Asset Purchase Buy With Gst In Maricopa

Category:

State:

Multi-State

County:

Maricopa

Control #:

US-00419

Format:

Word;

Rich Text

Instant download

Description

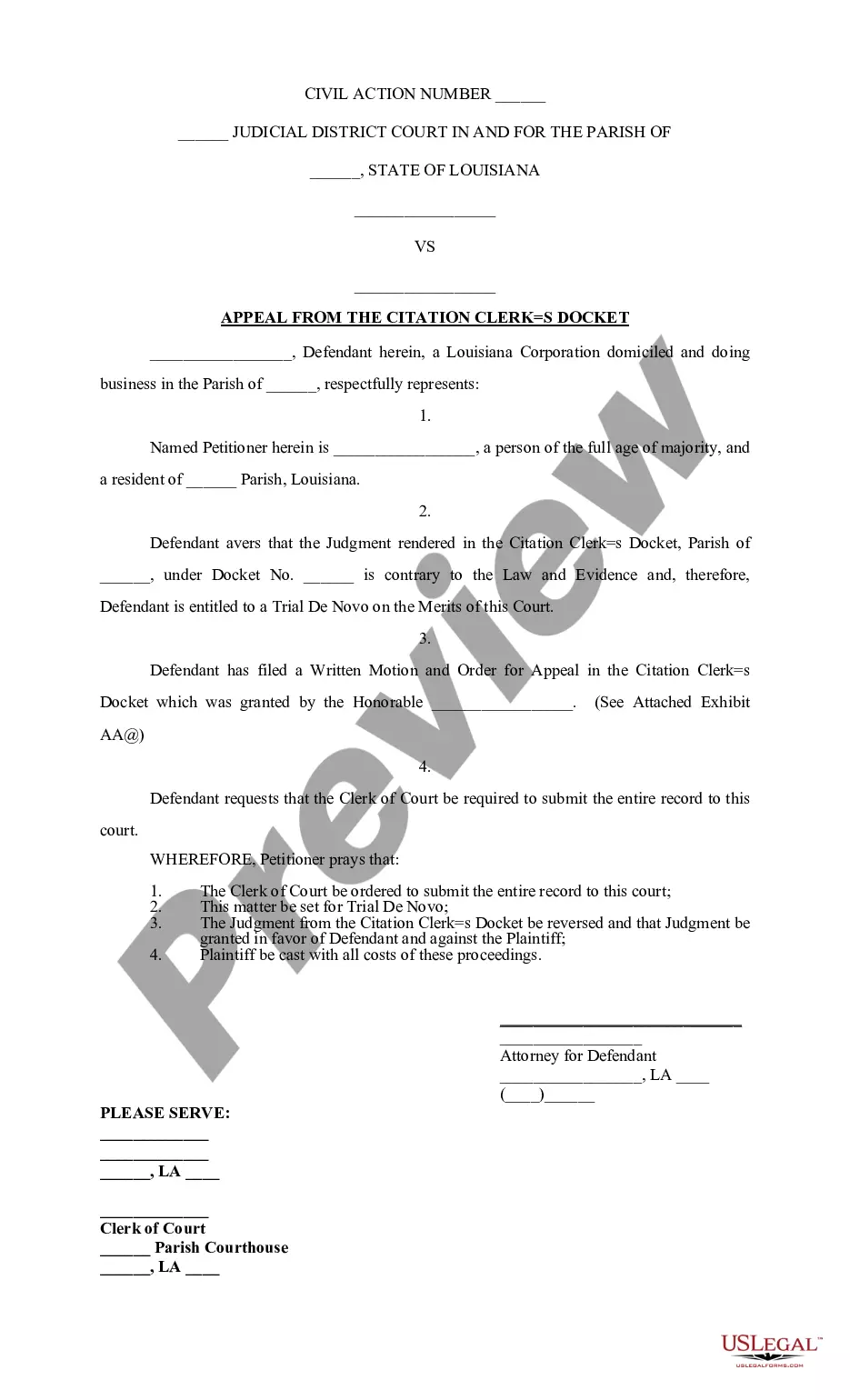

The Asset Purchase Agreement serves as a legal document facilitating the purchase of assets with applicable Goods and Services Tax (GST) considerations in Maricopa. This form outlines the agreement details between the Seller, Selling Shareholder, and Buyer, specifying assets purchased, purchase price allocation, and payment terms. Key features include sections on the exclusion of liabilities, representations and warranties by both parties, covenants, and conditions precedent for closing. Users should carefully fill in specific details such as the asset descriptions and financial amounts, ensuring amendments are compliant with legal standards. Legal professionals such as attorneys, partners, and paralegals will find this form useful as it helps navigate the intricacies of asset transactions while protecting their clients' interests. The form is particularly relevant for business mergers or acquisitions, assisting in the structured acquisition process of operational assets, enhancing legal clarity among involved parties.

Free preview