Asset Purchase Buy With Gst In Palm Beach

Category:

State:

Multi-State

County:

Palm Beach

Control #:

US-00419

Format:

Word;

Rich Text

Instant download

Description

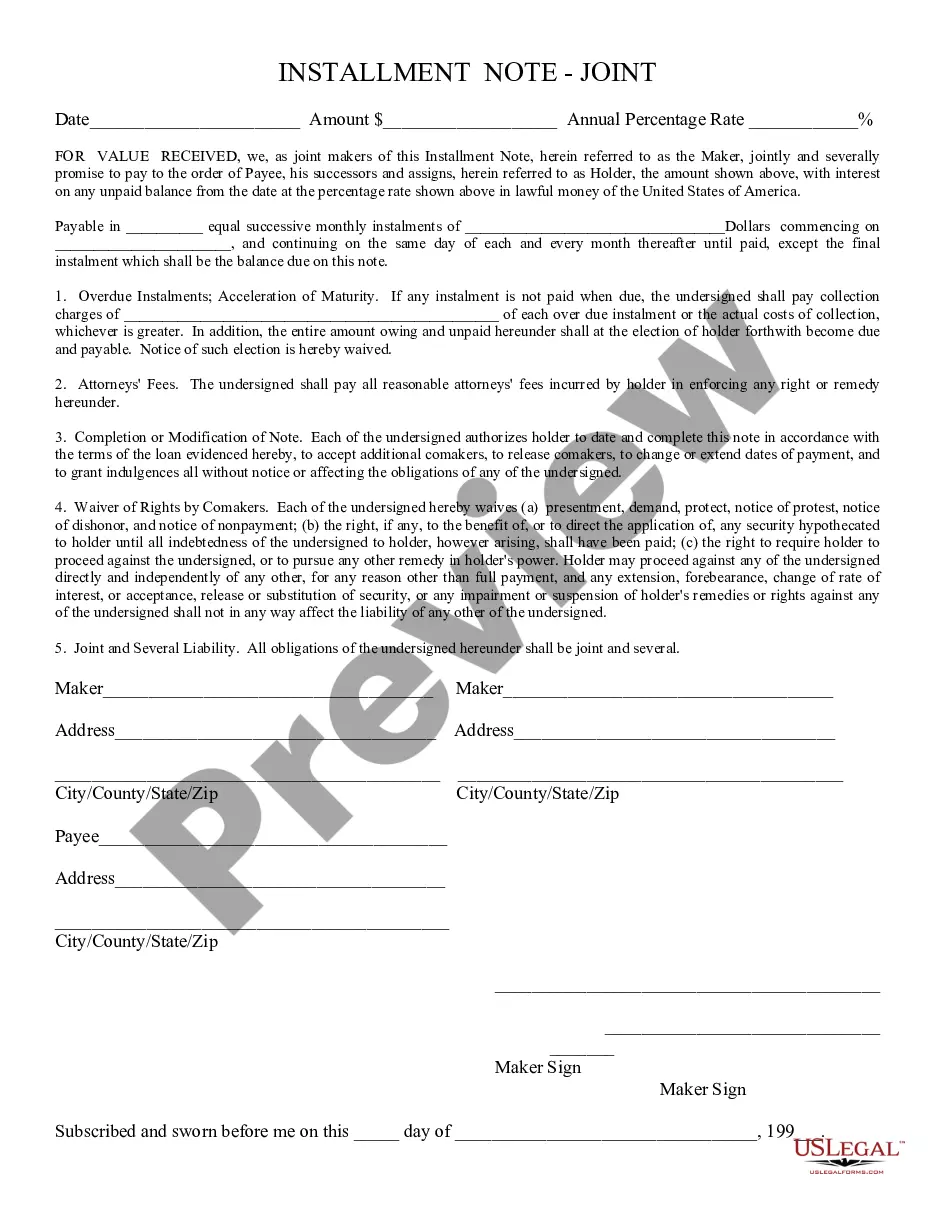

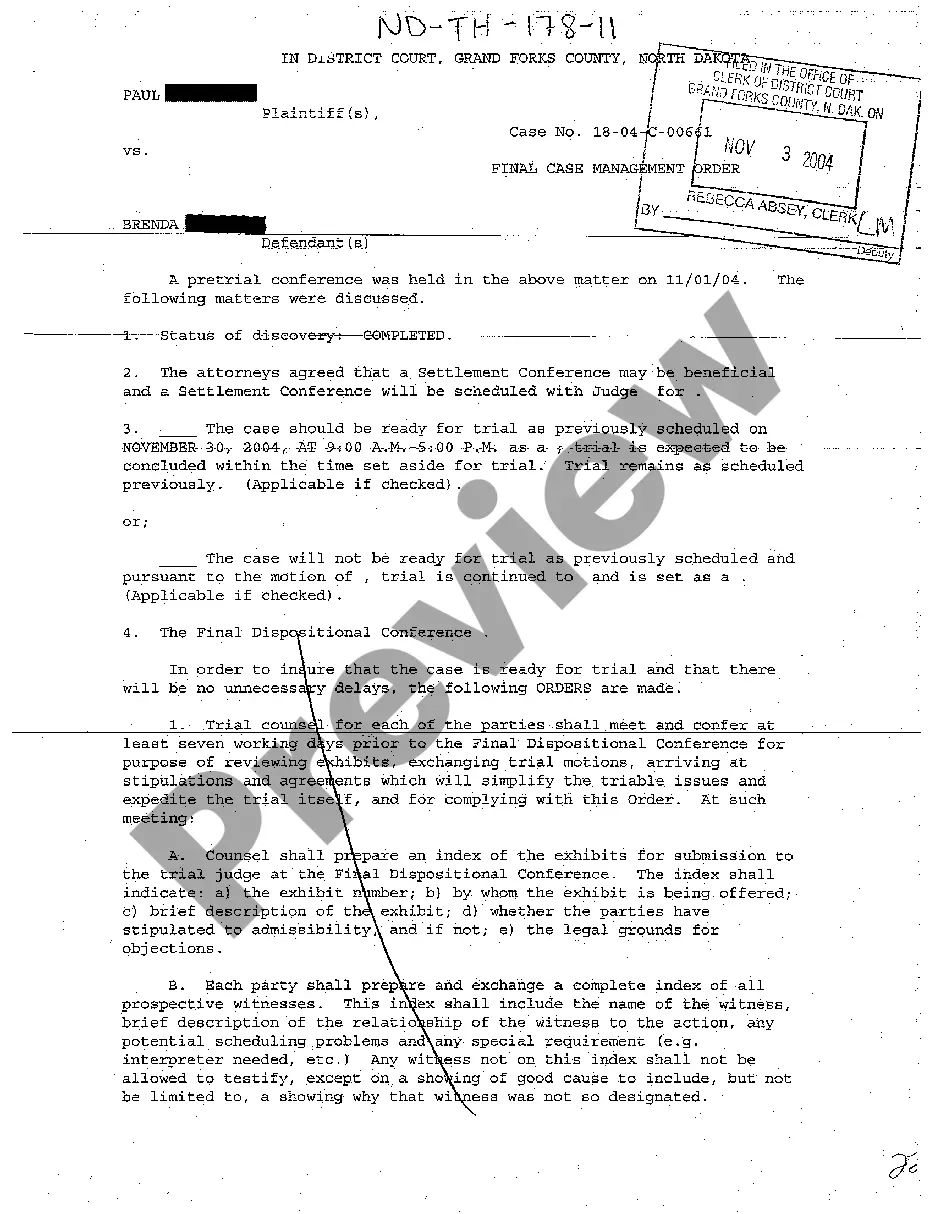

The Asset Purchase Agreement is a legally binding document used in Palm Beach for the sale of business assets, including equipment, inventory, and goodwill, while excluding certain liabilities and assets. This form outlines the purchase price, payment terms, and various seller and buyer representations, including corporate existence and authorization. Key features include asset descriptions, liability exclusions, security agreements, and the obligations of both parties prior to closing. Filling out the form requires accurate information about the parties involved, detailed asset descriptions, and signatures to finalize the agreement. It is designed to protect the interests of both buyers and sellers by providing terms for indemnification and representations. This agreement serves various legal professionals, such as attorneys and paralegals, as a tool for facilitating asset transfers, ensuring compliance with legal standards, and clearly defining responsibilities and liabilities in transactions. Specifically, it is useful for those negotiating asset purchases with GST implications, managing corporate transactions, or providing legal assistance in business transfers.

Free preview