Fixed Asset Purchase With Gst Entry In Santa Clara

Category:

State:

Multi-State

County:

Santa Clara

Control #:

US-00419

Format:

Word;

Rich Text

Instant download

Description

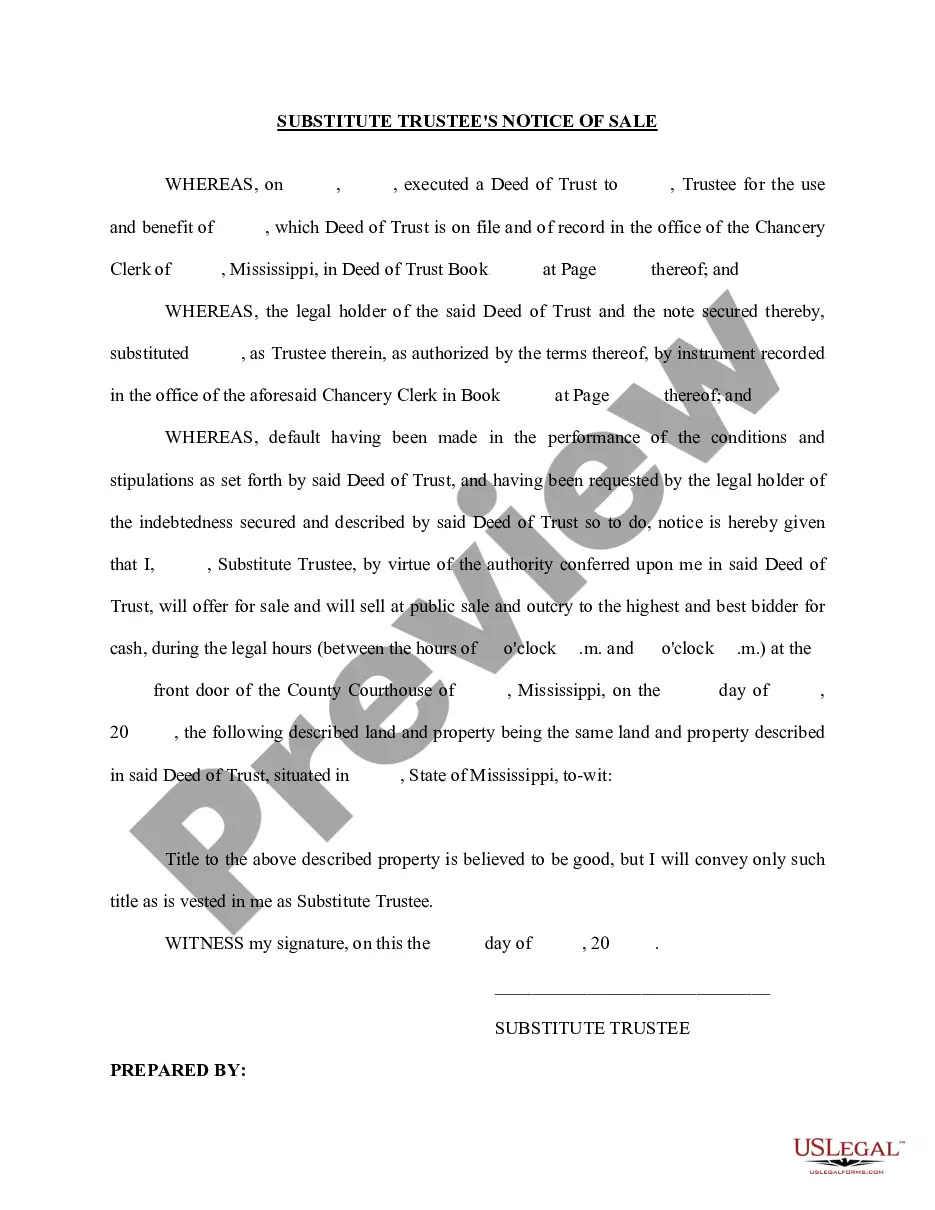

The Asset Purchase Agreement for a fixed asset purchase with GST entry in Santa Clara outlines the terms for the sale of a business's assets from the Seller to the Buyer. This form includes sections detailing the assets being sold, the purchase price, payment schedules, and liabilities assumed, as well as excluded assets. Additionally, it includes representations and warranties regarding corporate existence, title to assets, and compliance with regulations. The agreement emphasizes the obligation of the Buyer to pay all applicable sales and transfer taxes, including GST. For attorneys, partners, owners, associates, paralegals, and legal assistants, this form serves as a crucial document to structure the terms of a transaction while ensuring compliance with local tax regulations, thus minimizing legal risks. It also outlines specific rights and obligations following the closing of the sale, including indemnification clauses and conditions for terminating the agreement. Users should fill in specific details such as dates, amounts, and parties involved, while ensuring clarity to reduce the potential for disputes.

Free preview