Asset Purchase Buy With Gst Entry In Franklin

Category:

State:

Multi-State

County:

Franklin

Control #:

US-00419

Format:

Word;

Rich Text

Instant download

Description

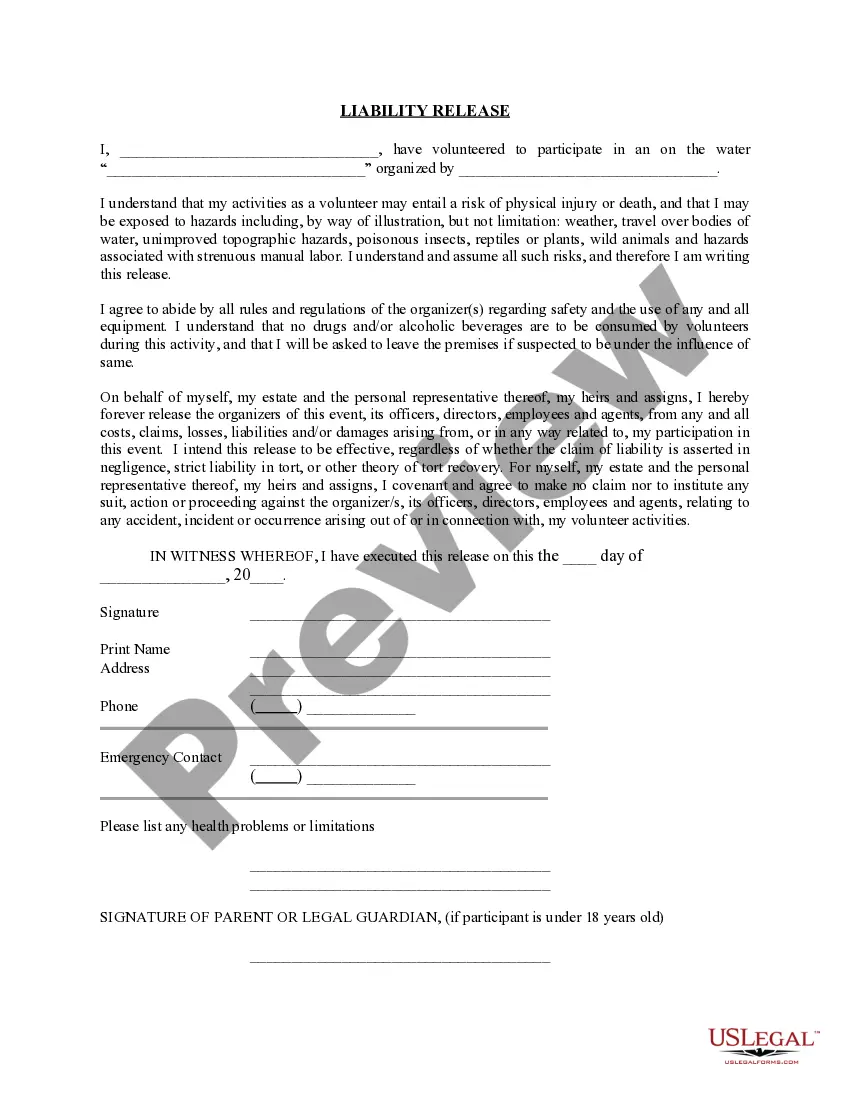

The Asset Purchase Agreement outlines the terms under which a buyer acquires assets from a seller, particularly focusing on transactions involving the purchase of business-related assets in Franklin with GST considerations. This form covers essential details such as the assets being sold, the purchase price allocated among different asset types, and payment schedules. The agreement specifies assets excluded from the sale, such as accounts receivable and cash, and explicitly states that the buyer will not assume any of the seller's liabilities. Key features include representations and warranties from both the seller and buyer, ensuring clarity regarding the condition and ownership of assets. Filling instructions entail accurately entering names, dates, and asset details into the prescribed sections. The form is particularly useful for attorneys, partners, owners, associates, paralegals, and legal assistants involved in business transactions, as it provides a framework to ensure that all legal obligations are met while minimizing potential liabilities. Specific use cases include mergers and acquisitions, business expansions, and strategic asset acquisitions where a legal foundation is necessary for both parties.

Free preview