Fixed Asset Purchase With Gst Entry In Middlesex

Category:

State:

Multi-State

County:

Middlesex

Control #:

US-00419

Format:

Word;

Rich Text

Instant download

Description

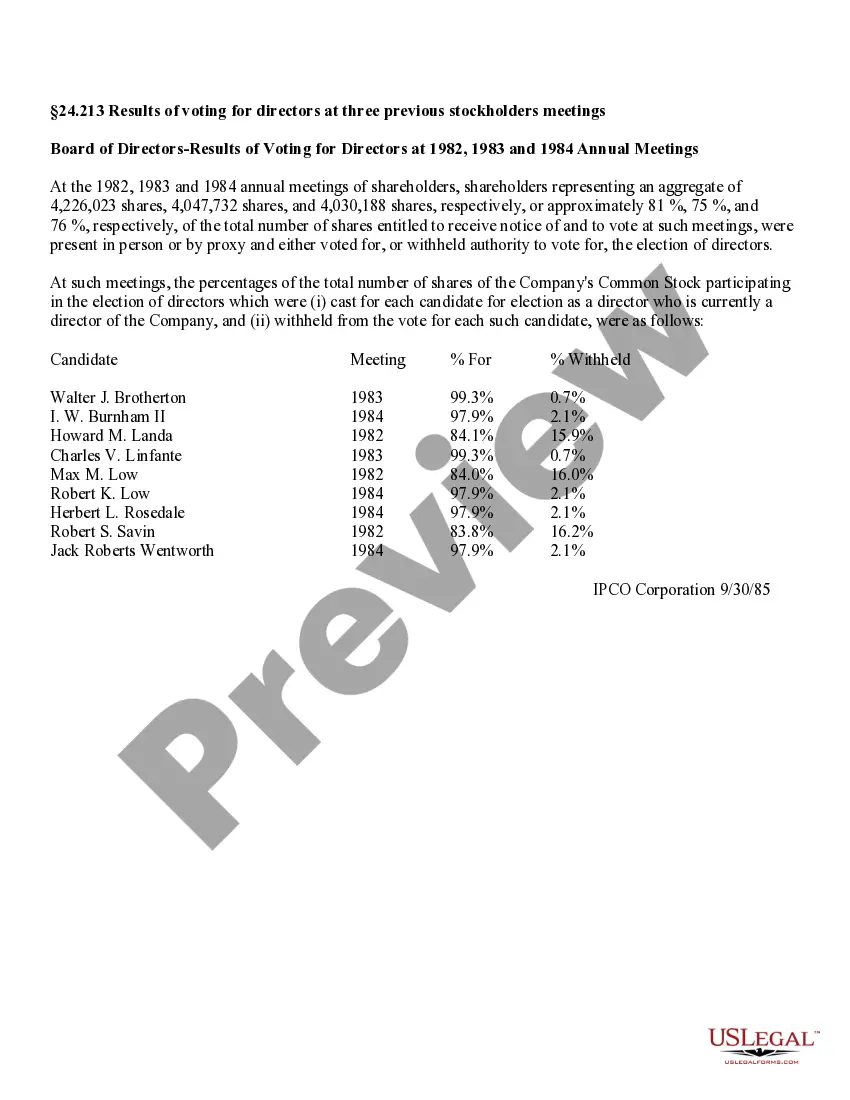

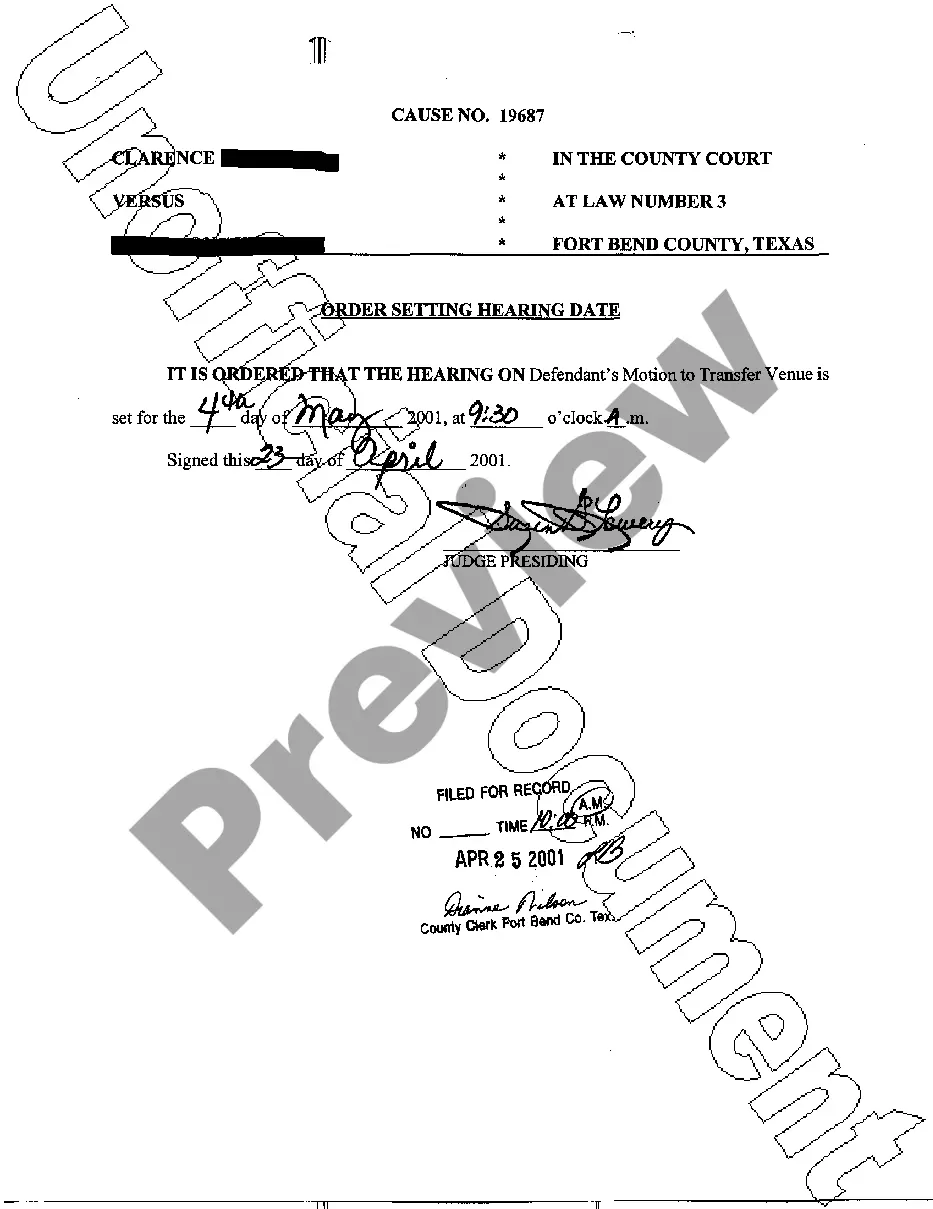

The Asset Purchase Agreement is a key legal document used in fixed asset purchases with GST entry in Middlesex. It outlines the terms of sale for business assets including equipment, inventory, and goodwill, while excluding certain liabilities and assets. The agreement requires precise filling of seller and buyer details, and careful editing to reflect accurate financial considerations including the allocated purchase price. It includes provisions for payment schedules, warranties from both parties, and conditions that must be satisfied before closing the transaction. Target users such as attorneys, partners, owners, associates, paralegals, and legal assistants can utilize this form to ensure legal compliance and structure when acquiring or transferring business assets. It serves as a clear guideline for the roles and responsibilities of each party, protecting their interests and facilitating smooth asset transitions while ensuring adherence to tax obligations. Legal professionals will find this document beneficial for mediating negotiations and clarifying asset management considerations.

Free preview