Nyc Deferred Comp Fees In Nevada

Category:

State:

Multi-State

Control #:

US-00418BG

Format:

Word;

Rich Text

Instant download

Description

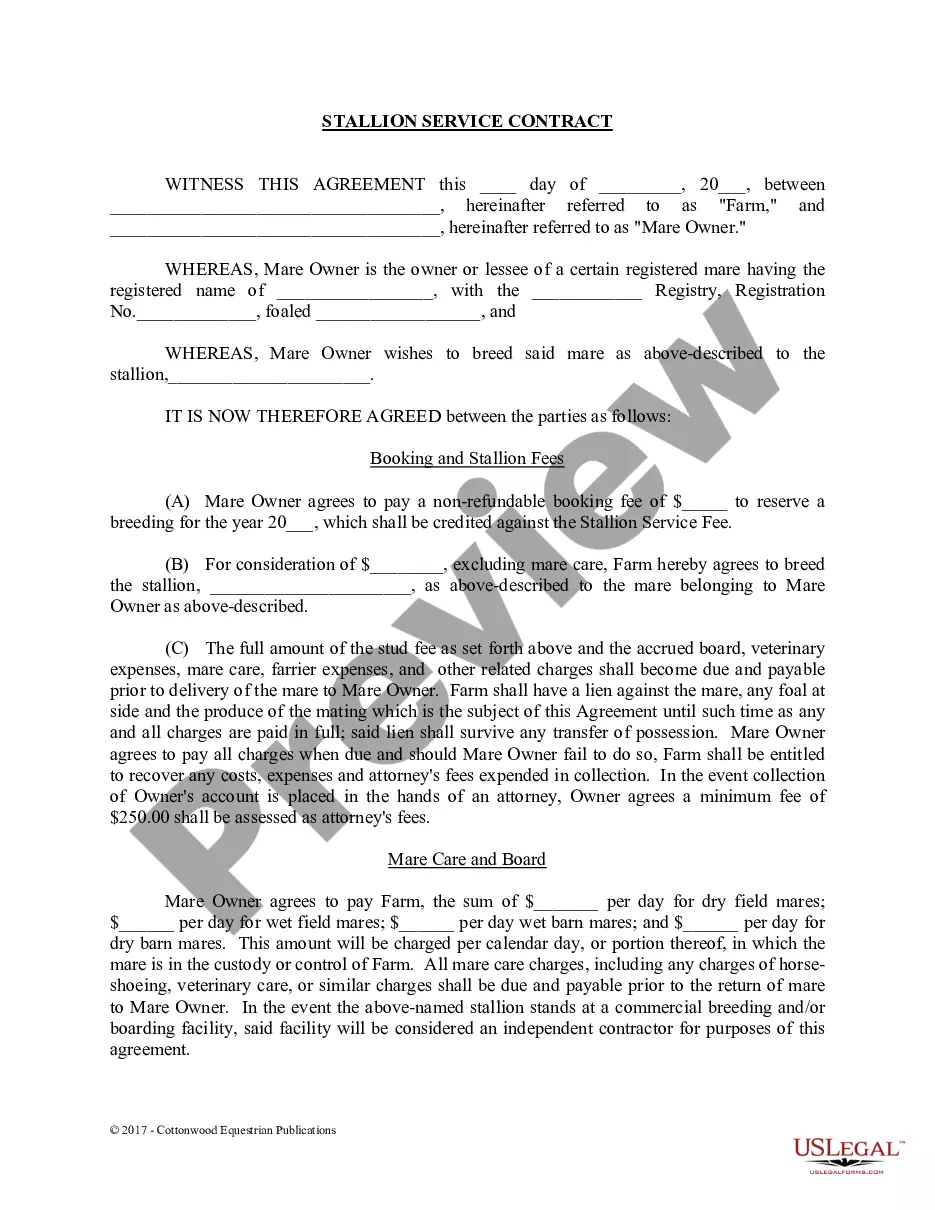

The Deferred Compensation Agreement is designed to outline the terms between an Employer and Employee regarding post-retirement compensation plans, specifically focusing on the NYC deferred comp fees applicable in Nevada. Key features include stipulations for retirement payments, death benefits for beneficiaries, and the conditions that may terminate the agreement, such as voluntary employee termination or noncompliance with terms. The document clearly defines the payment amounts, conditions under which they apply, and the method of calculation based on the National Consumer Price Index. Filling out the agreement requires specific information about the Corporation and the Employee, including addresses, retirement age, and payment amounts. Legal professionals, including attorneys, partners, associates, and paralegals, will find this form useful for ensuring compliance with compensation agreements while protecting their clients' interests. The document also addresses noncompetition clauses, ensuring that the Employee does not work for competitors after retirement to remain eligible for the agreed payments. It is vital for legal assistants to follow the instructions for modifications and ensure all parties sign the agreement correctly.

Free preview