Deferred Compensation Plan Examples In Collin

Category:

State:

Multi-State

County:

Collin

Control #:

US-00418BG

Format:

Word;

Rich Text

Instant download

Description

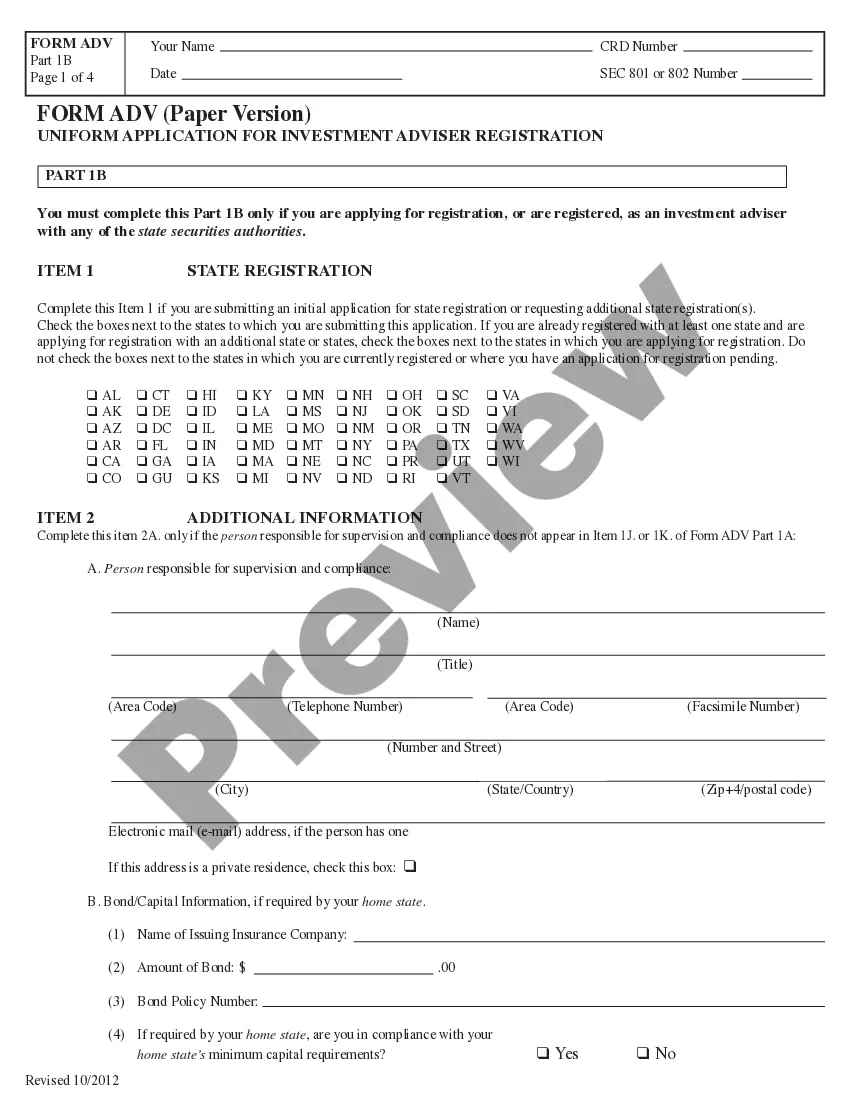

The Deferred Compensation Agreement between Employer and Employee outlines a compensation plan designed for employees who play critical roles within a corporation. Key features include a structured payment plan for retirement income and provisions for both pre-retirement death benefits and post-retirement incomes. The agreement specifies that the payments are subject to a multiplier based on the National Consumer Price Index, ensuring that compensation maintains its value over time. Filling in the form requires clear identification of the corporation, employee details, payment amounts, and specific conditions for retirement and death benefits. This form is particularly useful for attorneys, partners, owners, associates, paralegals, and legal assistants as it provides a clear framework for establishing financial retirement agreements while ensuring compliance with legal standards. The structure also emphasizes crucial aspects such as noncompetition clauses, rights to payments, and dispute resolution through mandatory arbitration. By understanding the details, legal professionals can effectively advise clients on implementing deferred compensation plans that align with both corporate goals and employee retention strategies.

Free preview