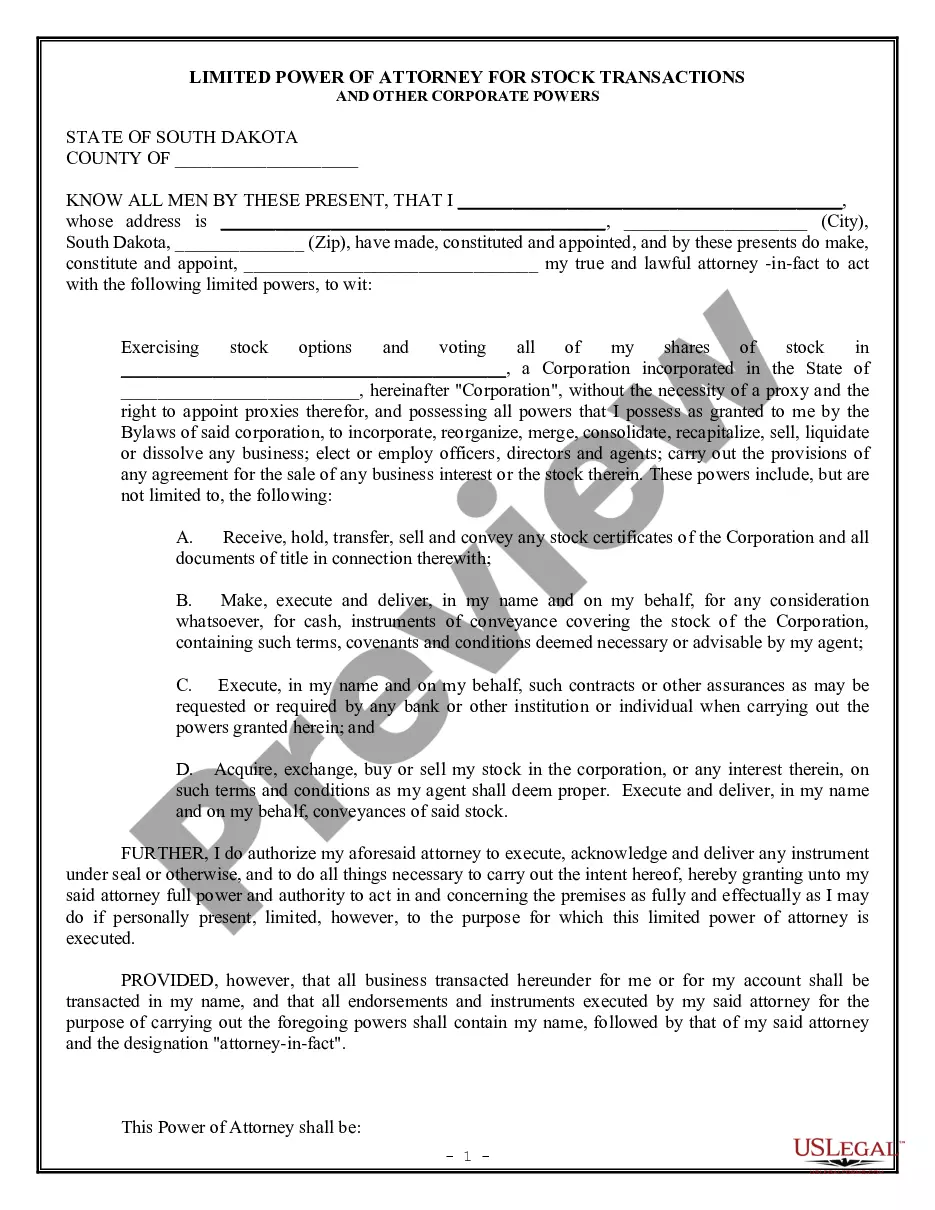

Description

The Overpayment Form SSS in California is designed to facilitate the correct return of excess payments made to state agencies. This form is particularly useful for attorneys, partners, owners, associates, paralegals, and legal assistants who manage financial transactions or tax-related issues for clients or their firms. Key features of this form include sections for detailing the overpayment amount, the specific agency involved, and any necessary payment voucher information. Users are instructed to complete the form by providing accurate payment details and enclosing relevant documentation, such as checks or deposit slips, to confirm the overpayment. The form can be edited to fit individual circumstances and is crucial for ensuring that clients receive prompt reimbursement from state authorities. It is essential for legal professionals to understand the intricacies of the form's submission process to ensure compliance and avoid delays in processing refunds. Specific use cases include scenarios where businesses accidentally submit more tax than required or when clients report discrepancies in state payments. Overall, the Overpayment Form SSS is a vital tool for managing state payment issues efficiently.